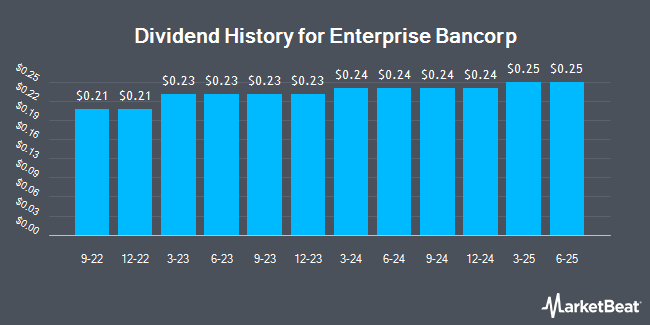

Enterprise Bancorp, Inc. (NASDAQ:EBTC - Get Free Report) announced a quarterly dividend on Tuesday, April 15th, RTT News reports. Shareholders of record on Monday, May 12th will be given a dividend of 0.25 per share by the savings and loans company on Monday, June 2nd. This represents a $1.00 dividend on an annualized basis and a yield of 2.85%. The ex-dividend date is Monday, May 12th.

Enterprise Bancorp has increased its dividend payment by an average of 9.1% per year over the last three years.

Enterprise Bancorp Stock Performance

NASDAQ:EBTC traded up $0.15 during midday trading on Friday, reaching $35.03. The stock had a trading volume of 30,183 shares, compared to its average volume of 28,548. The stock has a market cap of $436.44 million, a P/E ratio of 11.23 and a beta of 0.56. Enterprise Bancorp has a 12-month low of $22.60 and a 12-month high of $44.41. The firm has a fifty day simple moving average of $39.12 and a two-hundred day simple moving average of $38.23. The company has a quick ratio of 0.92, a current ratio of 0.92 and a debt-to-equity ratio of 0.33.

Enterprise Bancorp (NASDAQ:EBTC - Get Free Report) last released its earnings results on Thursday, April 17th. The savings and loans company reported $0.84 earnings per share (EPS) for the quarter. Enterprise Bancorp had a return on equity of 11.15% and a net margin of 15.30%. The company had revenue of $43.88 million for the quarter.

Wall Street Analyst Weigh In

Separately, StockNews.com assumed coverage on shares of Enterprise Bancorp in a report on Friday. They issued a "hold" rating for the company.

View Our Latest Research Report on EBTC

Enterprise Bancorp Company Profile

(

Get Free Report)

Enterprise Bancorp, Inc operates as the holding company for Enterprise Bank and Trust Company that engages in the provision of commercial banking products and services. It offers commercial and retail deposit products, including checking accounts, limited-transactional savings and money market accounts, commercial sweep products, and term certificates of deposit.

Featured Stories

Before you consider Enterprise Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enterprise Bancorp wasn't on the list.

While Enterprise Bancorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.