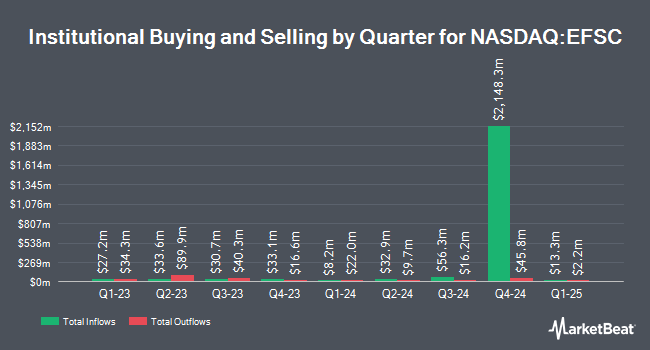

Bank of New York Mellon Corp reduced its position in shares of Enterprise Financial Services Corp (NASDAQ:EFSC - Free Report) by 4.6% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 174,900 shares of the bank's stock after selling 8,507 shares during the period. Bank of New York Mellon Corp owned 0.47% of Enterprise Financial Services worth $9,864,000 at the end of the most recent quarter.

Several other hedge funds also recently modified their holdings of EFSC. Versant Capital Management Inc acquired a new stake in shares of Enterprise Financial Services during the 4th quarter worth about $29,000. Quarry LP boosted its position in shares of Enterprise Financial Services by 2,593.5% in the third quarter. Quarry LP now owns 835 shares of the bank's stock worth $43,000 after acquiring an additional 804 shares during the last quarter. Point72 DIFC Ltd acquired a new stake in shares of Enterprise Financial Services in the third quarter worth approximately $102,000. FMR LLC boosted its position in shares of Enterprise Financial Services by 34.2% in the third quarter. FMR LLC now owns 2,560 shares of the bank's stock worth $131,000 after acquiring an additional 653 shares during the last quarter. Finally, Advisors Asset Management Inc. boosted its position in shares of Enterprise Financial Services by 169.7% in the third quarter. Advisors Asset Management Inc. now owns 3,452 shares of the bank's stock worth $177,000 after acquiring an additional 2,172 shares during the last quarter. 72.21% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In other Enterprise Financial Services news, Director James M. Havel sold 5,525 shares of Enterprise Financial Services stock in a transaction on Friday, February 28th. The shares were sold at an average price of $58.47, for a total value of $323,046.75. Following the completion of the transaction, the director now owns 15,447 shares of the company's stock, valued at $903,186.09. The trade was a 26.34 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this link. Insiders own 2.30% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on the stock. Keefe, Bruyette & Woods reissued an "outperform" rating and issued a $70.00 target price (up from $68.00) on shares of Enterprise Financial Services in a research report on Wednesday, January 29th. DA Davidson raised their target price on shares of Enterprise Financial Services from $67.00 to $70.00 and gave the stock a "buy" rating in a research report on Wednesday, January 29th.

Read Our Latest Stock Analysis on EFSC

Enterprise Financial Services Stock Down 0.4 %

Shares of EFSC traded down $0.20 during mid-day trading on Tuesday, reaching $56.45. 238,142 shares of the stock traded hands, compared to its average volume of 150,557. The firm has a market cap of $2.09 billion, a price-to-earnings ratio of 11.66 and a beta of 0.97. The stock has a fifty day simple moving average of $58.14 and a 200 day simple moving average of $56.05. Enterprise Financial Services Corp has a 12-month low of $37.28 and a 12-month high of $63.13. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.27.

Enterprise Financial Services (NASDAQ:EFSC - Get Free Report) last posted its quarterly earnings data on Monday, January 27th. The bank reported $1.32 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.18 by $0.14. Enterprise Financial Services had a net margin of 20.12% and a return on equity of 10.94%. Sell-side analysts expect that Enterprise Financial Services Corp will post 4.97 EPS for the current fiscal year.

Enterprise Financial Services Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, March 31st. Investors of record on Friday, March 14th will be paid a $0.29 dividend. This represents a $1.16 dividend on an annualized basis and a dividend yield of 2.05%. The ex-dividend date of this dividend is Friday, March 14th. This is a positive change from Enterprise Financial Services's previous quarterly dividend of $0.28. Enterprise Financial Services's payout ratio is 23.97%.

Enterprise Financial Services Company Profile

(

Free Report)

Enterprise Financial Services Corp operates as the holding company for Enterprise Bank & Trust that offers banking and wealth management services to individuals and corporate customers primarily in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico. It provides checking, savings, money market accounts, and certificates of deposit.

Further Reading

Before you consider Enterprise Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enterprise Financial Services wasn't on the list.

While Enterprise Financial Services currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.