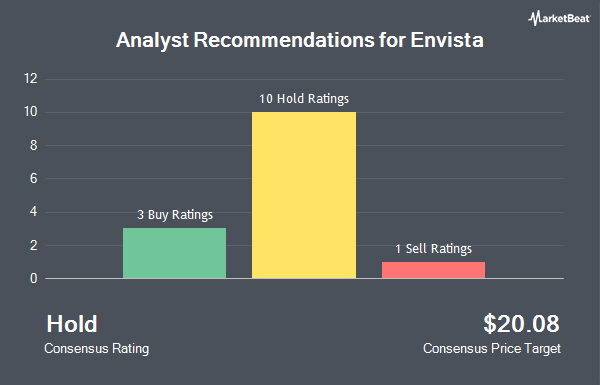

Shares of Envista Holdings Co. (NYSE:NVST - Get Free Report) have received a consensus rating of "Hold" from the sixteen ratings firms that are presently covering the stock, Marketbeat reports. Two equities research analysts have rated the stock with a sell rating, eleven have given a hold rating and three have assigned a buy rating to the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is $20.65.

NVST has been the topic of a number of analyst reports. Wells Fargo & Company initiated coverage on Envista in a research note on Tuesday, October 8th. They set an "equal weight" rating and a $20.00 price objective on the stock. Leerink Partnrs raised shares of Envista from a "strong sell" rating to a "hold" rating in a research note on Thursday, October 31st. Piper Sandler lifted their price target on shares of Envista from $16.00 to $17.00 and gave the stock a "neutral" rating in a report on Thursday, October 31st. Robert W. Baird raised their target price on shares of Envista from $17.00 to $22.00 and gave the stock a "neutral" rating in a research report on Thursday, October 31st. Finally, Stifel Nicolaus lifted their target price on shares of Envista from $18.00 to $21.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd.

Get Our Latest Research Report on Envista

Hedge Funds Weigh In On Envista

Hedge funds and other institutional investors have recently modified their holdings of the company. Mirae Asset Global Investments Co. Ltd. purchased a new position in shares of Envista in the 3rd quarter valued at $31,000. GAMMA Investing LLC raised its position in Envista by 69.8% in the third quarter. GAMMA Investing LLC now owns 1,766 shares of the company's stock valued at $35,000 after purchasing an additional 726 shares during the period. Huntington National Bank raised its position in Envista by 97.8% in the third quarter. Huntington National Bank now owns 1,919 shares of the company's stock valued at $38,000 after purchasing an additional 949 shares during the period. Blue Trust Inc. lifted its stake in shares of Envista by 69.7% during the third quarter. Blue Trust Inc. now owns 1,957 shares of the company's stock worth $39,000 after purchasing an additional 804 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC boosted its position in shares of Envista by 50.8% in the third quarter. Allspring Global Investments Holdings LLC now owns 2,161 shares of the company's stock worth $43,000 after buying an additional 728 shares during the period.

Envista Price Performance

NYSE:NVST traded down $0.13 during mid-day trading on Monday, hitting $19.11. 1,752,218 shares of the company's stock traded hands, compared to its average volume of 2,362,647. The firm's 50 day simple moving average is $20.22 and its 200 day simple moving average is $18.46. The company has a market cap of $3.29 billion, a PE ratio of -2.46, a price-to-earnings-growth ratio of 2.71 and a beta of 1.31. Envista has a 1 year low of $15.15 and a 1 year high of $25.64. The company has a debt-to-equity ratio of 0.42, a quick ratio of 1.77 and a current ratio of 2.08.

Envista (NYSE:NVST - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported $0.12 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.09 by $0.03. The firm had revenue of $601.00 million for the quarter, compared to analyst estimates of $590.34 million. Envista had a positive return on equity of 3.76% and a negative net margin of 53.42%. Envista's revenue was down 4.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.43 EPS. Sell-side analysts expect that Envista will post 0.72 EPS for the current year.

About Envista

(

Get Free ReportEnvista Holdings Corporation, together with its subsidiaries, develops, manufactures, markets, and sells dental products in the United States, China, and internationally. The company operates in two segments, Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment offers dental implant systems, guided surgery systems, biomaterials, and prefabricated and custom-built prosthetics to oral surgeons, prosthodontists and periodontists, and general dentist; and brackets and wires, tubes and bands, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products.

Recommended Stories

Before you consider Envista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envista wasn't on the list.

While Envista currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.