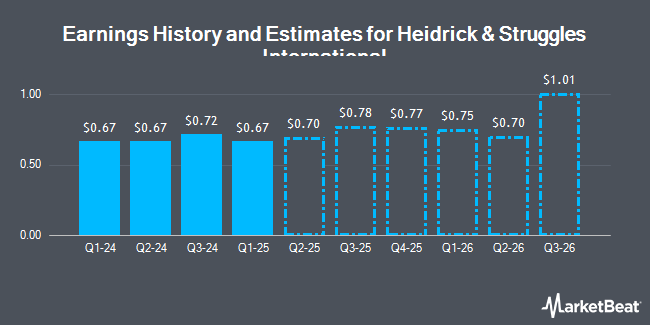

Heidrick & Struggles International, Inc. (NASDAQ:HSII - Free Report) - Investment analysts at Sidoti Csr increased their Q4 2024 earnings per share estimates for Heidrick & Struggles International in a research note issued on Wednesday, November 6th. Sidoti Csr analyst M. Riddick now anticipates that the business services provider will post earnings per share of $0.46 for the quarter, up from their previous estimate of $0.42. The consensus estimate for Heidrick & Struggles International's current full-year earnings is $2.62 per share. Sidoti Csr also issued estimates for Heidrick & Struggles International's Q3 2025 earnings at $0.72 EPS, Q4 2025 earnings at $0.61 EPS, FY2025 earnings at $2.63 EPS, Q1 2026 earnings at $0.73 EPS, Q2 2026 earnings at $0.70 EPS and Q3 2026 earnings at $0.95 EPS.

A number of other equities analysts have also recently weighed in on the company. Truist Financial reaffirmed a "hold" rating and issued a $40.00 price target (up previously from $33.00) on shares of Heidrick & Struggles International in a report on Tuesday. Barrington Research reaffirmed an "outperform" rating and set a $44.00 target price on shares of Heidrick & Struggles International in a research note on Friday, September 20th. Finally, StockNews.com raised shares of Heidrick & Struggles International from a "hold" rating to a "buy" rating in a research note on Wednesday.

Get Our Latest Research Report on Heidrick & Struggles International

Heidrick & Struggles International Trading Down 2.3 %

HSII traded down $1.07 on Thursday, reaching $46.34. The stock had a trading volume of 266,212 shares, compared to its average volume of 152,787. The business's 50-day moving average price is $38.37 and its two-hundred day moving average price is $35.63. Heidrick & Struggles International has a 12-month low of $25.13 and a 12-month high of $47.80. The company has a market cap of $941.63 million, a P/E ratio of 25.05, a price-to-earnings-growth ratio of 0.95 and a beta of 0.85.

Heidrick & Struggles International (NASDAQ:HSII - Get Free Report) last posted its earnings results on Monday, November 4th. The business services provider reported $0.72 earnings per share for the quarter, beating the consensus estimate of $0.68 by $0.04. Heidrick & Struggles International had a net margin of 3.53% and a return on equity of 12.51%. The firm had revenue of $282.82 million during the quarter, compared to analyst estimates of $267.65 million. During the same period in the previous year, the firm earned $0.73 EPS.

Heidrick & Struggles International Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, November 21st. Shareholders of record on Thursday, November 14th will be paid a dividend of $0.15 per share. The ex-dividend date is Thursday, November 14th. This represents a $0.60 annualized dividend and a yield of 1.29%. Heidrick & Struggles International's dividend payout ratio (DPR) is currently 32.43%.

Hedge Funds Weigh In On Heidrick & Struggles International

Hedge funds and other institutional investors have recently made changes to their positions in the company. Russell Investments Group Ltd. raised its stake in Heidrick & Struggles International by 158.6% in the 1st quarter. Russell Investments Group Ltd. now owns 115,663 shares of the business services provider's stock valued at $3,893,000 after purchasing an additional 70,940 shares during the last quarter. American Century Companies Inc. lifted its stake in shares of Heidrick & Struggles International by 43.8% in the second quarter. American Century Companies Inc. now owns 46,621 shares of the business services provider's stock worth $1,472,000 after buying an additional 14,209 shares in the last quarter. Innealta Capital LLC acquired a new position in Heidrick & Struggles International during the second quarter worth about $29,000. SG Americas Securities LLC grew its stake in Heidrick & Struggles International by 82.1% during the 3rd quarter. SG Americas Securities LLC now owns 11,414 shares of the business services provider's stock valued at $444,000 after acquiring an additional 5,145 shares in the last quarter. Finally, Algert Global LLC raised its holdings in Heidrick & Struggles International by 13.0% in the 2nd quarter. Algert Global LLC now owns 54,100 shares of the business services provider's stock valued at $1,708,000 after acquiring an additional 6,227 shares during the last quarter. Hedge funds and other institutional investors own 90.13% of the company's stock.

Heidrick & Struggles International Company Profile

(

Get Free Report)

Heidrick & Struggles International, Inc, together with its subsidiaries, provides executive search, consulting, and on-demand talent services to businesses and business leaders worldwide. It enables its clients to build leadership teams by facilitating the recruitment, management, and development of senior executives.

Featured Articles

Before you consider Heidrick & Struggles International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heidrick & Struggles International wasn't on the list.

While Heidrick & Struggles International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.