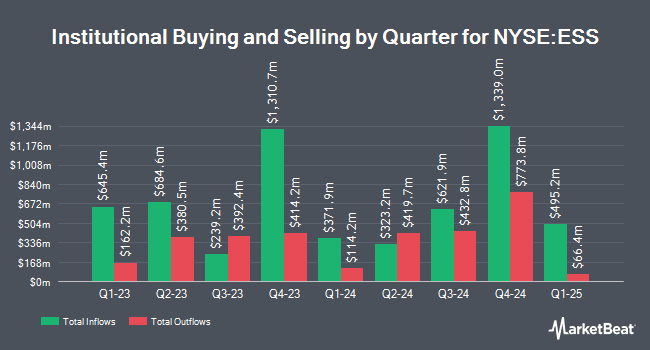

Entropy Technologies LP bought a new position in shares of Essex Property Trust, Inc. (NYSE:ESS - Free Report) during the third quarter, according to its most recent Form 13F filing with the SEC. The fund bought 2,442 shares of the real estate investment trust's stock, valued at approximately $721,000.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Catalytic Wealth RIA LLC grew its stake in shares of Essex Property Trust by 14.4% in the third quarter. Catalytic Wealth RIA LLC now owns 2,290 shares of the real estate investment trust's stock worth $677,000 after purchasing an additional 289 shares during the last quarter. Assetmark Inc. grew its position in shares of Essex Property Trust by 2,400.0% in the 3rd quarter. Assetmark Inc. now owns 100 shares of the real estate investment trust's stock valued at $30,000 after buying an additional 96 shares during the last quarter. CWA Asset Management Group LLC acquired a new stake in shares of Essex Property Trust in the third quarter valued at about $226,000. Consolidated Planning Corp bought a new position in shares of Essex Property Trust during the third quarter worth about $470,000. Finally, Sentry Investment Management LLC bought a new position in shares of Essex Property Trust during the third quarter worth about $89,000. 96.51% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of analysts have weighed in on the stock. Piper Sandler increased their target price on shares of Essex Property Trust from $315.00 to $355.00 and gave the company an "overweight" rating in a research report on Monday, August 26th. Wells Fargo & Company lifted their target price on shares of Essex Property Trust from $269.00 to $314.00 and gave the stock an "equal weight" rating in a research note on Monday, August 26th. Wedbush upped their price target on shares of Essex Property Trust from $264.00 to $301.00 and gave the company a "neutral" rating in a research report on Monday, August 5th. Scotiabank lifted their price objective on Essex Property Trust from $309.00 to $329.00 and gave the stock a "sector outperform" rating in a research report on Monday, September 16th. Finally, Raymond James downgraded Essex Property Trust from an "outperform" rating to a "market perform" rating in a research note on Monday, October 21st. One research analyst has rated the stock with a sell rating, thirteen have given a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat.com, Essex Property Trust has an average rating of "Hold" and an average price target of $297.00.

Check Out Our Latest Analysis on Essex Property Trust

Essex Property Trust Stock Down 0.3 %

NYSE ESS traded down $0.98 during trading hours on Friday, hitting $301.76. The company's stock had a trading volume of 316,714 shares, compared to its average volume of 379,049. The company has a current ratio of 1.14, a quick ratio of 1.14 and a debt-to-equity ratio of 1.13. The company's 50-day simple moving average is $297.61 and its two-hundred day simple moving average is $282.93. The company has a market capitalization of $19.39 billion, a PE ratio of 35.21, a price-to-earnings-growth ratio of 6.05 and a beta of 0.88. Essex Property Trust, Inc. has a 52 week low of $209.17 and a 52 week high of $317.73.

Essex Property Trust (NYSE:ESS - Get Free Report) last announced its earnings results on Tuesday, October 29th. The real estate investment trust reported $1.84 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.88 by ($2.04). The company had revenue of $450.70 million for the quarter, compared to analysts' expectations of $445.88 million. Essex Property Trust had a net margin of 31.55% and a return on equity of 9.72%. During the same period in the previous year, the firm earned $3.78 EPS. Research analysts anticipate that Essex Property Trust, Inc. will post 15.56 EPS for the current fiscal year.

Essex Property Trust Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, October 11th. Stockholders of record on Monday, September 30th were paid a $2.45 dividend. The ex-dividend date of this dividend was Monday, September 30th. This represents a $9.80 dividend on an annualized basis and a dividend yield of 3.25%. Essex Property Trust's payout ratio is presently 114.49%.

Insider Activity

In other Essex Property Trust news, Director Amal M. Johnson sold 7,298 shares of the firm's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $316.31, for a total value of $2,308,430.38. Following the completion of the sale, the director now directly owns 2,585 shares of the company's stock, valued at $817,661.35. This trade represents a 73.84 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CEO Angela L. Kleiman sold 8,080 shares of the company's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $315.10, for a total value of $2,546,008.00. Following the transaction, the chief executive officer now directly owns 9,494 shares in the company, valued at $2,991,559.40. This represents a 45.98 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 20,402 shares of company stock valued at $6,399,663 over the last three months. Corporate insiders own 3.80% of the company's stock.

Essex Property Trust Profile

(

Free Report)

Essex Property Trust, Inc, an S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets. Essex currently has ownership interests in 252 apartment communities comprising approximately 62,000 apartment homes with an additional property in active development.

Read More

Before you consider Essex Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essex Property Trust wasn't on the list.

While Essex Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.