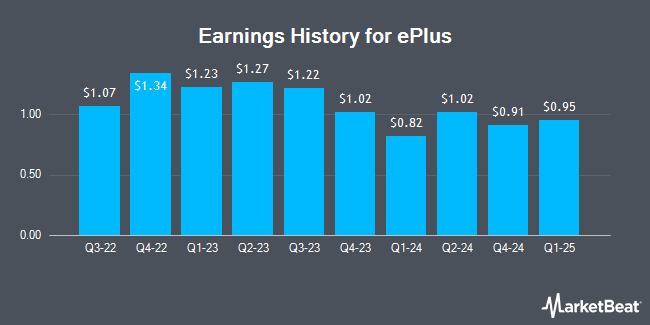

ePlus (NASDAQ:PLUS - Get Free Report) is expected to be posting its quarterly earnings results before the market opens on Wednesday, February 5th. Analysts expect ePlus to post earnings of $1.28 per share and revenue of $563.40 million for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

ePlus Stock Performance

Shares of PLUS traded up $0.97 during trading hours on Friday, hitting $80.07. The company had a trading volume of 74,583 shares, compared to its average volume of 173,857. The firm has a market cap of $2.15 billion, a price-to-earnings ratio of 19.87, a PEG ratio of 1.79 and a beta of 1.10. The business has a fifty day moving average of $78.00 and a 200-day moving average of $86.96. ePlus has a 12 month low of $56.33 and a 12 month high of $106.98. The company has a quick ratio of 1.71, a current ratio of 1.85 and a debt-to-equity ratio of 0.01.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered shares of ePlus from a "buy" rating to a "hold" rating in a research report on Friday, November 15th.

Check Out Our Latest Stock Analysis on ePlus

ePlus Company Profile

(

Get Free Report)

ePlus inc., together with its subsidiaries, provides information technology (IT) solutions that enable organizations to optimize their IT environment and supply chain processes in the United States and internationally. It operates through two segments, Technology and Financing. The Technology segment offers hardware, perpetual and subscription software, maintenance, software assurance, and internally provided and outsourced services; managed services or infrastructure and cloud; and enhanced maintenance support, service desk, storage-as-a-service, cloud hosted and managed, and managed security services; and professional, staff augmentation, cloud consulting, consulting, and security services.

Featured Stories

Before you consider ePlus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ePlus wasn't on the list.

While ePlus currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.