Entergy (NYSE:ETR - Get Free Report) updated its FY 2024 earnings guidance on Friday. The company provided earnings per share (EPS) guidance of 3.575-3.675 for the period, compared to the consensus estimate of 3.630. The company issued revenue guidance of -.

Entergy Trading Up 0.9 %

ETR stock traded up $0.64 during trading on Friday, reaching $75.13. 6,772,929 shares of the stock were exchanged, compared to its average volume of 3,257,159. The business has a 50 day moving average price of $72.86 and a 200-day moving average price of $63.41. Entergy has a 1 year low of $48.08 and a 1 year high of $79.04. The company has a current ratio of 0.89, a quick ratio of 0.59 and a debt-to-equity ratio of 1.77. The firm has a market capitalization of $32.22 billion, a price-to-earnings ratio of 18.30, a P/E/G ratio of 2.48 and a beta of 0.71.

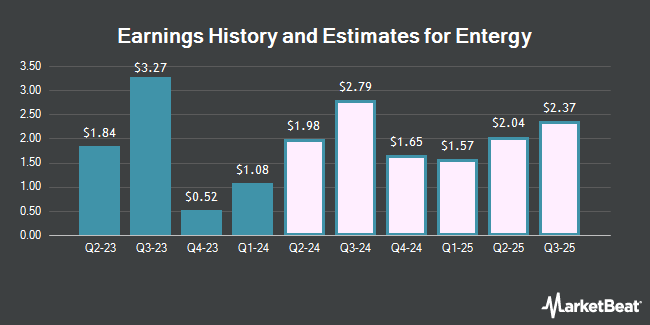

Entergy (NYSE:ETR - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The utilities provider reported $1.50 EPS for the quarter, beating analysts' consensus estimates of $1.46 by $0.04. The firm had revenue of $3.39 billion for the quarter, compared to analysts' expectations of $3.46 billion. Entergy had a return on equity of 9.53% and a net margin of 14.83%. During the same period in the prior year, the firm posted $1.64 earnings per share. On average, research analysts predict that Entergy will post 3.61 earnings per share for the current year.

Entergy Cuts Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Wednesday, November 13th were given a dividend of $0.60 per share. This represents a $2.40 dividend on an annualized basis and a dividend yield of 3.19%. The ex-dividend date was Wednesday, November 13th. Entergy's payout ratio is 58.39%.

Analysts Set New Price Targets

Several brokerages have weighed in on ETR. Barclays increased their target price on shares of Entergy from $68.50 to $76.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Scotiabank lifted their target price on shares of Entergy from $72.00 to $82.50 and gave the company a "sector perform" rating in a report on Thursday, December 12th. StockNews.com cut Entergy from a "hold" rating to a "sell" rating in a research note on Monday, December 9th. Wells Fargo & Company lifted their price objective on Entergy from $68.50 to $85.00 and gave the company an "overweight" rating in a research note on Friday, November 1st. Finally, Mizuho boosted their price objective on Entergy from $69.00 to $82.50 and gave the company an "outperform" rating in a report on Monday, November 4th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating, eight have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $77.40.

Check Out Our Latest Report on ETR

Insider Transactions at Entergy

In other Entergy news, insider Deanna D. Rodriguez sold 6,088 shares of the firm's stock in a transaction on Friday, December 13th. The stock was sold at an average price of $73.94, for a total value of $450,146.72. Following the sale, the insider now directly owns 3,952 shares in the company, valued at $292,210.88. This trade represents a 60.64 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Peter S. Norgeot, Jr. sold 15,844 shares of the company's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $65.00, for a total value of $1,029,860.00. Following the transaction, the chief operating officer now directly owns 69,986 shares of the company's stock, valued at approximately $4,549,090. This represents a 18.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 30,600 shares of company stock valued at $2,125,497. 0.39% of the stock is currently owned by corporate insiders.

About Entergy

(

Get Free Report)

Entergy Corporation, together with its subsidiaries, engages in the production and retail distribution of electricity in the United States. It generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, including the City of New Orleans; and distributes natural gas.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Entergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Entergy wasn't on the list.

While Entergy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.