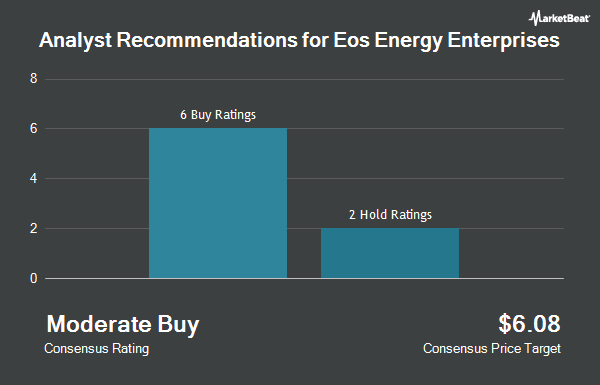

Shares of Eos Energy Enterprises, Inc. (NASDAQ:EOSE - Get Free Report) have been given an average rating of "Moderate Buy" by the seven brokerages that are currently covering the firm, MarketBeat.com reports. Two research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $3.90.

Several research firms recently commented on EOSE. Roth Mkm dropped their price target on shares of Eos Energy Enterprises from $4.50 to $4.00 and set a "buy" rating on the stock in a research report on Thursday, November 7th. Stifel Nicolaus reissued a "buy" rating and issued a $6.00 price target on shares of Eos Energy Enterprises in a report on Wednesday, August 21st.

Read Our Latest Stock Report on EOSE

Eos Energy Enterprises Trading Up 0.7 %

Shares of NASDAQ EOSE traded up $0.02 during trading on Thursday, reaching $2.70. 3,864,127 shares of the company traded hands, compared to its average volume of 6,787,219. The stock has a market cap of $588.36 million, a P/E ratio of -1.12 and a beta of 2.38. The firm's fifty day simple moving average is $2.86 and its 200 day simple moving average is $2.04. Eos Energy Enterprises has a 12-month low of $0.61 and a 12-month high of $3.66.

Insider Buying and Selling

In related news, Director Jeffrey S. Bornstein sold 30,000 shares of the business's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $2.62, for a total transaction of $78,600.00. Following the transaction, the director now directly owns 84,929 shares in the company, valued at approximately $222,513.98. The trade was a 26.10 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. 3.80% of the stock is owned by company insiders.

Hedge Funds Weigh In On Eos Energy Enterprises

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vanguard Group Inc. raised its holdings in shares of Eos Energy Enterprises by 6.6% during the 1st quarter. Vanguard Group Inc. now owns 9,375,916 shares of the company's stock worth $9,657,000 after acquiring an additional 580,022 shares during the period. American International Group Inc. increased its holdings in shares of Eos Energy Enterprises by 41.2% during the 1st quarter. American International Group Inc. now owns 75,555 shares of the company's stock worth $78,000 after buying an additional 22,056 shares during the last quarter. PEAK6 Investments LLC purchased a new stake in shares of Eos Energy Enterprises during the 1st quarter valued at approximately $103,000. Price T Rowe Associates Inc. MD lifted its holdings in Eos Energy Enterprises by 74.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 43,930 shares of the company's stock valued at $46,000 after acquiring an additional 18,735 shares during the last quarter. Finally, B. Riley Wealth Advisors Inc. grew its position in Eos Energy Enterprises by 940.6% in the first quarter. B. Riley Wealth Advisors Inc. now owns 275,765 shares of the company's stock worth $284,000 after acquiring an additional 249,265 shares during the period. Institutional investors and hedge funds own 54.87% of the company's stock.

Eos Energy Enterprises Company Profile

(

Get Free ReportEos Energy Enterprises, Inc designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States. The company offers Znyth technology battery energy storage system (BESS), which provides the operating flexibility to manage increased grid complexity and price volatility.

Recommended Stories

Before you consider Eos Energy Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eos Energy Enterprises wasn't on the list.

While Eos Energy Enterprises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.