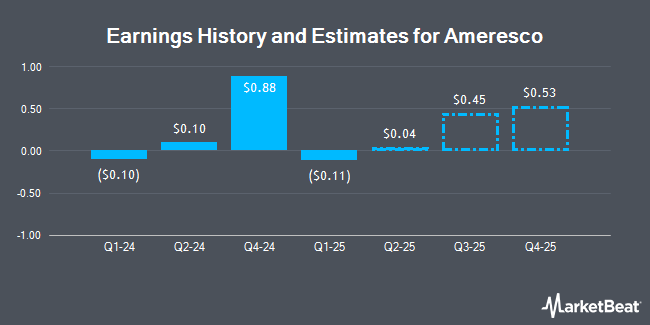

Ameresco, Inc. (NYSE:AMRC - Free Report) - Research analysts at William Blair issued their Q3 2025 EPS estimates for shares of Ameresco in a research note issued to investors on Friday, November 8th. William Blair analyst T. Mulrooney anticipates that the utilities provider will post earnings per share of $0.57 for the quarter. The consensus estimate for Ameresco's current full-year earnings is $1.16 per share. William Blair also issued estimates for Ameresco's Q4 2025 earnings at $0.66 EPS.

A number of other equities analysts have also weighed in on AMRC. Stifel Nicolaus boosted their target price on Ameresco from $32.00 to $34.00 and gave the stock a "buy" rating in a research report on Monday. Robert W. Baird boosted their price objective on shares of Ameresco from $32.00 to $42.00 and gave the company an "outperform" rating in a report on Monday, September 23rd. StockNews.com upgraded shares of Ameresco to a "sell" rating in a report on Wednesday, October 16th. UBS Group boosted their target price on shares of Ameresco from $39.00 to $40.00 and gave the company a "buy" rating in a research note on Thursday, September 5th. Finally, Jefferies Financial Group initiated coverage on Ameresco in a research note on Wednesday, September 4th. They issued a "hold" rating and a $33.00 price target on the stock. One investment analyst has rated the stock with a sell rating, four have issued a hold rating, eight have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $36.91.

Check Out Our Latest Analysis on AMRC

Ameresco Stock Up 6.8 %

Shares of Ameresco stock traded up $1.79 on Monday, reaching $28.27. The company's stock had a trading volume of 326,849 shares, compared to its average volume of 474,282. The company has a market capitalization of $1.48 billion, a price-to-earnings ratio of 28.24, a P/E/G ratio of 1.11 and a beta of 1.82. The company has a quick ratio of 1.00, a current ratio of 1.01 and a debt-to-equity ratio of 1.15. Ameresco has a 52 week low of $17.55 and a 52 week high of $39.68. The firm's fifty day simple moving average is $33.32 and its two-hundred day simple moving average is $30.99.

Institutional Trading of Ameresco

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Blue Trust Inc. grew its stake in Ameresco by 100.3% during the third quarter. Blue Trust Inc. now owns 781 shares of the utilities provider's stock valued at $30,000 after acquiring an additional 391 shares in the last quarter. nVerses Capital LLC bought a new position in Ameresco during the second quarter valued at approximately $75,000. Point72 DIFC Ltd purchased a new position in Ameresco during the 2nd quarter valued at approximately $86,000. GAMMA Investing LLC increased its stake in Ameresco by 1,215.2% in the 2nd quarter. GAMMA Investing LLC now owns 3,117 shares of the utilities provider's stock worth $90,000 after acquiring an additional 2,880 shares during the last quarter. Finally, SG Americas Securities LLC bought a new position in shares of Ameresco during the 2nd quarter valued at approximately $156,000. Institutional investors own 99.24% of the company's stock.

Ameresco Company Profile

(

Get Free Report)

Ameresco, Inc, a clean technology integrator, provides a portfolio of energy efficiency and renewable energy supply solutions in the United States, Canada, Europe, and internationally. It operates through U.S. Regions, U.S. Federal, Canada, Europe, Alternative Fuels, and All Other segments. The company offers energy efficiency, infrastructure upgrades, energy security and resilience, asset sustainability, and renewable energy solutions for businesses and organizations.

Featured Stories

Before you consider Ameresco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameresco wasn't on the list.

While Ameresco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.