Envista (NYSE:NVST - Free Report) had its price target upped by Wells Fargo & Company from $20.00 to $21.00 in a research report report published on Thursday morning,Benzinga reports. They currently have an equal weight rating on the stock.

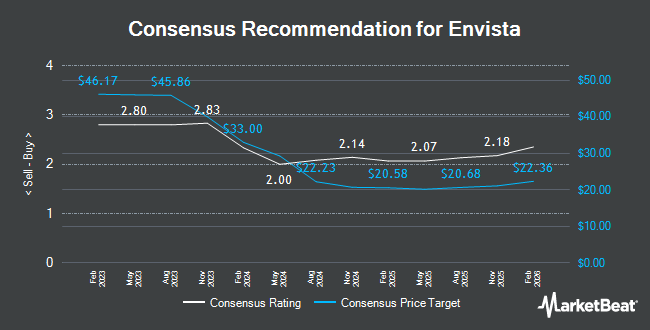

Other equities analysts have also recently issued research reports about the stock. Mizuho initiated coverage on shares of Envista in a research note on Wednesday, December 4th. They issued an "underperform" rating and a $20.00 price objective on the stock. Leerink Partners upgraded Envista from an "underperform" rating to a "market perform" rating and upped their price objective for the stock from $16.00 to $23.00 in a research note on Thursday, October 31st. Piper Sandler lifted their target price on Envista from $17.00 to $18.00 and gave the company a "neutral" rating in a research report on Monday, February 3rd. Jefferies Financial Group upped their price target on Envista from $20.00 to $22.00 and gave the stock a "hold" rating in a research report on Thursday, January 23rd. Finally, Robert W. Baird lifted their price objective on Envista from $17.00 to $22.00 and gave the company a "neutral" rating in a research report on Thursday, October 31st. Two analysts have rated the stock with a sell rating, nine have issued a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $20.21.

Read Our Latest Stock Report on NVST

Envista Stock Performance

Shares of NYSE:NVST traded down $0.01 during mid-day trading on Thursday, reaching $21.24. The company had a trading volume of 2,279,536 shares, compared to its average volume of 2,253,905. The company's 50-day moving average price is $19.94 and its 200-day moving average price is $19.20. Envista has a one year low of $15.15 and a one year high of $23.06. The company has a current ratio of 2.04, a quick ratio of 1.77 and a debt-to-equity ratio of 0.44. The firm has a market cap of $3.66 billion, a price-to-earnings ratio of -3.27, a PEG ratio of 2.06 and a beta of 1.34.

Envista (NYSE:NVST - Get Free Report) last released its earnings results on Wednesday, February 5th. The company reported $0.24 earnings per share for the quarter, beating analysts' consensus estimates of $0.23 by $0.01. Envista had a positive return on equity of 3.86% and a negative net margin of 44.56%. As a group, equities research analysts anticipate that Envista will post 1.06 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in the company. Royce & Associates LP boosted its holdings in shares of Envista by 88.9% in the 4th quarter. Royce & Associates LP now owns 526,985 shares of the company's stock valued at $10,166,000 after purchasing an additional 248,081 shares during the last quarter. Natixis Advisors LLC boosted its holdings in Envista by 1.8% in the fourth quarter. Natixis Advisors LLC now owns 106,652 shares of the company's stock valued at $2,057,000 after acquiring an additional 1,845 shares during the last quarter. Swiss National Bank increased its stake in Envista by 0.8% during the fourth quarter. Swiss National Bank now owns 338,200 shares of the company's stock worth $6,524,000 after acquiring an additional 2,800 shares during the last quarter. Pzena Investment Management LLC purchased a new position in shares of Envista in the 4th quarter worth about $16,979,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in shares of Envista by 17.7% in the 4th quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 42,057 shares of the company's stock valued at $811,000 after purchasing an additional 6,320 shares in the last quarter.

Envista Company Profile

(

Get Free Report)

Envista Holdings Corporation, together with its subsidiaries, develops, manufactures, markets, and sells dental products in the United States, China, and internationally. The company operates in two segments, Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment offers dental implant systems, guided surgery systems, biomaterials, and prefabricated and custom-built prosthetics to oral surgeons, prosthodontists and periodontists, and general dentist; and brackets and wires, tubes and bands, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products.

See Also

Before you consider Envista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envista wasn't on the list.

While Envista currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.