Entropy Technologies LP lowered its position in shares of Invitation Homes Inc. (NYSE:INVH - Free Report) by 48.4% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 34,165 shares of the company's stock after selling 32,046 shares during the quarter. Entropy Technologies LP's holdings in Invitation Homes were worth $1,205,000 at the end of the most recent quarter.

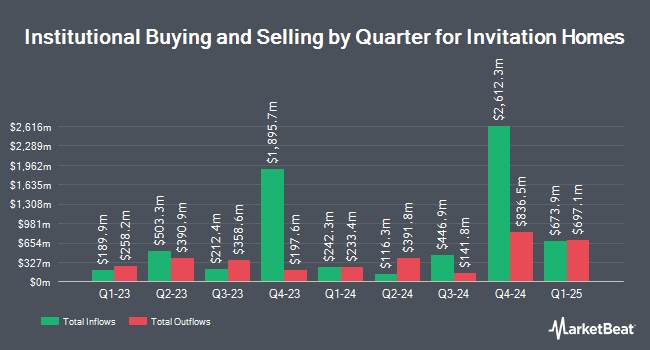

Other institutional investors also recently modified their holdings of the company. State Board of Administration of Florida Retirement System boosted its position in shares of Invitation Homes by 5.8% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 669,816 shares of the company's stock worth $23,852,000 after purchasing an additional 36,951 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. boosted its position in shares of Invitation Homes by 14.2% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 1,056,785 shares of the company's stock worth $37,632,000 after purchasing an additional 131,068 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in shares of Invitation Homes in the 1st quarter valued at $2,635,000. National Bank of Canada FI increased its position in shares of Invitation Homes by 321.5% in the 1st quarter. National Bank of Canada FI now owns 566,025 shares of the company's stock valued at $19,686,000 after buying an additional 431,735 shares in the last quarter. Finally, Public Employees Retirement System of Ohio lifted its holdings in Invitation Homes by 2.2% during the first quarter. Public Employees Retirement System of Ohio now owns 1,106,354 shares of the company's stock worth $39,397,000 after acquiring an additional 24,219 shares in the last quarter. Institutional investors own 96.79% of the company's stock.

Invitation Homes Price Performance

Shares of NYSE INVH traded down $0.36 during mid-day trading on Thursday, reaching $33.55. The company had a trading volume of 2,838,685 shares, compared to its average volume of 3,384,038. Invitation Homes Inc. has a one year low of $31.01 and a one year high of $37.80. The business's 50-day simple moving average is $34.44 and its 200 day simple moving average is $35.04. The company has a debt-to-equity ratio of 0.54, a quick ratio of 0.24 and a current ratio of 0.24. The firm has a market cap of $20.55 billion, a price-to-earnings ratio of 47.24, a PEG ratio of 5.08 and a beta of 1.02.

Invitation Homes Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, October 18th. Stockholders of record on Thursday, September 26th were issued a dividend of $0.28 per share. This represents a $1.12 dividend on an annualized basis and a dividend yield of 3.34%. The ex-dividend date of this dividend was Thursday, September 26th. Invitation Homes's dividend payout ratio (DPR) is presently 157.75%.

Analysts Set New Price Targets

Several equities analysts recently issued reports on INVH shares. Deutsche Bank Aktiengesellschaft upgraded Invitation Homes from a "hold" rating to a "buy" rating and boosted their price objective for the company from $35.00 to $41.00 in a research report on Wednesday, July 24th. Bank of America lowered shares of Invitation Homes from a "buy" rating to a "neutral" rating and dropped their price objective for the stock from $39.00 to $37.00 in a report on Tuesday, September 24th. Wells Fargo & Company lowered shares of Invitation Homes from an "overweight" rating to an "equal weight" rating and upped their target price for the stock from $37.00 to $38.00 in a research note on Monday, August 26th. Keefe, Bruyette & Woods cut their price target on Invitation Homes from $37.00 to $35.00 and set a "market perform" rating on the stock in a report on Wednesday, November 6th. Finally, Mizuho dropped their target price on Invitation Homes from $36.00 to $35.00 and set a "neutral" rating on the stock in a research report on Thursday, October 10th. Eight investment analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. Based on data from MarketBeat.com, Invitation Homes presently has an average rating of "Moderate Buy" and a consensus target price of $38.80.

Get Our Latest Stock Analysis on INVH

About Invitation Homes

(

Free Report)

Invitation Homes, an S&P 500 company, is the nation's premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality, updated homes with valued features such as close proximity to jobs and access to good schools. The company's mission, Together with you, we make a house a home, reflects its commitment to providing homes where individuals and families can thrive and high-touch service that continuously enhances residents' living experiences.

Further Reading

Before you consider Invitation Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invitation Homes wasn't on the list.

While Invitation Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.