Entropy Technologies LP lifted its stake in Everest Group, Ltd. (NYSE:EG - Free Report) by 85.4% during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 5,009 shares of the company's stock after acquiring an additional 2,307 shares during the period. Entropy Technologies LP's holdings in Everest Group were worth $1,816,000 at the end of the most recent reporting period.

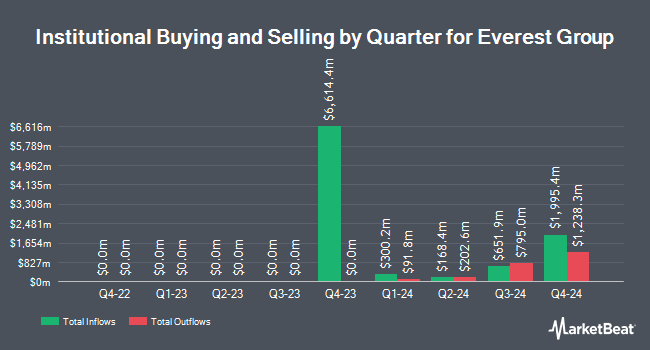

A number of other institutional investors have also made changes to their positions in EG. Eastern Bank bought a new position in shares of Everest Group in the 3rd quarter valued at approximately $35,000. Brooklyn Investment Group bought a new position in Everest Group in the 3rd quarter worth approximately $39,000. Private Trust Co. NA increased its position in Everest Group by 51.7% in the 3rd quarter. Private Trust Co. NA now owns 132 shares of the company's stock worth $52,000 after buying an additional 45 shares during the period. Wilmington Savings Fund Society FSB bought a new position in Everest Group in the 3rd quarter worth approximately $64,000. Finally, Avior Wealth Management LLC increased its position in Everest Group by 22.4% in the 4th quarter. Avior Wealth Management LLC now owns 257 shares of the company's stock worth $93,000 after buying an additional 47 shares during the period. 92.64% of the stock is owned by institutional investors.

Everest Group Price Performance

EG stock traded up $4.19 during trading on Thursday, hitting $335.77. The company had a trading volume of 273,600 shares, compared to its average volume of 441,010. The company has a fifty day moving average price of $356.79 and a two-hundred day moving average price of $372.23. The company has a current ratio of 0.40, a quick ratio of 0.40 and a debt-to-equity ratio of 0.26. The company has a market cap of $14.43 billion, a P/E ratio of 10.69, a P/E/G ratio of 0.22 and a beta of 0.65. Everest Group, Ltd. has a fifty-two week low of $327.37 and a fifty-two week high of $407.30.

Everest Group (NYSE:EG - Get Free Report) last announced its quarterly earnings results on Monday, February 3rd. The company reported ($18.39) EPS for the quarter, missing the consensus estimate of $11.64 by ($30.03). Everest Group had a net margin of 7.95% and a return on equity of 9.04%. Equities research analysts expect that Everest Group, Ltd. will post 53.11 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several brokerages have commented on EG. Keefe, Bruyette & Woods lifted their price target on Everest Group from $420.00 to $434.00 and gave the stock an "outperform" rating in a research report on Friday, January 10th. Barclays lifted their price objective on Everest Group from $461.00 to $470.00 and gave the stock an "overweight" rating in a report on Tuesday, February 4th. Jefferies Financial Group lowered Everest Group from a "buy" rating to a "hold" rating and lifted their price objective for the stock from $420.00 to $429.00 in a report on Tuesday, November 26th. Morgan Stanley reissued an "equal weight" rating and set a $340.00 price objective (down previously from $425.00) on shares of Everest Group in a report on Wednesday, February 5th. Finally, Wells Fargo & Company decreased their price objective on Everest Group from $390.00 to $380.00 and set an "equal weight" rating on the stock in a report on Tuesday, January 14th. Six research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, Everest Group presently has an average rating of "Hold" and an average target price of $416.50.

Read Our Latest Stock Report on Everest Group

Everest Group Company Profile

(

Free Report)

Everest Group, Ltd., through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally. The company operates through two segment, Insurance and Reinsurance. The Reinsurance segment writes property and casualty reinsurance; and specialty lines of business through reinsurance brokers, as well as directly with ceding companies in the United States, Bermuda, Ireland, Canada, Singapore, Switzerland, and the United Kingdom.

See Also

Before you consider Everest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Everest Group wasn't on the list.

While Everest Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.