Equinix (NASDAQ:EQIX - Get Free Report) had its target price upped by equities research analysts at Truist Financial from $935.00 to $1,090.00 in a research report issued on Friday,Benzinga reports. The brokerage presently has a "buy" rating on the financial services provider's stock. Truist Financial's price objective would suggest a potential upside of 11.06% from the company's current price.

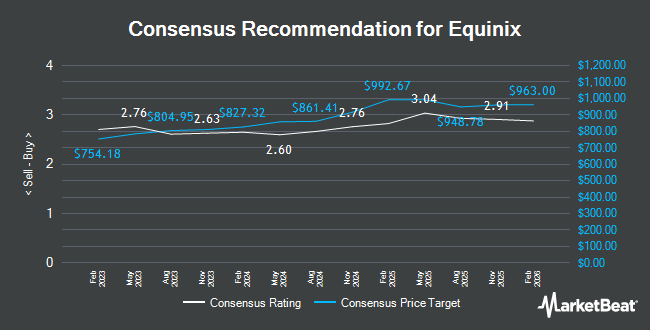

Other equities analysts also recently issued research reports about the company. BMO Capital Markets boosted their price target on Equinix from $975.00 to $1,020.00 and gave the stock an "outperform" rating in a research report on Thursday, October 31st. Cfra reissued a "hold" rating on shares of Equinix in a report on Tuesday, September 24th. HSBC raised Equinix from a "hold" rating to a "buy" rating and raised their price target for the company from $865.00 to $1,000.00 in a report on Friday, October 4th. TD Cowen increased their price objective on shares of Equinix from $865.00 to $984.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. Finally, Wells Fargo & Company raised their target price on shares of Equinix from $875.00 to $975.00 and gave the stock an "overweight" rating in a research note on Thursday, October 17th. Five investment analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $962.56.

View Our Latest Analysis on Equinix

Equinix Stock Up 0.2 %

Shares of Equinix stock traded up $2.38 on Friday, reaching $981.48. 362,814 shares of the company were exchanged, compared to its average volume of 533,021. The company has a market capitalization of $94.70 billion, a price-to-earnings ratio of 88.50, a PEG ratio of 2.52 and a beta of 0.71. The company has a current ratio of 1.16, a quick ratio of 1.16 and a debt-to-equity ratio of 1.12. Equinix has a one year low of $684.14 and a one year high of $994.03. The company has a 50-day moving average of $902.59 and a 200 day moving average of $832.87.

Insider Transactions at Equinix

In other news, Director Christopher B. Paisley sold 100 shares of the business's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $891.00, for a total value of $89,100.00. Following the completion of the transaction, the director now directly owns 17,794 shares in the company, valued at approximately $15,854,454. The trade was a 0.56 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Brandi Galvin Morandi sold 864 shares of the stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $850.00, for a total transaction of $734,400.00. Following the sale, the insider now owns 9,094 shares in the company, valued at $7,729,900. This represents a 8.68 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 13,754 shares of company stock valued at $11,666,756. 0.27% of the stock is owned by corporate insiders.

Institutional Trading of Equinix

Large investors have recently bought and sold shares of the business. State Street Corp boosted its position in Equinix by 1.4% in the third quarter. State Street Corp now owns 5,826,082 shares of the financial services provider's stock valued at $5,171,405,000 after buying an additional 81,941 shares in the last quarter. Geode Capital Management LLC boosted its holdings in shares of Equinix by 1.4% during the 3rd quarter. Geode Capital Management LLC now owns 2,350,508 shares of the financial services provider's stock valued at $2,079,591,000 after acquiring an additional 33,277 shares in the last quarter. Principal Financial Group Inc. grew its position in Equinix by 0.3% during the 3rd quarter. Principal Financial Group Inc. now owns 1,894,101 shares of the financial services provider's stock worth $1,681,256,000 after acquiring an additional 5,910 shares during the last quarter. Dimensional Fund Advisors LP increased its holdings in Equinix by 1.5% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,333,992 shares of the financial services provider's stock worth $1,009,293,000 after purchasing an additional 19,844 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its position in Equinix by 5.0% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,134,171 shares of the financial services provider's stock valued at $1,006,724,000 after purchasing an additional 53,729 shares during the last quarter. 94.94% of the stock is owned by institutional investors and hedge funds.

Equinix Company Profile

(

Get Free Report)

Equinix Nasdaq: EQIX is the world's digital infrastructure company . Digital leaders harness Equinix's trusted platform to bring together and interconnect foundational infrastructure at software speed. Equinix enables organizations to access all the right places, partners and possibilities to scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value, while supporting their sustainability goals.

See Also

Before you consider Equinix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equinix wasn't on the list.

While Equinix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.