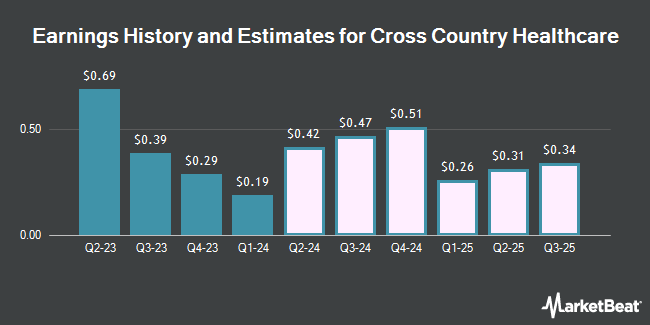

Cross Country Healthcare, Inc. (NASDAQ:CCRN - Free Report) - Stock analysts at William Blair reduced their Q4 2024 earnings per share (EPS) estimates for Cross Country Healthcare in a report issued on Thursday, November 7th. William Blair analyst T. Romeo now expects that the business services provider will earn $0.12 per share for the quarter, down from their previous forecast of $0.14. The consensus estimate for Cross Country Healthcare's current full-year earnings is $0.52 per share. William Blair also issued estimates for Cross Country Healthcare's Q1 2025 earnings at $0.06 EPS, Q2 2025 earnings at $0.12 EPS, Q3 2025 earnings at $0.15 EPS and Q4 2025 earnings at $0.18 EPS.

Cross Country Healthcare (NASDAQ:CCRN - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The business services provider reported $0.12 EPS for the quarter, topping the consensus estimate of $0.10 by $0.02. The firm had revenue of $315.12 million for the quarter, compared to analyst estimates of $310.05 million. Cross Country Healthcare had a return on equity of 7.29% and a net margin of 0.54%.

Several other analysts also recently weighed in on CCRN. Barrington Research lowered their target price on Cross Country Healthcare from $21.00 to $19.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. Truist Financial reduced their price target on Cross Country Healthcare from $17.00 to $15.00 and set a "hold" rating for the company in a report on Monday, October 21st. Finally, Benchmark dropped their price objective on Cross Country Healthcare from $19.00 to $18.00 and set a "buy" rating on the stock in a report on Thursday. Three analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average price target of $18.50.

View Our Latest Stock Report on CCRN

Cross Country Healthcare Price Performance

CCRN traded down $1.91 during trading hours on Friday, reaching $10.36. 1,046,619 shares of the stock traded hands, compared to its average volume of 530,927. Cross Country Healthcare has a fifty-two week low of $10.35 and a fifty-two week high of $23.64. The company has a market cap of $350.26 million, a price-to-earnings ratio of -207.20, a PEG ratio of 2.17 and a beta of 0.65. The firm's fifty day simple moving average is $12.94 and its two-hundred day simple moving average is $14.35.

Hedge Funds Weigh In On Cross Country Healthcare

A number of hedge funds have recently bought and sold shares of CCRN. Allspring Global Investments Holdings LLC lifted its holdings in Cross Country Healthcare by 212.9% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 12,089 shares of the business services provider's stock worth $226,000 after buying an additional 8,225 shares during the last quarter. Empowered Funds LLC lifted its stake in Cross Country Healthcare by 8.2% during the first quarter. Empowered Funds LLC now owns 113,290 shares of the business services provider's stock worth $2,121,000 after purchasing an additional 8,559 shares during the last quarter. Sei Investments Co. boosted its holdings in Cross Country Healthcare by 6.4% in the first quarter. Sei Investments Co. now owns 138,863 shares of the business services provider's stock worth $2,600,000 after purchasing an additional 8,362 shares during the period. State Board of Administration of Florida Retirement System increased its stake in Cross Country Healthcare by 40.8% during the first quarter. State Board of Administration of Florida Retirement System now owns 13,875 shares of the business services provider's stock valued at $260,000 after purchasing an additional 4,020 shares during the last quarter. Finally, Foundry Partners LLC increased its stake in Cross Country Healthcare by 8.0% during the first quarter. Foundry Partners LLC now owns 278,171 shares of the business services provider's stock valued at $5,207,000 after purchasing an additional 20,679 shares during the last quarter. 96.03% of the stock is currently owned by institutional investors and hedge funds.

Cross Country Healthcare Company Profile

(

Get Free Report)

Cross Country Healthcare, Inc provides talent management and other consultative services for healthcare clients in the United States. The company's Nurse and Allied Staffing segment provides traditional staffing, recruiting, and value-added total talent solutions, including temporary and permanent placement of travel and local nurse and, allied professionals; temporary placement of healthcare leaders within nursing, allied, physician, and human resources; vendor neutral and managed services programs; education healthcare services; in-home care services; and outsourcing services.

Further Reading

Before you consider Cross Country Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cross Country Healthcare wasn't on the list.

While Cross Country Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.