EPIQ Capital Group LLC lowered its stake in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 11.2% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 41,168 shares of the specialty retailer's stock after selling 5,201 shares during the period. Alibaba Group makes up approximately 0.9% of EPIQ Capital Group LLC's holdings, making the stock its 17th biggest position. EPIQ Capital Group LLC's holdings in Alibaba Group were worth $3,491,000 as of its most recent SEC filing.

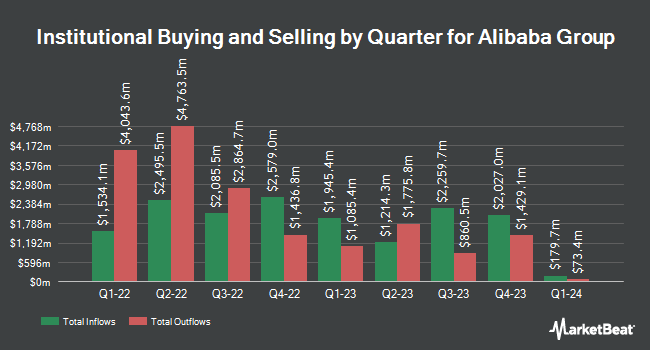

A number of other large investors have also recently made changes to their positions in the stock. Future Fund LLC boosted its holdings in Alibaba Group by 45.3% in the fourth quarter. Future Fund LLC now owns 11,230 shares of the specialty retailer's stock worth $952,000 after purchasing an additional 3,500 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank boosted its stake in shares of Alibaba Group by 29.6% in the 4th quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 18,589 shares of the specialty retailer's stock worth $1,576,000 after buying an additional 4,242 shares during the last quarter. Jackson Hole Capital Partners LLC grew its holdings in shares of Alibaba Group by 1.2% in the fourth quarter. Jackson Hole Capital Partners LLC now owns 17,768 shares of the specialty retailer's stock worth $1,507,000 after acquiring an additional 207 shares during the period. Amundi increased its position in Alibaba Group by 80.0% during the fourth quarter. Amundi now owns 646,058 shares of the specialty retailer's stock valued at $54,069,000 after acquiring an additional 287,127 shares during the last quarter. Finally, Rialto Wealth Management LLC bought a new position in Alibaba Group in the fourth quarter valued at about $170,000. 13.47% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

BABA has been the subject of a number of recent research reports. Sanford C. Bernstein upgraded Alibaba Group from a "market perform" rating to an "outperform" rating and boosted their price target for the company from $104.00 to $165.00 in a research note on Tuesday, February 25th. Barclays boosted their target price on shares of Alibaba Group from $130.00 to $180.00 and gave the company an "overweight" rating in a research report on Friday, February 21st. Robert W. Baird lifted their price target on shares of Alibaba Group from $110.00 to $125.00 and gave the stock an "outperform" rating in a research note on Wednesday, February 19th. Arete Research raised shares of Alibaba Group to a "strong-buy" rating in a research report on Friday, February 28th. Finally, Citigroup raised their target price on Alibaba Group from $133.00 to $138.00 and gave the stock a "buy" rating in a report on Friday, January 10th. Fifteen investment analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $144.07.

Read Our Latest Stock Report on BABA

Alibaba Group Stock Performance

NYSE:BABA opened at $140.59 on Monday. The stock has a 50-day moving average price of $105.46 and a 200 day moving average price of $96.90. The stock has a market capitalization of $334.04 billion, a P/E ratio of 20.32, a P/E/G ratio of 0.61 and a beta of 0.28. Alibaba Group Holding Limited has a 12-month low of $68.36 and a 12-month high of $145.36. The company has a current ratio of 1.48, a quick ratio of 1.48 and a debt-to-equity ratio of 0.19.

Alibaba Group (NYSE:BABA - Get Free Report) last released its quarterly earnings data on Thursday, February 20th. The specialty retailer reported $2.77 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.84 by ($0.07). Alibaba Group had a net margin of 12.29% and a return on equity of 12.89%. The company had revenue of $38.38 billion for the quarter, compared to the consensus estimate of $38.19 billion. Equities research analysts forecast that Alibaba Group Holding Limited will post 7.86 EPS for the current fiscal year.

Alibaba Group Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.