Entropy Technologies LP purchased a new position in Exelixis, Inc. (NASDAQ:EXEL - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm purchased 18,300 shares of the biotechnology company's stock, valued at approximately $475,000.

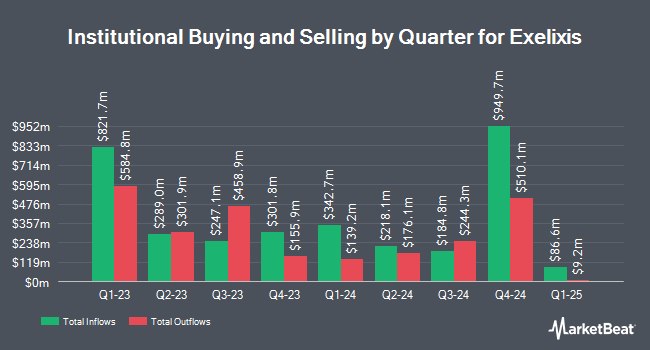

Several other institutional investors also recently modified their holdings of EXEL. V Square Quantitative Management LLC purchased a new stake in Exelixis during the 3rd quarter valued at about $30,000. Park Place Capital Corp purchased a new stake in Exelixis during the 2nd quarter valued at about $45,000. GAMMA Investing LLC grew its position in Exelixis by 107.9% during the 2nd quarter. GAMMA Investing LLC now owns 2,006 shares of the biotechnology company's stock valued at $45,000 after purchasing an additional 1,041 shares during the last quarter. EntryPoint Capital LLC grew its position in Exelixis by 537.2% during the 1st quarter. EntryPoint Capital LLC now owns 2,071 shares of the biotechnology company's stock valued at $49,000 after purchasing an additional 1,746 shares during the last quarter. Finally, Capital Performance Advisors LLP purchased a new stake in Exelixis during the 3rd quarter valued at about $61,000. 85.27% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, EVP Jeffrey Hessekiel sold 50,000 shares of Exelixis stock in a transaction that occurred on Friday, November 1st. The shares were sold at an average price of $34.13, for a total transaction of $1,706,500.00. Following the sale, the executive vice president now owns 530,325 shares in the company, valued at $18,099,992.25. This trade represents a 8.62 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, EVP Dana Aftab sold 96,986 shares of Exelixis stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $35.00, for a total transaction of $3,394,510.00. Following the sale, the executive vice president now owns 498,945 shares in the company, valued at approximately $17,463,075. The trade was a 16.27 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 248,148 shares of company stock worth $8,042,547. Company insiders own 2.85% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on EXEL shares. Stifel Nicolaus raised their price target on shares of Exelixis from $26.00 to $30.00 and gave the company a "hold" rating in a report on Wednesday, October 16th. BMO Capital Markets raised their price target on shares of Exelixis from $29.00 to $36.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $34.00 price target on shares of Exelixis in a report on Wednesday, October 30th. JMP Securities reaffirmed a "market outperform" rating and set a $29.00 price target on shares of Exelixis in a report on Friday, October 11th. Finally, The Goldman Sachs Group raised shares of Exelixis to a "strong sell" rating in a report on Tuesday, October 15th. One research analyst has rated the stock with a sell rating, five have issued a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, Exelixis presently has a consensus rating of "Moderate Buy" and an average target price of $31.44.

View Our Latest Report on Exelixis

Exelixis Trading Down 1.7 %

NASDAQ EXEL traded down $0.60 on Friday, reaching $34.45. 2,867,787 shares of the stock were exchanged, compared to its average volume of 2,082,104. Exelixis, Inc. has a one year low of $19.20 and a one year high of $36.60. The firm has a market capitalization of $9.84 billion, a PE ratio of 22.08, a PEG ratio of 0.89 and a beta of 0.51. The company's 50-day simple moving average is $29.04 and its two-hundred day simple moving average is $25.14.

Exelixis (NASDAQ:EXEL - Get Free Report) last released its earnings results on Tuesday, October 29th. The biotechnology company reported $0.40 EPS for the quarter, topping analysts' consensus estimates of $0.36 by $0.04. Exelixis had a net margin of 22.43% and a return on equity of 20.99%. The company had revenue of $539.50 million for the quarter, compared to analysts' expectations of $490.31 million. During the same quarter last year, the business earned $0.10 EPS. The firm's revenue was up 14.3% compared to the same quarter last year. Sell-side analysts forecast that Exelixis, Inc. will post 1.68 earnings per share for the current fiscal year.

Exelixis Profile

(

Free Report)

Exelixis, Inc, an oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States. The company offers CABOMETYX tablets for the treatment of patients with advanced renal cell carcinoma who received prior anti-angiogenic therapy; and COMETRIQ capsules for the treatment of progressive and metastatic medullary thyroid cancer.

Further Reading

Before you consider Exelixis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exelixis wasn't on the list.

While Exelixis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.