Envestnet Asset Management Inc. boosted its holdings in shares of Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 5.7% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 295,311 shares of the company's stock after buying an additional 15,821 shares during the quarter. Envestnet Asset Management Inc. owned 0.40% of Churchill Downs worth $39,436,000 as of its most recent SEC filing.

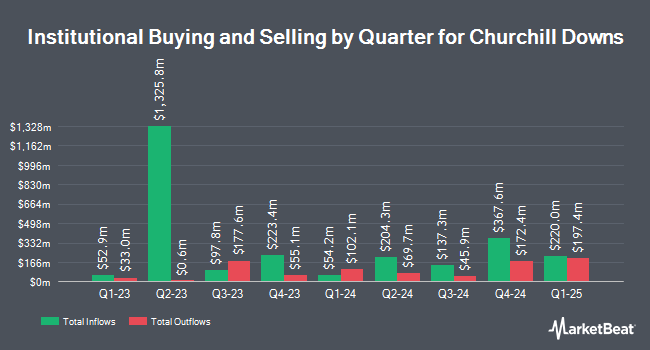

Other institutional investors have also modified their holdings of the company. Truist Financial Corp lifted its stake in Churchill Downs by 22.1% in the fourth quarter. Truist Financial Corp now owns 29,637 shares of the company's stock worth $3,958,000 after acquiring an additional 5,372 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Churchill Downs by 1.7% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 605,355 shares of the company's stock valued at $80,839,000 after purchasing an additional 10,153 shares in the last quarter. Proficio Capital Partners LLC acquired a new stake in Churchill Downs during the fourth quarter worth approximately $1,927,000. JPMorgan Chase & Co. raised its holdings in shares of Churchill Downs by 7.1% in the third quarter. JPMorgan Chase & Co. now owns 183,594 shares of the company's stock valued at $24,824,000 after buying an additional 12,226 shares during the last quarter. Finally, Victory Capital Management Inc. grew its holdings in shares of Churchill Downs by 4.7% during the fourth quarter. Victory Capital Management Inc. now owns 228,550 shares of the company's stock worth $30,521,000 after buying an additional 10,359 shares during the last quarter. Institutional investors and hedge funds own 82.59% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have weighed in on the company. Mizuho lowered their target price on Churchill Downs from $151.00 to $148.00 and set an "outperform" rating on the stock in a research note on Wednesday, February 19th. Stifel Nicolaus cut their price objective on shares of Churchill Downs from $161.00 to $142.00 and set a "buy" rating for the company in a research report on Thursday, April 10th. JMP Securities reaffirmed a "market outperform" rating and issued a $166.00 target price on shares of Churchill Downs in a report on Thursday, January 16th. Barclays began coverage on shares of Churchill Downs in a report on Friday, April 11th. They set an "overweight" rating and a $125.00 price target for the company. Finally, StockNews.com cut shares of Churchill Downs from a "hold" rating to a "sell" rating in a research note on Tuesday, April 8th. One analyst has rated the stock with a sell rating and nine have given a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $153.44.

Check Out Our Latest Stock Analysis on Churchill Downs

Churchill Downs Price Performance

Churchill Downs stock traded up $1.21 during mid-day trading on Thursday, hitting $102.20. 127,888 shares of the company were exchanged, compared to its average volume of 504,236. Churchill Downs Incorporated has a 12-month low of $96.67 and a 12-month high of $150.21. The company has a market capitalization of $7.51 billion, a P/E ratio of 17.96, a PEG ratio of 2.95 and a beta of 0.86. The business's 50 day simple moving average is $111.70 and its two-hundred day simple moving average is $126.93. The company has a debt-to-equity ratio of 4.47, a current ratio of 0.57 and a quick ratio of 0.55.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last announced its earnings results on Wednesday, February 19th. The company reported $0.92 earnings per share for the quarter, missing the consensus estimate of $0.98 by ($0.06). The firm had revenue of $624.20 million during the quarter, compared to analyst estimates of $620.21 million. Churchill Downs had a net margin of 15.61% and a return on equity of 43.67%. Analysts forecast that Churchill Downs Incorporated will post 6.92 earnings per share for the current fiscal year.

Churchill Downs announced that its board has initiated a stock buyback program on Wednesday, March 12th that authorizes the company to repurchase $500.00 million in outstanding shares. This repurchase authorization authorizes the company to repurchase up to 6.4% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's board believes its shares are undervalued.

Churchill Downs Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, April 15th. Shareholders of record on Monday, March 31st were paid a $0.06 dividend. This represents a $0.24 dividend on an annualized basis and a yield of 0.23%. Churchill Downs's payout ratio is 7.04%.

Churchill Downs Company Profile

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Further Reading

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.