Envestnet Asset Management Inc. cut its stake in British American Tobacco p.l.c. (NYSE:BTI - Free Report) by 38.6% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 1,404,552 shares of the company's stock after selling 882,760 shares during the period. Envestnet Asset Management Inc. owned 0.07% of British American Tobacco worth $51,013,000 at the end of the most recent reporting period.

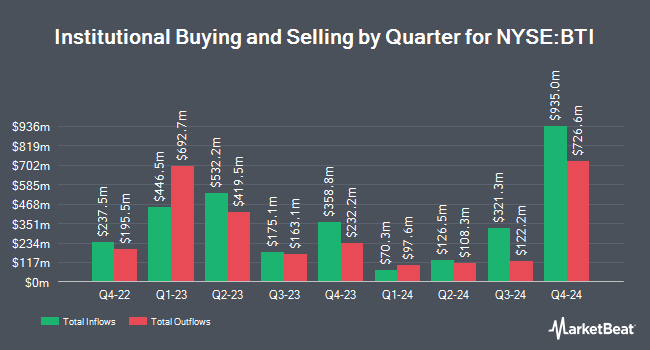

Several other institutional investors and hedge funds have also added to or reduced their stakes in the company. Arrowstreet Capital Limited Partnership lifted its position in British American Tobacco by 24.4% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 6,094,244 shares of the company's stock valued at $221,343,000 after purchasing an additional 1,196,020 shares during the period. Natixis Advisors LLC raised its stake in British American Tobacco by 4.8% during the 4th quarter. Natixis Advisors LLC now owns 3,010,687 shares of the company's stock valued at $109,348,000 after purchasing an additional 137,231 shares during the period. Raymond James Financial Inc. bought a new stake in shares of British American Tobacco during the fourth quarter valued at approximately $55,620,000. Grantham Mayo Van Otterloo & Co. LLC lifted its stake in British American Tobacco by 202.8% in the 4th quarter. Grantham Mayo Van Otterloo & Co. LLC now owns 1,369,751 shares of the company's stock worth $49,749,000 after purchasing an additional 917,334 shares in the last quarter. Finally, First Eagle Investment Management LLC boosted its stake in British American Tobacco by 13.0% during the fourth quarter. First Eagle Investment Management LLC now owns 967,976 shares of the company's stock valued at $35,157,000 after buying an additional 111,033 shares during the last quarter. Hedge funds and other institutional investors own 16.16% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. StockNews.com raised British American Tobacco from a "hold" rating to a "buy" rating in a research report on Monday, February 17th. UBS Group raised British American Tobacco from a "neutral" rating to a "buy" rating in a research report on Monday, January 27th.

Read Our Latest Stock Analysis on BTI

British American Tobacco Stock Performance

Shares of BTI traded up $0.38 during mid-day trading on Tuesday, reaching $42.39. The company had a trading volume of 3,668,095 shares, compared to its average volume of 4,670,148. The company has a quick ratio of 0.58, a current ratio of 0.76 and a debt-to-equity ratio of 0.65. British American Tobacco p.l.c. has a 52-week low of $28.25 and a 52-week high of $42.74. The stock has a 50 day moving average of $40.36 and a two-hundred day moving average of $37.87. The stock has a market capitalization of $87.73 billion, a P/E ratio of 8.70 and a beta of 0.38.

British American Tobacco Dividend Announcement

The business also recently disclosed a dividend, which will be paid on Monday, May 12th. Shareholders of record on Friday, March 28th will be issued a dividend of $0.7491 per share. The ex-dividend date of this dividend is Friday, March 28th. British American Tobacco's payout ratio is 60.57%.

British American Tobacco Profile

(

Free Report)

British American Tobacco p.l.c. engages in the provision of tobacco and nicotine products to consumers worldwide. It also offers vapour, heated, and modern oral nicotine products; combustible cigarettes; and traditional oral products, such as snus and moist snuff. The company offers its products under the Vuse, glo, Velo, Grizzly, Kodiak, Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Camel, Natural American Spirit, Newport, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, State Express 555 and Shuang Xi brands.

Featured Articles

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.