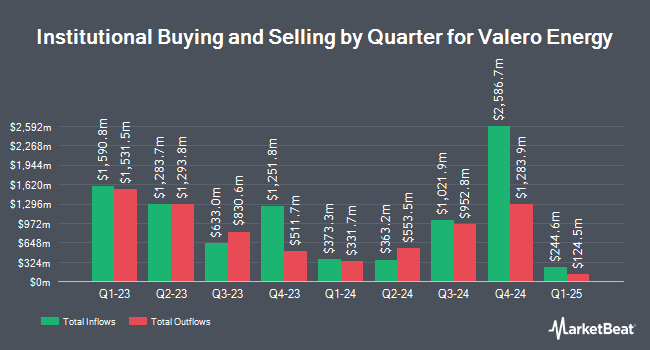

Entropy Technologies LP bought a new position in Valero Energy Co. (NYSE:VLO - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 7,030 shares of the oil and gas company's stock, valued at approximately $949,000.

Other institutional investors and hedge funds have also modified their holdings of the company. EdgeRock Capital LLC purchased a new stake in Valero Energy in the 2nd quarter worth approximately $27,000. Lynx Investment Advisory acquired a new stake in Valero Energy during the second quarter valued at $29,000. Pathway Financial Advisers LLC purchased a new position in Valero Energy in the first quarter valued at about $33,000. Summit Securities Group LLC purchased a new stake in shares of Valero Energy during the 2nd quarter worth about $31,000. Finally, First Foundation Advisors acquired a new stake in shares of Valero Energy during the 1st quarter valued at about $37,000. Hedge funds and other institutional investors own 78.69% of the company's stock.

Valero Energy Stock Performance

VLO traded down $0.57 during midday trading on Thursday, reaching $138.99. The company's stock had a trading volume of 1,031,405 shares, compared to its average volume of 2,945,596. The company has a current ratio of 1.57, a quick ratio of 1.11 and a debt-to-equity ratio of 0.35. The company has a fifty day simple moving average of $135.62 and a 200 day simple moving average of $146.75. The stock has a market cap of $44.00 billion, a P/E ratio of 12.52, a PEG ratio of 2.51 and a beta of 1.39. Valero Energy Co. has a twelve month low of $120.21 and a twelve month high of $184.79.

Valero Energy (NYSE:VLO - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The oil and gas company reported $1.14 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.98 by $0.16. The business had revenue of $32.88 billion for the quarter, compared to the consensus estimate of $31.04 billion. Valero Energy had a net margin of 2.74% and a return on equity of 13.07%. Valero Energy's quarterly revenue was down 14.4% on a year-over-year basis. During the same quarter last year, the company posted $7.49 earnings per share. Research analysts expect that Valero Energy Co. will post 9.1 earnings per share for the current year.

Valero Energy Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Wednesday, November 20th will be given a dividend of $1.07 per share. This represents a $4.28 dividend on an annualized basis and a dividend yield of 3.08%. The ex-dividend date of this dividend is Wednesday, November 20th. Valero Energy's dividend payout ratio is currently 38.39%.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on VLO shares. JPMorgan Chase & Co. dropped their price objective on Valero Energy from $172.00 to $151.00 and set an "overweight" rating on the stock in a report on Wednesday, October 2nd. StockNews.com lowered shares of Valero Energy from a "buy" rating to a "hold" rating in a research note on Wednesday, July 17th. The Goldman Sachs Group cut their price target on shares of Valero Energy from $149.00 to $131.00 and set a "sell" rating on the stock in a report on Monday, September 16th. TD Cowen decreased their price objective on shares of Valero Energy from $145.00 to $140.00 and set a "buy" rating for the company in a report on Friday, October 25th. Finally, Bank of America began coverage on Valero Energy in a report on Thursday, October 17th. They set a "neutral" rating and a $150.00 target price on the stock. One analyst has rated the stock with a sell rating, four have given a hold rating, ten have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Valero Energy currently has a consensus rating of "Moderate Buy" and a consensus target price of $155.86.

Read Our Latest Research Report on Valero Energy

Valero Energy Company Profile

(

Free Report)

Valero Energy Corporation manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally. It operates through three segments: Refining, Renewable Diesel, and Ethanol.

Further Reading

Before you consider Valero Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valero Energy wasn't on the list.

While Valero Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.