Gordon Haskett upgraded shares of Equifax (NYSE:EFX - Free Report) to a strong-buy rating in a report published on Tuesday morning,Zacks.com reports.

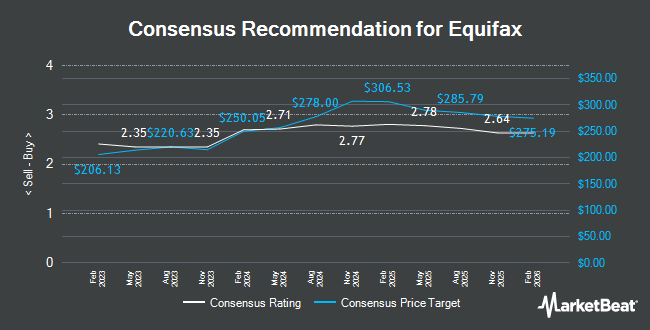

Other research analysts have also recently issued reports about the company. JPMorgan Chase & Co. reduced their price target on Equifax from $304.00 to $283.00 and set an "overweight" rating for the company in a research report on Tuesday, November 19th. Wolfe Research lowered Equifax from an "outperform" rating to a "peer perform" rating in a research note on Thursday, December 12th. UBS Group lowered their price target on Equifax from $335.00 to $310.00 and set a "buy" rating on the stock in a research note on Friday, February 7th. William Blair reaffirmed an "outperform" rating on shares of Equifax in a research note on Friday, February 7th. Finally, Morgan Stanley lowered their price objective on Equifax from $320.00 to $316.00 and set an "overweight" rating on the stock in a research note on Tuesday, January 28th. Three equities research analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Equifax has an average rating of "Moderate Buy" and a consensus target price of $301.13.

Check Out Our Latest Analysis on EFX

Equifax Stock Performance

Shares of NYSE:EFX traded down $3.18 during trading on Tuesday, hitting $238.04. The stock had a trading volume of 849,908 shares, compared to its average volume of 1,060,844. Equifax has a 12-month low of $213.02 and a 12-month high of $309.63. The stock has a market capitalization of $29.51 billion, a price-to-earnings ratio of 49.28, a price-to-earnings-growth ratio of 2.81 and a beta of 1.58. The company has a quick ratio of 0.88, a current ratio of 0.75 and a debt-to-equity ratio of 0.90. The stock has a 50-day simple moving average of $258.10 and a two-hundred day simple moving average of $272.93.

Equifax (NYSE:EFX - Get Free Report) last announced its quarterly earnings data on Thursday, February 6th. The credit services provider reported $2.12 earnings per share (EPS) for the quarter, hitting the consensus estimate of $2.12. Equifax had a return on equity of 19.13% and a net margin of 10.63%. On average, equities research analysts expect that Equifax will post 7.58 earnings per share for the current fiscal year.

Equifax Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, March 14th. Stockholders of record on Friday, February 21st will be paid a $0.39 dividend. This represents a $1.56 annualized dividend and a dividend yield of 0.66%. The ex-dividend date of this dividend is Friday, February 21st. Equifax's dividend payout ratio (DPR) is presently 32.30%.

Insider Activity

In related news, EVP Lisa M. Nelson sold 551 shares of the business's stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $260.39, for a total value of $143,474.89. Following the sale, the executive vice president now owns 11,697 shares in the company, valued at approximately $3,045,781.83. The trade was a 4.50 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 1.57% of the company's stock.

Institutional Investors Weigh In On Equifax

Several institutional investors and hedge funds have recently modified their holdings of EFX. Exchange Traded Concepts LLC purchased a new stake in shares of Equifax in the 3rd quarter valued at $48,000. Blue Trust Inc. raised its holdings in shares of Equifax by 178.8% in the 3rd quarter. Blue Trust Inc. now owns 435 shares of the credit services provider's stock valued at $128,000 after buying an additional 279 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in Equifax by 3.7% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 6,397 shares of the credit services provider's stock worth $1,880,000 after purchasing an additional 231 shares during the period. Whittier Trust Co. of Nevada Inc. increased its holdings in Equifax by 154.5% during the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 756 shares of the credit services provider's stock worth $222,000 after purchasing an additional 459 shares during the period. Finally, Sequoia Financial Advisors LLC increased its holdings in Equifax by 34.8% during the 3rd quarter. Sequoia Financial Advisors LLC now owns 1,454 shares of the credit services provider's stock worth $427,000 after purchasing an additional 375 shares during the period. Hedge funds and other institutional investors own 96.20% of the company's stock.

About Equifax

(

Get Free Report)

Equifax Inc operates as a data, analytics, and technology company. The company operates through three segments: Workforce Solutions, U.S. Information Solutions (USIS), and International. The Workforce Solutions segment offers services that enables customers to verify income, employment, educational history, criminal justice data, healthcare professional licensure, and sanctions of people in the United States; and employer customers with services that assist them in complying with and automating payroll-related and human resource management processes throughout the entire cycle of the employment relationship.

Featured Articles

Before you consider Equifax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equifax wasn't on the list.

While Equifax currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.