BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp trimmed its position in shares of Equifax Inc. (NYSE:EFX - Free Report) by 13.3% during the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 20,622 shares of the credit services provider's stock after selling 3,169 shares during the quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp's holdings in Equifax were worth $6,060,000 at the end of the most recent reporting period.

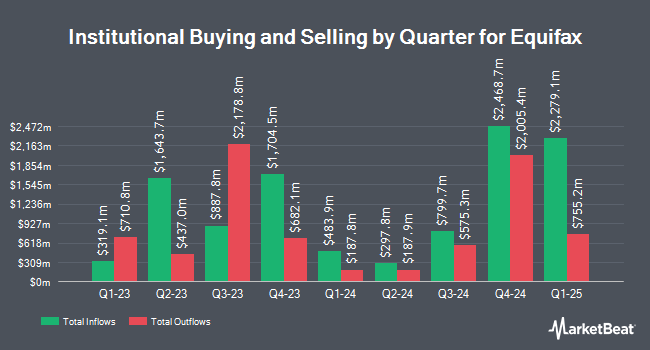

Several other institutional investors also recently bought and sold shares of EFX. Brookstone Capital Management boosted its holdings in shares of Equifax by 8.5% during the 2nd quarter. Brookstone Capital Management now owns 26,675 shares of the credit services provider's stock valued at $6,916,000 after acquiring an additional 2,085 shares during the last quarter. Cetera Investment Advisers boosted its holdings in shares of Equifax by 183.0% during the 1st quarter. Cetera Investment Advisers now owns 17,015 shares of the credit services provider's stock valued at $4,552,000 after acquiring an additional 11,002 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its holdings in shares of Equifax by 23.0% during the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 13,365 shares of the credit services provider's stock valued at $3,241,000 after acquiring an additional 2,499 shares during the last quarter. Susquehanna Fundamental Investments LLC purchased a new stake in shares of Equifax during the 2nd quarter valued at about $15,646,000. Finally, Royal London Asset Management Ltd. boosted its holdings in shares of Equifax by 3.9% during the 2nd quarter. Royal London Asset Management Ltd. now owns 54,509 shares of the credit services provider's stock valued at $13,216,000 after acquiring an additional 2,047 shares during the last quarter. 96.20% of the stock is owned by hedge funds and other institutional investors.

Equifax Price Performance

Shares of EFX stock traded up $2.47 during mid-day trading on Tuesday, hitting $261.17. The company had a trading volume of 715,740 shares, compared to its average volume of 873,860. Equifax Inc. has a 52-week low of $213.02 and a 52-week high of $309.63. The stock's 50 day moving average price is $272.90 and its 200-day moving average price is $268.83. The company has a debt-to-equity ratio of 0.96, a current ratio of 0.88 and a quick ratio of 0.88. The company has a market capitalization of $32.37 billion, a P/E ratio of 58.04, a P/E/G ratio of 3.21 and a beta of 1.57.

Equifax (NYSE:EFX - Get Free Report) last released its earnings results on Wednesday, October 16th. The credit services provider reported $1.85 EPS for the quarter, topping the consensus estimate of $1.84 by $0.01. Equifax had a net margin of 10.07% and a return on equity of 18.56%. The firm had revenue of $1.44 billion for the quarter, compared to the consensus estimate of $1.44 billion. During the same quarter in the previous year, the firm earned $1.76 earnings per share. The company's quarterly revenue was up 9.3% compared to the same quarter last year. Equities research analysts forecast that Equifax Inc. will post 7.28 earnings per share for the current year.

Equifax Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 22nd will be given a $0.39 dividend. This represents a $1.56 annualized dividend and a yield of 0.60%. The ex-dividend date of this dividend is Friday, November 22nd. Equifax's dividend payout ratio is presently 34.67%.

Insider Buying and Selling

In other Equifax news, CEO Mark W. Begor sold 58,304 shares of the business's stock in a transaction on Friday, October 25th. The shares were sold at an average price of $270.49, for a total transaction of $15,770,648.96. Following the transaction, the chief executive officer now owns 109,183 shares in the company, valued at $29,532,909.67. The trade was a 34.81 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP John J. Kelley III sold 1,000 shares of the business's stock in a transaction on Friday, October 25th. The shares were sold at an average price of $272.92, for a total transaction of $272,920.00. Following the transaction, the executive vice president now owns 11,269 shares in the company, valued at $3,075,535.48. This trade represents a 8.15 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 59,855 shares of company stock worth $16,187,044. Insiders own 1.66% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently issued reports on EFX shares. JPMorgan Chase & Co. dropped their price target on shares of Equifax from $304.00 to $283.00 and set an "overweight" rating on the stock in a report on Tuesday, November 19th. Stifel Nicolaus cut their target price on shares of Equifax from $305.00 to $284.00 and set a "buy" rating for the company in a research report on Wednesday, November 20th. Barclays boosted their target price on shares of Equifax from $300.00 to $380.00 and gave the company an "overweight" rating in a research report on Friday, September 13th. Oppenheimer cut their target price on shares of Equifax from $315.00 to $286.00 and set an "outperform" rating for the company in a research report on Tuesday, November 19th. Finally, Needham & Company LLC restated a "buy" rating and set a $350.00 target price on shares of Equifax in a research report on Monday, October 28th. Four analysts have rated the stock with a hold rating and fifteen have given a buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $306.74.

Check Out Our Latest Stock Analysis on EFX

Equifax Profile

(

Free Report)

Equifax Inc operates as a data, analytics, and technology company. The company operates through three segments: Workforce Solutions, U.S. Information Solutions (USIS), and International. The Workforce Solutions segment offers services that enables customers to verify income, employment, educational history, criminal justice data, healthcare professional licensure, and sanctions of people in the United States; and employer customers with services that assist them in complying with and automating payroll-related and human resource management processes throughout the entire cycle of the employment relationship.

Featured Articles

Before you consider Equifax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equifax wasn't on the list.

While Equifax currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.