Entropy Technologies LP acquired a new stake in Progyny, Inc. (NASDAQ:PGNY - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 45,384 shares of the company's stock, valued at approximately $761,000. Entropy Technologies LP owned 0.05% of Progyny as of its most recent filing with the Securities and Exchange Commission.

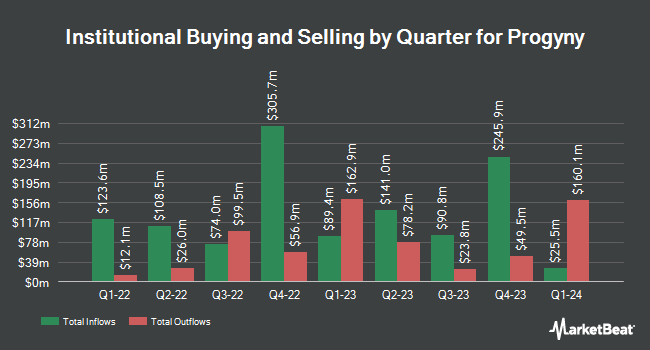

A number of other large investors also recently bought and sold shares of the company. Quarry LP raised its position in Progyny by 1,900.0% in the second quarter. Quarry LP now owns 880 shares of the company's stock worth $25,000 after acquiring an additional 836 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. purchased a new position in shares of Progyny in the 2nd quarter valued at about $44,000. Cambridge Trust Co. acquired a new stake in shares of Progyny during the 1st quarter valued at approximately $95,000. Natixis Investment Managers International purchased a new stake in Progyny during the first quarter worth $117,000. Finally, Mendota Financial Group LLC purchased a new position in shares of Progyny in the third quarter valued at $56,000. Hedge funds and other institutional investors own 94.93% of the company's stock.

Progyny Stock Performance

Shares of NASDAQ:PGNY traded down $0.21 during mid-day trading on Friday, hitting $13.77. 2,387,756 shares of the company traded hands, compared to its average volume of 1,398,215. The firm's 50 day simple moving average is $17.49 and its 200 day simple moving average is $23.49. The firm has a market cap of $1.17 billion, a P/E ratio of 24.10, a PEG ratio of 1.31 and a beta of 1.44. Progyny, Inc. has a 52-week low of $13.39 and a 52-week high of $42.08.

Progyny (NASDAQ:PGNY - Get Free Report) last announced its quarterly earnings data on Tuesday, November 12th. The company reported $0.11 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.37 by ($0.26). The firm had revenue of $286.63 million for the quarter, compared to analyst estimates of $296.85 million. Progyny had a net margin of 5.03% and a return on equity of 11.36%. The company's quarterly revenue was up 2.0% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.16 EPS. Equities research analysts expect that Progyny, Inc. will post 0.64 EPS for the current fiscal year.

Analyst Ratings Changes

Several equities research analysts recently commented on PGNY shares. Cantor Fitzgerald reiterated an "overweight" rating and issued a $25.00 price objective on shares of Progyny in a research report on Tuesday, October 1st. JMP Securities lowered shares of Progyny from an "outperform" rating to a "market perform" rating in a research report on Thursday, September 19th. JPMorgan Chase & Co. reduced their target price on Progyny from $31.00 to $22.00 and set an "overweight" rating on the stock in a research note on Thursday, September 19th. Truist Financial reissued a "hold" rating and set a $19.00 price target (down previously from $26.00) on shares of Progyny in a research report on Wednesday. Finally, Canaccord Genuity Group cut Progyny from a "buy" rating to a "hold" rating and cut their price target for the stock from $37.00 to $24.00 in a report on Wednesday, August 7th. Eight investment analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat, Progyny currently has an average rating of "Hold" and an average price target of $25.42.

View Our Latest Stock Analysis on PGNY

Progyny Profile

(

Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Featured Articles

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.