Entegris (NASDAQ:ENTG - Get Free Report) had its price target decreased by equities research analysts at UBS Group from $130.00 to $115.00 in a research report issued to clients and investors on Tuesday, Benzinga reports. The firm currently has a "neutral" rating on the semiconductor company's stock. UBS Group's price objective would indicate a potential upside of 11.52% from the stock's current price.

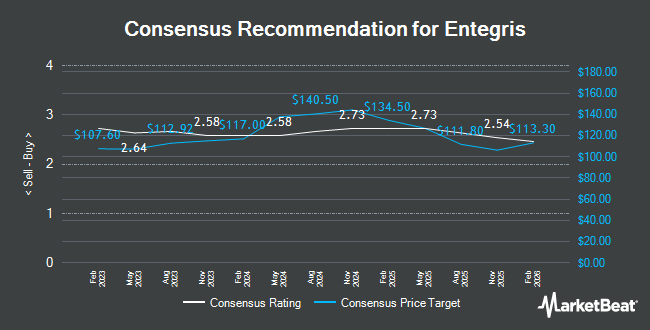

Several other equities analysts have also weighed in on ENTG. Mizuho raised shares of Entegris from a "neutral" rating to an "outperform" rating and set a $143.00 price objective on the stock in a research report on Thursday, August 1st. Needham & Company LLC restated a "buy" rating and set a $150.00 price target on shares of Entegris in a report on Thursday, August 1st. KeyCorp decreased their price objective on shares of Entegris from $164.00 to $154.00 and set an "overweight" rating for the company in a report on Tuesday. Citigroup raised shares of Entegris from a "neutral" rating to a "buy" rating and increased their price target for the stock from $119.00 to $130.00 in a research report on Monday, September 16th. Finally, Deutsche Bank Aktiengesellschaft lowered their price objective on Entegris from $145.00 to $115.00 and set a "buy" rating on the stock in a research note on Tuesday. One research analyst has rated the stock with a sell rating, one has given a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $136.10.

View Our Latest Report on Entegris

Entegris Trading Up 2.1 %

Shares of ENTG stock traded up $2.14 during trading hours on Tuesday, reaching $103.12. 2,788,982 shares of the stock traded hands, compared to its average volume of 1,647,469. The business has a fifty day moving average price of $109.13 and a 200 day moving average price of $121.10. The firm has a market capitalization of $15.57 billion, a PE ratio of 67.05, a PEG ratio of 1.45 and a beta of 1.24. Entegris has a 1-year low of $89.09 and a 1-year high of $147.57. The company has a quick ratio of 2.14, a current ratio of 3.58 and a debt-to-equity ratio of 1.18.

Entegris (NASDAQ:ENTG - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The semiconductor company reported $0.77 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.78 by ($0.01). Entegris had a return on equity of 12.03% and a net margin of 5.61%. The firm had revenue of $807.70 million for the quarter, compared to analysts' expectations of $832.44 million. During the same quarter in the prior year, the business posted $0.68 earnings per share. Entegris's revenue was down 9.1% on a year-over-year basis. On average, equities research analysts forecast that Entegris will post 3.13 EPS for the current year.

Institutional Trading of Entegris

A number of large investors have recently made changes to their positions in the company. CANADA LIFE ASSURANCE Co lifted its holdings in Entegris by 161.1% during the first quarter. CANADA LIFE ASSURANCE Co now owns 107,677 shares of the semiconductor company's stock worth $15,135,000 after acquiring an additional 66,437 shares in the last quarter. Diversified Trust Co bought a new stake in Entegris during the 2nd quarter worth approximately $851,000. Cetera Investment Advisers raised its holdings in Entegris by 128.0% during the 1st quarter. Cetera Investment Advisers now owns 20,387 shares of the semiconductor company's stock worth $2,865,000 after buying an additional 11,444 shares during the period. SG Americas Securities LLC lifted its stake in Entegris by 272.2% in the first quarter. SG Americas Securities LLC now owns 6,484 shares of the semiconductor company's stock valued at $911,000 after buying an additional 4,742 shares in the last quarter. Finally, Swedbank AB boosted its holdings in shares of Entegris by 520.3% in the second quarter. Swedbank AB now owns 300,361 shares of the semiconductor company's stock valued at $40,669,000 after buying an additional 251,938 shares during the period.

Entegris Company Profile

(

Get Free Report)

Entegris, Inc develops, manufactures, and supplies microcontamination control products, specialty chemicals, and advanced materials handling solutions in North America, Taiwan, China, South Korea, Japan, Europe, and Southeast Asia. It operates in three segments: Materials Solutions (MS); Microcontamination Control (MC); and Advanced Materials Handling (AMH).

Featured Stories

Before you consider Entegris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Entegris wasn't on the list.

While Entegris currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.