James Investment Research Inc. decreased its stake in shares of Eos Energy Enterprises, Inc. (NASDAQ:EOSE - Free Report) by 64.1% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 42,425 shares of the company's stock after selling 75,914 shares during the quarter. James Investment Research Inc.'s holdings in Eos Energy Enterprises were worth $206,000 at the end of the most recent reporting period.

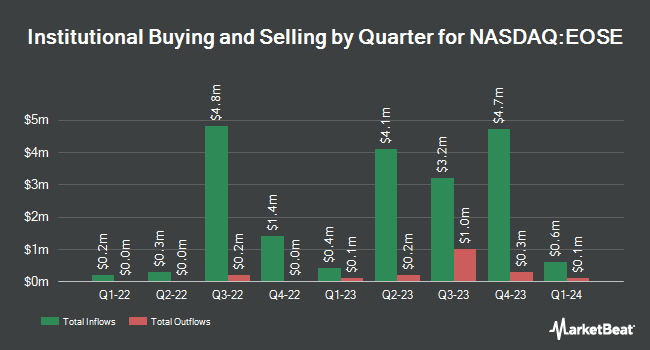

A number of other hedge funds have also bought and sold shares of EOSE. Montag A & Associates Inc. increased its stake in shares of Eos Energy Enterprises by 21.0% in the fourth quarter. Montag A & Associates Inc. now owns 13,809 shares of the company's stock worth $67,000 after acquiring an additional 2,400 shares during the period. R Squared Ltd purchased a new position in Eos Energy Enterprises during the fourth quarter valued at $31,000. Hollencrest Capital Management lifted its holdings in Eos Energy Enterprises by 1,000.0% during the third quarter. Hollencrest Capital Management now owns 8,250 shares of the company's stock valued at $25,000 after purchasing an additional 7,500 shares in the last quarter. Lake Street Private Wealth LLC purchased a new position in Eos Energy Enterprises during the fourth quarter valued at $51,000. Finally, WESPAC Advisors LLC purchased a new position in Eos Energy Enterprises during the third quarter valued at $32,000. Institutional investors and hedge funds own 54.87% of the company's stock.

Eos Energy Enterprises Stock Performance

Shares of NASDAQ:EOSE traded down $0.07 during midday trading on Thursday, hitting $4.75. The company's stock had a trading volume of 8,236,519 shares, compared to its average volume of 8,024,633. The business's 50 day simple moving average is $5.14 and its 200 day simple moving average is $3.52. The company has a market cap of $1.04 billion, a P/E ratio of -1.97 and a beta of 2.10. Eos Energy Enterprises, Inc. has a 12-month low of $0.61 and a 12-month high of $6.64.

Wall Street Analysts Forecast Growth

Separately, Roth Mkm downgraded shares of Eos Energy Enterprises from a "buy" rating to a "neutral" rating and increased their price objective for the company from $4.00 to $5.00 in a report on Thursday. Three investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to MarketBeat.com, Eos Energy Enterprises currently has a consensus rating of "Moderate Buy" and a consensus price target of $4.10.

Check Out Our Latest Research Report on EOSE

Eos Energy Enterprises Profile

(

Free Report)

Eos Energy Enterprises, Inc designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States. The company offers Znyth technology battery energy storage system (BESS), which provides the operating flexibility to manage increased grid complexity and price volatility.

See Also

Before you consider Eos Energy Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eos Energy Enterprises wasn't on the list.

While Eos Energy Enterprises currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.