Entropy Technologies LP lessened its holdings in General Dynamics Co. (NYSE:GD - Free Report) by 65.7% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 2,889 shares of the aerospace company's stock after selling 5,546 shares during the period. Entropy Technologies LP's holdings in General Dynamics were worth $873,000 as of its most recent SEC filing.

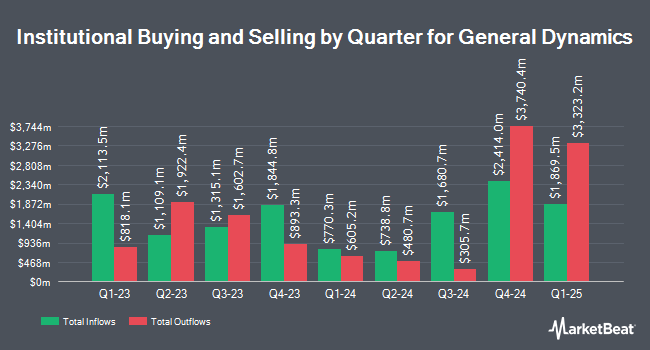

Other institutional investors have also recently added to or reduced their stakes in the company. Olstein Capital Management L.P. raised its stake in shares of General Dynamics by 36.4% during the third quarter. Olstein Capital Management L.P. now owns 15,000 shares of the aerospace company's stock valued at $4,533,000 after purchasing an additional 4,000 shares during the period. CWC Advisors LLC. acquired a new position in General Dynamics in the 3rd quarter worth $771,000. Kingsview Wealth Management LLC boosted its position in General Dynamics by 87.6% in the 1st quarter. Kingsview Wealth Management LLC now owns 14,690 shares of the aerospace company's stock valued at $4,150,000 after buying an additional 6,858 shares during the last quarter. Clearbridge Investments LLC acquired a new stake in shares of General Dynamics during the first quarter valued at about $493,000. Finally, Peak Financial Advisors LLC purchased a new stake in shares of General Dynamics during the third quarter worth about $3,022,000. 86.14% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, Director Peter A. Wall sold 1,320 shares of the company's stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $308.05, for a total value of $406,626.00. Following the completion of the sale, the director now directly owns 3,592 shares of the company's stock, valued at approximately $1,106,515.60. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 1.52% of the company's stock.

Wall Street Analyst Weigh In

GD has been the subject of a number of recent analyst reports. Morgan Stanley upgraded General Dynamics from an "equal weight" rating to an "overweight" rating and raised their price objective for the company from $293.00 to $345.00 in a research note on Friday, August 9th. TD Cowen raised shares of General Dynamics to a "strong-buy" rating in a research report on Tuesday, October 8th. Royal Bank of Canada upped their price target on shares of General Dynamics from $320.00 to $330.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. Barclays raised their price objective on shares of General Dynamics from $325.00 to $330.00 and gave the stock an "overweight" rating in a report on Tuesday, October 29th. Finally, Wells Fargo & Company upped their target price on shares of General Dynamics from $317.00 to $322.00 and gave the company an "equal weight" rating in a research note on Thursday, October 24th. Seven investment analysts have rated the stock with a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $323.69.

Check Out Our Latest Stock Report on GD

General Dynamics Stock Performance

Shares of GD stock traded down $17.74 during trading hours on Thursday, reaching $296.29. The stock had a trading volume of 524,379 shares, compared to its average volume of 1,090,455. The firm has a market capitalization of $81.47 billion, a PE ratio of 23.76, a price-to-earnings-growth ratio of 1.89 and a beta of 0.61. The firm has a 50-day simple moving average of $302.64 and a 200-day simple moving average of $296.23. General Dynamics Co. has a twelve month low of $243.87 and a twelve month high of $316.90. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.32 and a quick ratio of 0.80.

General Dynamics (NYSE:GD - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The aerospace company reported $3.35 EPS for the quarter, missing the consensus estimate of $3.48 by ($0.13). The firm had revenue of $11.67 billion during the quarter, compared to analyst estimates of $11.65 billion. General Dynamics had a net margin of 7.90% and a return on equity of 16.59%. General Dynamics's revenue for the quarter was up 10.4% compared to the same quarter last year. During the same quarter in the previous year, the business posted $3.04 EPS. As a group, equities analysts forecast that General Dynamics Co. will post 13.97 earnings per share for the current year.

General Dynamics Company Profile

(

Free Report)

General Dynamics Corporation operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets; and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services.

Featured Articles

Before you consider General Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Dynamics wasn't on the list.

While General Dynamics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.