EntryPoint Capital LLC acquired a new stake in shares of IDEAYA Biosciences, Inc. (NASDAQ:IDYA - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 14,670 shares of the company's stock, valued at approximately $377,000.

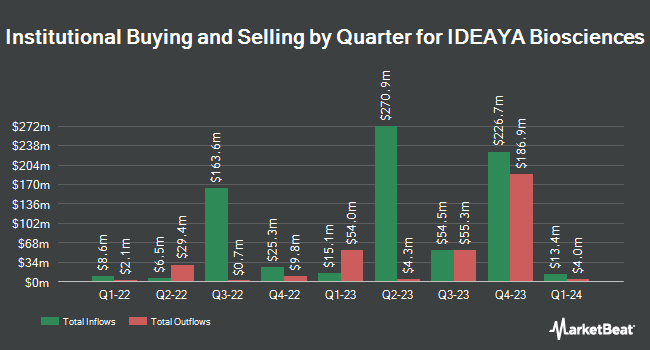

Other institutional investors also recently modified their holdings of the company. R Squared Ltd purchased a new position in IDEAYA Biosciences during the 4th quarter valued at about $35,000. Quantbot Technologies LP purchased a new position in shares of IDEAYA Biosciences during the third quarter valued at approximately $83,000. Daiwa Securities Group Inc. raised its holdings in shares of IDEAYA Biosciences by 44.0% during the fourth quarter. Daiwa Securities Group Inc. now owns 2,792 shares of the company's stock valued at $72,000 after acquiring an additional 853 shares in the last quarter. KBC Group NV lifted its stake in IDEAYA Biosciences by 84.6% in the fourth quarter. KBC Group NV now owns 4,197 shares of the company's stock worth $108,000 after acquiring an additional 1,923 shares during the period. Finally, Paloma Partners Management Co bought a new stake in IDEAYA Biosciences in the third quarter valued at $213,000. 98.29% of the stock is currently owned by hedge funds and other institutional investors.

IDEAYA Biosciences Stock Performance

Shares of NASDAQ:IDYA traded down $0.67 during trading on Monday, reaching $16.38. 1,845,774 shares of the stock traded hands, compared to its average volume of 862,979. The stock has a market cap of $1.43 billion, a P/E ratio of -4.96 and a beta of 0.76. The stock has a 50-day moving average of $20.68 and a two-hundred day moving average of $25.63. IDEAYA Biosciences, Inc. has a 52-week low of $15.94 and a 52-week high of $44.42.

IDEAYA Biosciences (NASDAQ:IDYA - Get Free Report) last issued its earnings results on Thursday, February 13th. The company reported ($1.49) EPS for the quarter, missing the consensus estimate of ($0.67) by ($0.82). The business had revenue of $7.00 million during the quarter, compared to analyst estimates of $7.00 million. Sell-side analysts expect that IDEAYA Biosciences, Inc. will post -3.07 earnings per share for the current year.

Analyst Upgrades and Downgrades

IDYA has been the subject of several research analyst reports. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $61.00 target price on shares of IDEAYA Biosciences in a research report on Wednesday, January 15th. Wedbush restated an "outperform" rating and issued a $52.00 price objective on shares of IDEAYA Biosciences in a report on Tuesday, December 17th. Stephens reiterated an "overweight" rating and set a $50.00 target price on shares of IDEAYA Biosciences in a report on Friday, February 14th. Finally, Cantor Fitzgerald reissued an "overweight" rating on shares of IDEAYA Biosciences in a research report on Monday, January 13th. Two research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $53.58.

View Our Latest Stock Report on IDYA

About IDEAYA Biosciences

(

Free Report)

IDEAYA Biosciences, Inc, a synthetic lethality-focused precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States. The company's products in development include IDE196, a protein kinase C inhibitor that is in Phase 2/3 clinical trials for genetically defined cancers having GNAQ or GNA11 gene mutations; IDE397, a methionine adenosyltransferase 2a inhibitor that is in Phase 1/2 clinical trials for patients with solid tumors having methylthioadenosine phosphorylase gene deletions, such as non-small cell lung, bladder, gastric, and esophageal cancers; IDE161, a poly ADP-ribose glycohydrolase inhibitor that is in Phase 1 clinical trial to treat tumors with homologous recombination deficiency (HRD), and other genetic or molecular signatures; GSK101, a Pol Theta Helicase inhibitor that is in Phase 1 clinical trial for the treatment of tumors with BRCA or other homologous recombination, and HRD mutations; and Werner Helicase inhibitors for tumors with high microsatellite instability.

Featured Articles

Before you consider IDEAYA Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEAYA Biosciences wasn't on the list.

While IDEAYA Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.