Brown Brothers Harriman & Co. lowered its stake in EOG Resources, Inc. (NYSE:EOG - Free Report) by 11.5% during the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 62,002 shares of the energy exploration company's stock after selling 8,058 shares during the quarter. Brown Brothers Harriman & Co.'s holdings in EOG Resources were worth $7,622,000 as of its most recent filing with the SEC.

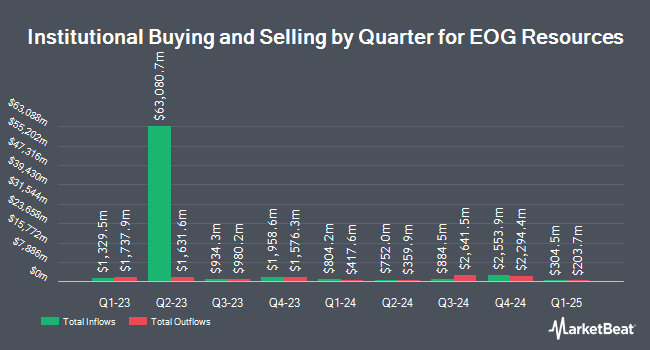

A number of other large investors have also made changes to their positions in EOG. DRW Securities LLC boosted its stake in EOG Resources by 98.6% in the 3rd quarter. DRW Securities LLC now owns 26,838 shares of the energy exploration company's stock worth $3,299,000 after buying an additional 13,324 shares during the last quarter. Independent Advisor Alliance increased its position in EOG Resources by 3.4% during the 3rd quarter. Independent Advisor Alliance now owns 27,958 shares of the energy exploration company's stock worth $3,437,000 after purchasing an additional 909 shares in the last quarter. Fisher Asset Management LLC raised its holdings in EOG Resources by 856.7% in the third quarter. Fisher Asset Management LLC now owns 1,200,851 shares of the energy exploration company's stock valued at $147,621,000 after buying an additional 1,075,334 shares during the period. Daiwa Securities Group Inc. lifted its position in EOG Resources by 11.0% during the third quarter. Daiwa Securities Group Inc. now owns 69,879 shares of the energy exploration company's stock valued at $8,590,000 after buying an additional 6,919 shares in the last quarter. Finally, Marco Investment Management LLC increased its position in shares of EOG Resources by 2.0% in the third quarter. Marco Investment Management LLC now owns 37,240 shares of the energy exploration company's stock worth $4,578,000 after acquiring an additional 735 shares in the last quarter. Institutional investors and hedge funds own 89.91% of the company's stock.

EOG Resources Stock Up 0.4 %

Shares of EOG stock traded up $0.56 on Tuesday, hitting $132.54. The stock had a trading volume of 3,129,539 shares, compared to its average volume of 3,134,564. EOG Resources, Inc. has a 12-month low of $108.94 and a 12-month high of $139.67. The company has a debt-to-equity ratio of 0.13, a current ratio of 2.31 and a quick ratio of 2.07. The business has a 50 day moving average of $128.34 and a 200 day moving average of $126.18. The stock has a market cap of $74.55 billion, a price-to-earnings ratio of 10.67, a price-to-earnings-growth ratio of 3.62 and a beta of 1.28.

EOG Resources announced that its Board of Directors has authorized a stock buyback plan on Thursday, November 7th that authorizes the company to repurchase $5.00 billion in shares. This repurchase authorization authorizes the energy exploration company to reacquire up to 7% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's board believes its stock is undervalued.

EOG Resources Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Stockholders of record on Friday, January 17th will be given a dividend of $0.975 per share. This represents a $3.90 dividend on an annualized basis and a dividend yield of 2.94%. The ex-dividend date of this dividend is Friday, January 17th. This is a boost from EOG Resources's previous quarterly dividend of $0.91. EOG Resources's dividend payout ratio is currently 31.40%.

Insider Buying and Selling

In related news, Director Janet F. Clark sold 568 shares of the stock in a transaction on Tuesday, November 19th. The stock was sold at an average price of $135.33, for a total value of $76,867.44. Following the transaction, the director now owns 43,532 shares of the company's stock, valued at $5,891,185.56. This represents a 1.29 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 0.30% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on EOG. UBS Group decreased their target price on EOG Resources from $167.00 to $154.00 and set a "buy" rating for the company in a research report on Wednesday, September 18th. Raymond James increased their target price on shares of EOG Resources from $156.00 to $167.00 and gave the stock a "strong-buy" rating in a report on Thursday, November 21st. Truist Financial boosted their price objective on EOG Resources from $115.00 to $135.00 and gave the company a "hold" rating in a research report on Tuesday, November 12th. JPMorgan Chase & Co. dropped their price target on shares of EOG Resources from $143.00 to $135.00 and set a "neutral" rating on the stock in a research note on Thursday, September 12th. Finally, Barclays decreased their price objective on shares of EOG Resources from $144.00 to $137.00 and set an "equal weight" rating for the company in a report on Thursday, October 3rd. Fifteen equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $144.20.

Read Our Latest Report on EOG

About EOG Resources

(

Free Report)

EOG Resources, Inc, together with its subsidiaries, explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally. The company was formerly known as Enron Oil & Gas Company.

Further Reading

Before you consider EOG Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EOG Resources wasn't on the list.

While EOG Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.