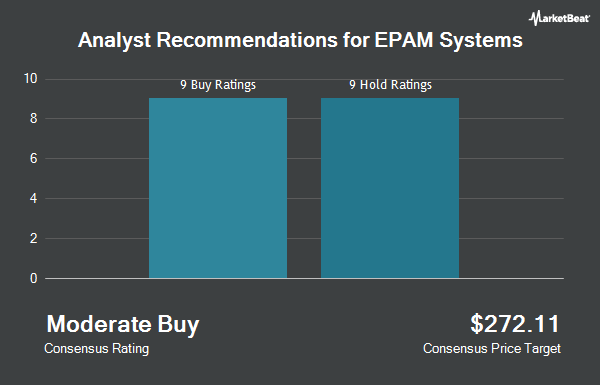

EPAM Systems, Inc. (NYSE:EPAM - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the twenty brokerages that are presently covering the company, Marketbeat reports. Eight research analysts have rated the stock with a hold recommendation and twelve have assigned a buy recommendation to the company. The average 1-year price objective among brokers that have issued ratings on the stock in the last year is $264.20.

A number of analysts have commented on the company. Piper Sandler raised their price objective on EPAM Systems from $225.00 to $258.00 and gave the stock an "overweight" rating in a research report on Thursday, November 7th. JPMorgan Chase & Co. raised their target price on EPAM Systems from $222.00 to $262.00 and gave the stock an "overweight" rating in a research report on Friday, September 6th. Susquehanna raised their target price on EPAM Systems from $240.00 to $270.00 and gave the stock a "positive" rating in a research report on Friday, November 8th. Itau BBA Securities upgraded EPAM Systems from a "market perform" rating to an "outperform" rating and set a $269.00 target price for the company in a research report on Friday, November 8th. Finally, Citigroup raised their target price on EPAM Systems from $207.00 to $210.00 and gave the stock a "neutral" rating in a research report on Monday, October 28th.

Get Our Latest Research Report on EPAM Systems

EPAM Systems Stock Performance

EPAM traded up $1.40 during midday trading on Wednesday, reaching $241.91. The company's stock had a trading volume of 933,588 shares, compared to its average volume of 621,788. The stock has a market cap of $13.72 billion, a P/E ratio of 31.36, a PEG ratio of 3.73 and a beta of 1.49. The company has a fifty day simple moving average of $212.90 and a 200 day simple moving average of $200.42. The company has a current ratio of 4.56, a quick ratio of 4.56 and a debt-to-equity ratio of 0.01. EPAM Systems has a twelve month low of $169.43 and a twelve month high of $317.50.

EPAM Systems declared that its board has authorized a stock buyback program on Thursday, August 8th that allows the company to buyback $500.00 million in outstanding shares. This buyback authorization allows the information technology services provider to purchase up to 4.3% of its stock through open market purchases. Stock buyback programs are typically an indication that the company's management believes its stock is undervalued.

Insiders Place Their Bets

In related news, CFO Jason D. Peterson sold 1,000 shares of the company's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $237.00, for a total transaction of $237,000.00. Following the sale, the chief financial officer now owns 24,836 shares in the company, valued at approximately $5,886,132. This represents a 3.87 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Corporate insiders own 4.30% of the company's stock.

Hedge Funds Weigh In On EPAM Systems

Several institutional investors and hedge funds have recently made changes to their positions in EPAM. Metis Global Partners LLC boosted its stake in shares of EPAM Systems by 2.5% in the third quarter. Metis Global Partners LLC now owns 2,029 shares of the information technology services provider's stock valued at $404,000 after buying an additional 50 shares during the period. Retirement Systems of Alabama lifted its stake in shares of EPAM Systems by 0.4% in the 2nd quarter. Retirement Systems of Alabama now owns 12,788 shares of the information technology services provider's stock valued at $2,406,000 after acquiring an additional 52 shares during the last quarter. Taylor Frigon Capital Management LLC lifted its stake in shares of EPAM Systems by 0.5% in the 2nd quarter. Taylor Frigon Capital Management LLC now owns 12,339 shares of the information technology services provider's stock valued at $2,321,000 after acquiring an additional 56 shares during the last quarter. First Horizon Advisors Inc. lifted its stake in shares of EPAM Systems by 21.3% in the 3rd quarter. First Horizon Advisors Inc. now owns 325 shares of the information technology services provider's stock valued at $65,000 after acquiring an additional 57 shares during the last quarter. Finally, SkyView Investment Advisors LLC lifted its stake in shares of EPAM Systems by 3.0% in the 3rd quarter. SkyView Investment Advisors LLC now owns 2,055 shares of the information technology services provider's stock valued at $409,000 after acquiring an additional 60 shares during the last quarter. Institutional investors and hedge funds own 91.58% of the company's stock.

EPAM Systems Company Profile

(

Get Free ReportEPAM Systems, Inc provides digital platform engineering and software development services worldwide. The company offers engineering services, including requirements analysis and platform selection, customization, cross-platform migration, implementation, and integration; infrastructure management services, such as software development, testing, performance tuning, deployment, maintenance, and support services.

Recommended Stories

Before you consider EPAM Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EPAM Systems wasn't on the list.

While EPAM Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.