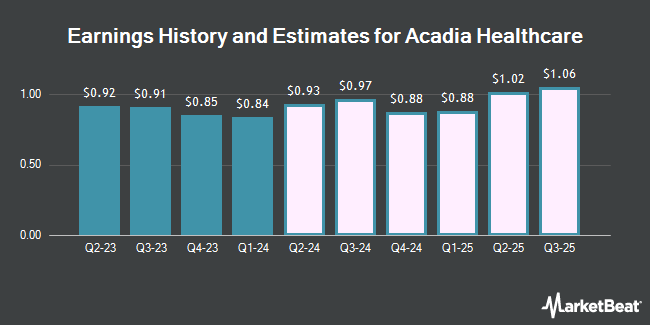

Acadia Healthcare Company, Inc. (NASDAQ:ACHC - Free Report) - Stock analysts at Zacks Research decreased their FY2024 earnings per share (EPS) estimates for shares of Acadia Healthcare in a note issued to investors on Wednesday, November 13th. Zacks Research analyst Z. Masood now forecasts that the company will post earnings per share of $3.37 for the year, down from their prior forecast of $3.46. The consensus estimate for Acadia Healthcare's current full-year earnings is $3.38 per share. Zacks Research also issued estimates for Acadia Healthcare's Q4 2024 earnings at $0.71 EPS, Q1 2025 earnings at $0.76 EPS, Q2 2025 earnings at $0.94 EPS, Q1 2026 earnings at $0.88 EPS, Q2 2026 earnings at $0.99 EPS, Q3 2026 earnings at $1.07 EPS and FY2026 earnings at $3.99 EPS.

Acadia Healthcare (NASDAQ:ACHC - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $0.91 EPS for the quarter, topping analysts' consensus estimates of $0.90 by $0.01. The firm had revenue of $815.60 million during the quarter, compared to the consensus estimate of $819.42 million. Acadia Healthcare had a net margin of 8.99% and a return on equity of 11.12%. The firm's revenue was up 8.7% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.91 earnings per share.

A number of other research firms have also recently issued reports on ACHC. Royal Bank of Canada cut their target price on Acadia Healthcare from $94.00 to $64.00 and set an "outperform" rating on the stock in a research note on Monday. Barclays cut their price objective on shares of Acadia Healthcare from $83.00 to $76.00 and set an "overweight" rating on the stock in a research report on Monday, September 30th. KeyCorp began coverage on shares of Acadia Healthcare in a research note on Friday, October 11th. They set a "sector weight" rating for the company. Cantor Fitzgerald restated a "neutral" rating and issued a $90.00 price target on shares of Acadia Healthcare in a research note on Tuesday, October 1st. Finally, StockNews.com upgraded Acadia Healthcare from a "sell" rating to a "hold" rating in a research report on Thursday. Five analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $83.33.

Get Our Latest Analysis on Acadia Healthcare

Acadia Healthcare Stock Performance

ACHC stock traded down $0.69 during midday trading on Monday, reaching $37.13. The company had a trading volume of 1,250,346 shares, compared to its average volume of 1,004,496. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 0.60. The stock has a 50 day moving average price of $57.27 and a 200 day moving average price of $65.34. The firm has a market capitalization of $3.45 billion, a PE ratio of 12.17, a P/E/G ratio of 1.68 and a beta of 1.33. Acadia Healthcare has a fifty-two week low of $36.50 and a fifty-two week high of $87.77.

Institutional Investors Weigh In On Acadia Healthcare

Several hedge funds and other institutional investors have recently bought and sold shares of the business. Harbor Capital Advisors Inc. acquired a new position in Acadia Healthcare in the 2nd quarter worth approximately $800,000. TCW Group Inc. boosted its stake in Acadia Healthcare by 63.8% during the second quarter. TCW Group Inc. now owns 62,888 shares of the company's stock worth $4,247,000 after buying an additional 24,487 shares in the last quarter. SG Americas Securities LLC boosted its position in shares of Acadia Healthcare by 435.6% during the 2nd quarter. SG Americas Securities LLC now owns 18,227 shares of the company's stock valued at $1,231,000 after acquiring an additional 14,824 shares in the last quarter. Principal Financial Group Inc. boosted its holdings in Acadia Healthcare by 19.4% during the second quarter. Principal Financial Group Inc. now owns 643,521 shares of the company's stock valued at $43,463,000 after purchasing an additional 104,359 shares in the last quarter. Finally, Texas Permanent School Fund Corp grew its position in Acadia Healthcare by 11.3% in the second quarter. Texas Permanent School Fund Corp now owns 89,821 shares of the company's stock valued at $6,067,000 after acquiring an additional 9,115 shares during the period.

About Acadia Healthcare

(

Get Free Report)

Acadia Healthcare Company, Inc provides behavioral healthcare services in the United States and Puerto Rico. The company develops and operates acute inpatient psychiatric facilities, specialty treatment facilities comprising residential recovery facilities and eating disorder facilities, comprehensive treatment centers, and residential treatment centers, as well as facilities offering outpatient behavioral healthcare services for the behavioral healthcare and recovery needs of communities.

Recommended Stories

Before you consider Acadia Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acadia Healthcare wasn't on the list.

While Acadia Healthcare currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.