CIBC Asset Management Inc increased its stake in EQT Co. (NYSE:EQT - Free Report) by 45.9% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 86,353 shares of the oil and gas producer's stock after purchasing an additional 27,147 shares during the quarter. CIBC Asset Management Inc's holdings in EQT were worth $3,164,000 at the end of the most recent quarter.

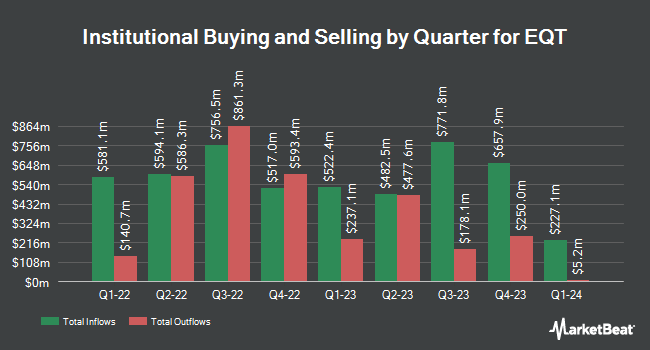

A number of other hedge funds also recently made changes to their positions in the stock. HM Payson & Co. purchased a new stake in EQT in the 3rd quarter worth $25,000. Innealta Capital LLC bought a new position in EQT during the second quarter valued at approximately $28,000. Hexagon Capital Partners LLC boosted its stake in EQT by 18,080.0% during the third quarter. Hexagon Capital Partners LLC now owns 909 shares of the oil and gas producer's stock valued at $33,000 after buying an additional 904 shares during the last quarter. Wolff Wiese Magana LLC grew its holdings in EQT by 936.1% during the 2nd quarter. Wolff Wiese Magana LLC now owns 1,005 shares of the oil and gas producer's stock valued at $37,000 after buying an additional 908 shares in the last quarter. Finally, Blue Trust Inc. increased its stake in EQT by 149.5% in the 2nd quarter. Blue Trust Inc. now owns 998 shares of the oil and gas producer's stock worth $37,000 after acquiring an additional 598 shares during the last quarter. 90.81% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

EQT has been the subject of several research reports. StockNews.com upgraded shares of EQT to a "sell" rating in a research report on Friday, July 26th. Bank of America began coverage on shares of EQT in a research note on Monday, October 28th. They issued a "buy" rating and a $50.00 price objective for the company. Piper Sandler boosted their target price on shares of EQT from $32.00 to $34.00 and gave the company a "neutral" rating in a research note on Monday, November 4th. JPMorgan Chase & Co. raised their target price on shares of EQT from $37.00 to $39.00 and gave the company an "overweight" rating in a research note on Thursday, September 26th. Finally, Wells Fargo & Company upgraded EQT from an "equal weight" rating to an "overweight" rating and boosted their price target for the stock from $40.00 to $42.00 in a research note on Wednesday, August 14th. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating and eleven have given a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $42.83.

Get Our Latest Stock Report on EQT

EQT Stock Performance

EQT stock traded down $0.20 during trading on Tuesday, hitting $44.08. 5,674,609 shares of the company traded hands, compared to its average volume of 7,060,998. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.51 and a quick ratio of 0.51. EQT Co. has a 1 year low of $30.02 and a 1 year high of $44.62. The stock's 50-day simple moving average is $37.16 and its 200 day simple moving average is $36.81. The company has a market cap of $26.30 billion, a PE ratio of 52.71 and a beta of 1.06.

EQT (NYSE:EQT - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The oil and gas producer reported $0.12 earnings per share for the quarter, beating the consensus estimate of $0.06 by $0.06. EQT had a return on equity of 3.74% and a net margin of 5.52%. The firm had revenue of $1.28 billion during the quarter, compared to analyst estimates of $1.35 billion. During the same quarter in the previous year, the business earned $0.30 EPS. EQT's revenue for the quarter was up 8.2% compared to the same quarter last year. On average, equities analysts expect that EQT Co. will post 1.28 earnings per share for the current fiscal year.

EQT Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 2nd. Stockholders of record on Wednesday, November 6th will be issued a dividend of $0.1575 per share. This represents a $0.63 dividend on an annualized basis and a dividend yield of 1.43%. The ex-dividend date is Wednesday, November 6th. EQT's payout ratio is 75.00%.

EQT Company Profile

(

Free Report)

EQT Corporation operates as a natural gas production company in the United States. The company sells natural gas and natural gas liquids to marketers, utilities, and industrial customers through pipelines located in the Appalachian Basin. It also offers marketing services and contractual pipeline capacity management services.

See Also

Before you consider EQT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EQT wasn't on the list.

While EQT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.