Entropy Technologies LP boosted its position in shares of Equinix, Inc. (NASDAQ:EQIX - Free Report) by 90.1% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 5,900 shares of the financial services provider's stock after purchasing an additional 2,797 shares during the quarter. Entropy Technologies LP's holdings in Equinix were worth $5,237,000 as of its most recent filing with the Securities and Exchange Commission.

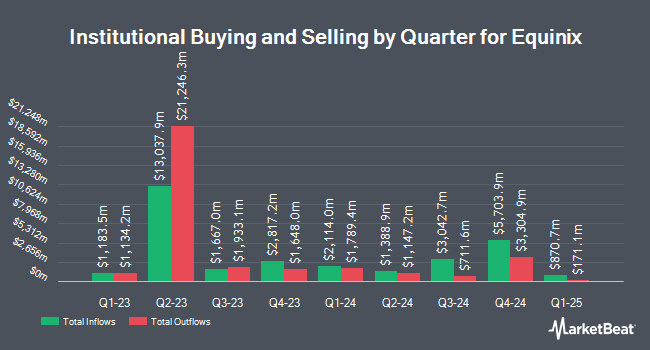

A number of other hedge funds and other institutional investors have also recently bought and sold shares of EQIX. Empowered Funds LLC lifted its holdings in shares of Equinix by 29.4% in the first quarter. Empowered Funds LLC now owns 1,620 shares of the financial services provider's stock valued at $1,337,000 after purchasing an additional 368 shares in the last quarter. Susquehanna Fundamental Investments LLC acquired a new position in shares of Equinix in the first quarter valued at about $743,000. Concurrent Investment Advisors LLC boosted its stake in shares of Equinix by 38.4% in the first quarter. Concurrent Investment Advisors LLC now owns 1,060 shares of the financial services provider's stock valued at $874,000 after buying an additional 294 shares during the period. QRG Capital Management Inc. increased its position in shares of Equinix by 370.0% in the first quarter. QRG Capital Management Inc. now owns 4,700 shares of the financial services provider's stock worth $3,879,000 after purchasing an additional 3,700 shares during the period. Finally, Bleakley Financial Group LLC lifted its holdings in shares of Equinix by 1.5% during the 1st quarter. Bleakley Financial Group LLC now owns 3,513 shares of the financial services provider's stock worth $2,899,000 after acquiring an additional 51 shares during the period. 94.94% of the stock is owned by institutional investors.

Insider Buying and Selling at Equinix

In other news, Chairman Charles J. Meyers sold 6,234 shares of the stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $823.97, for a total transaction of $5,136,628.98. Following the completion of the transaction, the chairman now directly owns 7,680 shares in the company, valued at approximately $6,328,089.60. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other news, Chairman Charles J. Meyers sold 6,234 shares of the company's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $823.97, for a total value of $5,136,628.98. Following the completion of the sale, the chairman now directly owns 7,680 shares of the company's stock, valued at approximately $6,328,089.60. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Raouf Abdel sold 1,022 shares of the stock in a transaction on Friday, November 8th. The stock was sold at an average price of $923.56, for a total value of $943,878.32. Following the sale, the executive vice president now directly owns 4,893 shares of the company's stock, valued at approximately $4,518,979.08. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 13,654 shares of company stock worth $11,577,656. Insiders own 0.27% of the company's stock.

Equinix Stock Performance

Equinix stock traded down $10.48 during midday trading on Tuesday, hitting $903.02. 810,357 shares of the company were exchanged, compared to its average volume of 528,598. The business has a fifty day simple moving average of $879.56 and a two-hundred day simple moving average of $813.36. Equinix, Inc. has a fifty-two week low of $684.14 and a fifty-two week high of $943.02. The firm has a market capitalization of $87.13 billion, a PE ratio of 82.37, a price-to-earnings-growth ratio of 2.31 and a beta of 0.71. The company has a debt-to-equity ratio of 1.12, a quick ratio of 1.16 and a current ratio of 1.16.

Equinix Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Wednesday, November 13th will be paid a $4.26 dividend. This represents a $17.04 annualized dividend and a yield of 1.89%. The ex-dividend date of this dividend is Wednesday, November 13th. Equinix's dividend payout ratio is currently 153.65%.

Analyst Ratings Changes

A number of research firms have weighed in on EQIX. JPMorgan Chase & Co. boosted their target price on shares of Equinix from $950.00 to $975.00 and gave the stock an "overweight" rating in a research note on Tuesday, October 1st. Deutsche Bank Aktiengesellschaft upped their price objective on shares of Equinix from $880.00 to $910.00 and gave the company a "buy" rating in a report on Tuesday, August 13th. Evercore ISI upped their target price on shares of Equinix from $945.00 to $975.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. Wells Fargo & Company upped their price objective on shares of Equinix from $875.00 to $975.00 and gave the stock an "overweight" rating in a research report on Thursday, October 17th. Finally, Cfra reaffirmed a "hold" rating on shares of Equinix in a research report on Tuesday, September 24th. Five equities research analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $944.63.

Read Our Latest Research Report on Equinix

Equinix Company Profile

(

Free Report)

Equinix Nasdaq: EQIX is the world's digital infrastructure company . Digital leaders harness Equinix's trusted platform to bring together and interconnect foundational infrastructure at software speed. Equinix enables organizations to access all the right places, partners and possibilities to scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value, while supporting their sustainability goals.

Featured Articles

Before you consider Equinix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equinix wasn't on the list.

While Equinix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.