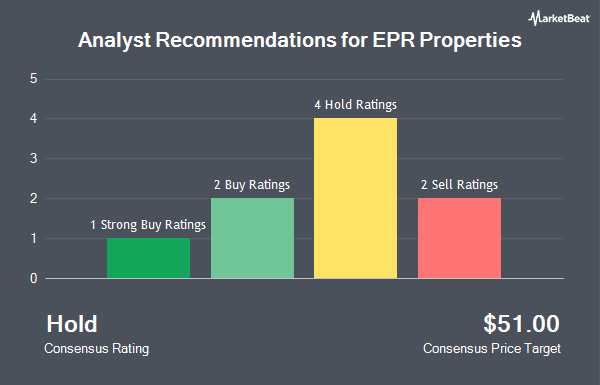

EPR Properties (NYSE:EPR - Get Free Report) has been assigned a consensus recommendation of "Hold" from the nine analysts that are presently covering the stock, Marketbeat reports. Two equities research analysts have rated the stock with a sell recommendation, four have assigned a hold recommendation, two have assigned a buy recommendation and one has given a strong buy recommendation to the company. The average 1-year price objective among analysts that have issued ratings on the stock in the last year is $47.94.

A number of research analysts recently issued reports on the stock. Royal Bank of Canada reissued an "outperform" rating and issued a $50.00 price objective on shares of EPR Properties in a research note on Thursday, January 30th. UBS Group began coverage on shares of EPR Properties in a research report on Thursday, November 14th. They issued a "neutral" rating and a $48.00 target price on the stock.

Read Our Latest Stock Analysis on EPR Properties

EPR Properties Price Performance

NYSE:EPR traded down $0.12 during mid-day trading on Wednesday, reaching $49.42. The stock had a trading volume of 1,036,136 shares, compared to its average volume of 554,376. The stock has a 50-day simple moving average of $46.10 and a two-hundred day simple moving average of $46.39. The stock has a market capitalization of $3.74 billion, a PE ratio of 21.39 and a beta of 1.75. The company has a debt-to-equity ratio of 1.19, a current ratio of 7.81 and a quick ratio of 7.81. EPR Properties has a 12 month low of $39.65 and a 12 month high of $50.26.

EPR Properties Announces Dividend

The business also recently announced a feb 25 dividend, which will be paid on Monday, March 17th. Shareholders of record on Friday, February 28th will be given a $0.285 dividend. The ex-dividend date of this dividend is Friday, February 28th. This represents a yield of 7%. EPR Properties's dividend payout ratio is currently 148.05%.

Hedge Funds Weigh In On EPR Properties

Hedge funds have recently modified their holdings of the business. Abich Financial Wealth Management LLC lifted its holdings in shares of EPR Properties by 1,725.0% during the third quarter. Abich Financial Wealth Management LLC now owns 511 shares of the real estate investment trust's stock worth $25,000 after purchasing an additional 483 shares during the period. V Square Quantitative Management LLC acquired a new position in shares of EPR Properties during the third quarter worth $27,000. Brooklyn Investment Group acquired a new position in shares of EPR Properties during the third quarter worth $27,000. Synergy Investment Management LLC acquired a new position in shares of EPR Properties during the fourth quarter worth $27,000. Finally, Blue Trust Inc. lifted its holdings in shares of EPR Properties by 67.2% during the third quarter. Blue Trust Inc. now owns 709 shares of the real estate investment trust's stock worth $35,000 after purchasing an additional 285 shares during the period. Institutional investors and hedge funds own 74.66% of the company's stock.

EPR Properties Company Profile

(

Get Free ReportEPR Properties NYSE: EPR is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry. We focus on real estate venues that create value by facilitating out of home leisure and recreation experiences where consumers choose to spend their discretionary time and money.

Further Reading

Before you consider EPR Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EPR Properties wasn't on the list.

While EPR Properties currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.