Entropy Technologies LP lowered its stake in Powell Industries, Inc. (NASDAQ:POWL - Free Report) by 65.6% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 1,572 shares of the industrial products company's stock after selling 2,999 shares during the quarter. Entropy Technologies LP's holdings in Powell Industries were worth $349,000 as of its most recent SEC filing.

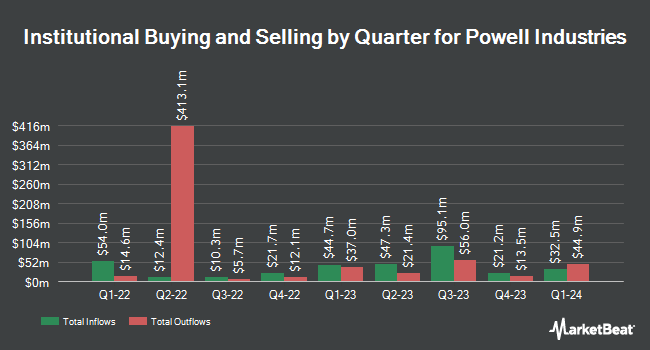

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Swiss National Bank raised its stake in shares of Powell Industries by 1.1% during the 1st quarter. Swiss National Bank now owns 18,900 shares of the industrial products company's stock worth $2,689,000 after purchasing an additional 200 shares in the last quarter. Russell Investments Group Ltd. grew its position in shares of Powell Industries by 8.7% in the 1st quarter. Russell Investments Group Ltd. now owns 22,190 shares of the industrial products company's stock valued at $3,158,000 after acquiring an additional 1,770 shares during the period. Avantax Advisory Services Inc. acquired a new position in shares of Powell Industries during the 1st quarter worth about $321,000. ProShare Advisors LLC bought a new stake in shares of Powell Industries in the 1st quarter valued at about $266,000. Finally, State Board of Administration of Florida Retirement System lifted its stake in Powell Industries by 135.2% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 6,175 shares of the industrial products company's stock valued at $879,000 after purchasing an additional 3,550 shares during the last quarter. Institutional investors own 89.77% of the company's stock.

Insider Activity at Powell Industries

In other news, major shareholder Thomas W. Powell sold 5,000 shares of the business's stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $347.74, for a total value of $1,738,700.00. Following the completion of the sale, the insider now owns 677,265 shares of the company's stock, valued at approximately $235,512,131.10. The trade was a 0.73 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director James W. Mcgill sold 6,600 shares of the firm's stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $185.84, for a total transaction of $1,226,544.00. Following the transaction, the director now directly owns 9,660 shares in the company, valued at approximately $1,795,214.40. This represents a 40.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 66,600 shares of company stock worth $15,906,386. Insiders own 2.20% of the company's stock.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded Powell Industries from a "hold" rating to a "buy" rating in a research note on Friday.

View Our Latest Stock Analysis on Powell Industries

Powell Industries Price Performance

Shares of Powell Industries stock opened at $278.53 on Friday. The business has a fifty day simple moving average of $247.95 and a two-hundred day simple moving average of $191.41. Powell Industries, Inc. has a 1 year low of $75.05 and a 1 year high of $364.98. The company has a market capitalization of $3.34 billion, a price-to-earnings ratio of 26.06, a P/E/G ratio of 1.60 and a beta of 0.86.

Powell Industries Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, November 20th will be issued a dividend of $0.265 per share. This represents a $1.06 annualized dividend and a dividend yield of 0.38%. The ex-dividend date is Wednesday, November 20th. Powell Industries's payout ratio is 9.92%.

About Powell Industries

(

Free Report)

Powell Industries, Inc, together with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems. The company's principal products include integrated power control room substations, custom-engineered modules, electrical houses, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, switches, and bus duct systems, as well as traditional and arc-resistant distribution switchgears and control gears.

Recommended Stories

Before you consider Powell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Powell Industries wasn't on the list.

While Powell Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.