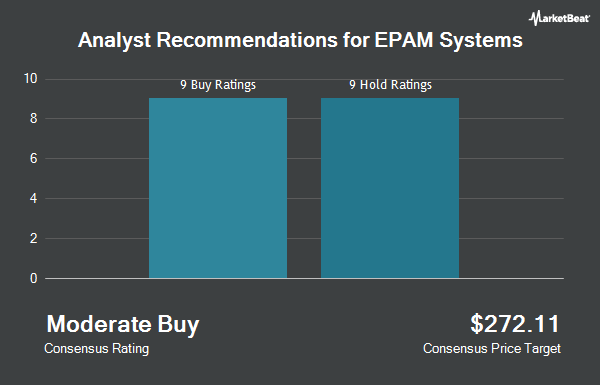

Shares of EPAM Systems, Inc. (NYSE:EPAM - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the twenty brokerages that are currently covering the firm, Marketbeat reports. Nine research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. The average 1 year price target among brokers that have issued ratings on the stock in the last year is $261.50.

A number of research analysts have commented on the company. Susquehanna upped their price target on EPAM Systems from $240.00 to $270.00 and gave the stock a "positive" rating in a research note on Friday. Piper Sandler raised their target price on EPAM Systems from $225.00 to $258.00 and gave the company an "overweight" rating in a report on Thursday. JPMorgan Chase & Co. lifted their target price on EPAM Systems from $222.00 to $262.00 and gave the company an "overweight" rating in a research report on Friday, September 6th. Itau BBA Securities raised shares of EPAM Systems from a "market perform" rating to an "outperform" rating and set a $269.00 price objective for the company in a research note on Friday. Finally, Deutsche Bank Aktiengesellschaft began coverage on shares of EPAM Systems in a report on Thursday, August 22nd. They issued a "hold" rating and a $204.00 price objective for the company.

Get Our Latest Stock Analysis on EPAM

EPAM Systems Trading Up 0.2 %

Shares of NYSE EPAM traded up $0.53 during trading on Friday, hitting $233.45. 794,168 shares of the company were exchanged, compared to its average volume of 554,863. The company has a fifty day moving average price of $198.94 and a 200-day moving average price of $198.28. EPAM Systems has a 12-month low of $169.43 and a 12-month high of $317.50. The company has a debt-to-equity ratio of 0.01, a quick ratio of 4.84 and a current ratio of 4.84. The firm has a market capitalization of $13.29 billion, a PE ratio of 33.45, a P/E/G ratio of 4.45 and a beta of 1.46.

EPAM Systems (NYSE:EPAM - Get Free Report) last issued its quarterly earnings data on Thursday, August 8th. The information technology services provider reported $2.45 earnings per share for the quarter, topping the consensus estimate of $2.26 by $0.19. EPAM Systems had a return on equity of 14.31% and a net margin of 8.86%. The company had revenue of $1.15 billion during the quarter, compared to analyst estimates of $1.14 billion. During the same period in the prior year, the business posted $2.21 earnings per share. The firm's revenue for the quarter was down 2.0% compared to the same quarter last year. As a group, equities research analysts expect that EPAM Systems will post 8.08 EPS for the current year.

EPAM Systems declared that its board has initiated a stock repurchase plan on Thursday, August 8th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the information technology services provider to reacquire up to 4.3% of its stock through open market purchases. Stock repurchase plans are usually a sign that the company's board of directors believes its stock is undervalued.

Institutional Investors Weigh In On EPAM Systems

Several large investors have recently modified their holdings of the company. Aurora Investment Counsel increased its position in EPAM Systems by 3.3% in the 3rd quarter. Aurora Investment Counsel now owns 6,056 shares of the information technology services provider's stock valued at $1,205,000 after acquiring an additional 191 shares during the period. First Horizon Advisors Inc. grew its holdings in EPAM Systems by 21.3% during the third quarter. First Horizon Advisors Inc. now owns 325 shares of the information technology services provider's stock worth $65,000 after acquiring an additional 57 shares during the period. Commerce Bank raised its position in EPAM Systems by 3.3% in the third quarter. Commerce Bank now owns 3,381 shares of the information technology services provider's stock worth $673,000 after acquiring an additional 109 shares in the last quarter. PNC Financial Services Group Inc. boosted its stake in shares of EPAM Systems by 10.1% during the third quarter. PNC Financial Services Group Inc. now owns 15,448 shares of the information technology services provider's stock valued at $3,075,000 after acquiring an additional 1,414 shares during the last quarter. Finally, B. Metzler seel. Sohn & Co. Holding AG acquired a new position in EPAM Systems in the 3rd quarter valued at about $291,000. 91.58% of the stock is owned by institutional investors and hedge funds.

About EPAM Systems

(

Get Free ReportEPAM Systems, Inc provides digital platform engineering and software development services worldwide. The company offers engineering services, including requirements analysis and platform selection, customization, cross-platform migration, implementation, and integration; infrastructure management services, such as software development, testing, performance tuning, deployment, maintenance, and support services.

See Also

Before you consider EPAM Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EPAM Systems wasn't on the list.

While EPAM Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.