Entropy Technologies LP purchased a new position in shares of Zillow Group, Inc. (NASDAQ:Z - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 21,451 shares of the financial services provider's stock, valued at approximately $1,370,000.

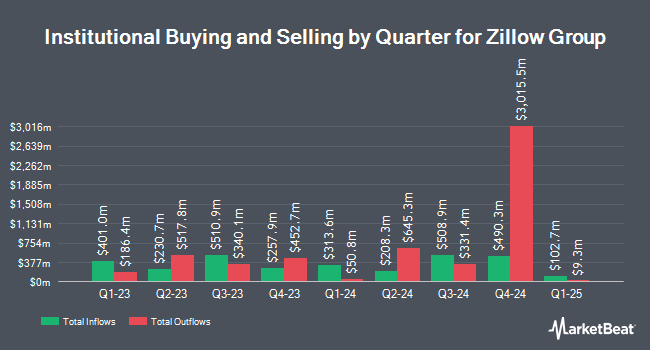

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in Z. Brighton Jones LLC grew its position in Zillow Group by 2.4% during the 3rd quarter. Brighton Jones LLC now owns 6,953 shares of the financial services provider's stock worth $444,000 after purchasing an additional 166 shares during the period. Arkadios Wealth Advisors grew its holdings in Zillow Group by 0.5% during the third quarter. Arkadios Wealth Advisors now owns 41,430 shares of the financial services provider's stock worth $2,645,000 after acquiring an additional 198 shares during the period. Doliver Advisors LP lifted its holdings in Zillow Group by 3.3% in the third quarter. Doliver Advisors LP now owns 9,681 shares of the financial services provider's stock valued at $618,000 after acquiring an additional 310 shares during the period. Blue Trust Inc. boosted its position in Zillow Group by 66.3% in the 3rd quarter. Blue Trust Inc. now owns 785 shares of the financial services provider's stock worth $50,000 after purchasing an additional 313 shares in the last quarter. Finally, Flynn Zito Capital Management LLC grew its stake in shares of Zillow Group by 7.2% during the 2nd quarter. Flynn Zito Capital Management LLC now owns 4,810 shares of the financial services provider's stock worth $223,000 after purchasing an additional 325 shares during the period. Institutional investors and hedge funds own 71.01% of the company's stock.

Analyst Upgrades and Downgrades

Z has been the subject of a number of analyst reports. Deutsche Bank Aktiengesellschaft upped their price target on Zillow Group from $55.00 to $60.00 and gave the stock a "buy" rating in a report on Friday, August 9th. Bank of America increased their target price on Zillow Group from $54.00 to $71.00 and gave the company a "neutral" rating in a research report on Friday, October 18th. Wedbush raised shares of Zillow Group from a "neutral" rating to an "outperform" rating and boosted their price target for the stock from $50.00 to $80.00 in a report on Monday, September 16th. Needham & Company LLC reiterated a "hold" rating on shares of Zillow Group in a research report on Thursday, November 7th. Finally, Cantor Fitzgerald raised shares of Zillow Group to a "hold" rating in a research note on Thursday, September 5th. Four analysts have rated the stock with a hold rating, four have given a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $70.33.

Read Our Latest Report on Zillow Group

Insiders Place Their Bets

In other Zillow Group news, Director Amy Bohutinsky sold 20,625 shares of Zillow Group stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $67.23, for a total transaction of $1,386,618.75. Following the completion of the sale, the director now directly owns 5,652 shares of the company's stock, valued at $379,983.96. The trade was a 78.49 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CAO Jennifer Rock sold 3,650 shares of the firm's stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $54.71, for a total value of $199,691.50. Following the sale, the chief accounting officer now directly owns 72,836 shares in the company, valued at $3,984,857.56. This trade represents a 4.77 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 48,237 shares of company stock worth $2,914,414 in the last quarter. 23.76% of the stock is owned by company insiders.

Zillow Group Trading Down 0.5 %

NASDAQ:Z traded down $0.36 on Thursday, reaching $74.31. 2,629,910 shares of the company's stock were exchanged, compared to its average volume of 3,769,697. The business has a fifty day moving average of $63.22 and a 200-day moving average of $52.84. The company has a quick ratio of 3.13, a current ratio of 3.13 and a debt-to-equity ratio of 0.11. Zillow Group, Inc. has a 52-week low of $37.63 and a 52-week high of $76.69. The firm has a market capitalization of $17.20 billion, a price-to-earnings ratio of -130.37 and a beta of 1.95.

Zillow Group Profile

(

Free Report)

Zillow Group, Inc operates real estate brands in mobile applications and Websites in the United States. The company offers premier agent and rentals marketplaces, new construction marketplaces, advertising, display advertising, and business technology solutions, as well as dotloop and floor plans. It also provides mortgage originations and the sale of mortgages, and advertising to mortgage lenders and other mortgage professionals; and title and escrow services.

Recommended Stories

Before you consider Zillow Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zillow Group wasn't on the list.

While Zillow Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.