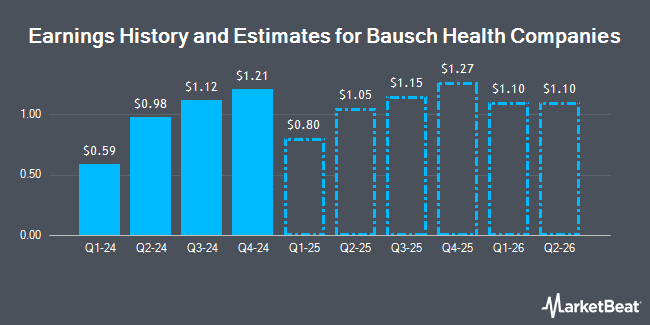

Bausch Health Companies Inc. (NYSE:BHC - Free Report) - Zacks Research cut their FY2025 EPS estimates for Bausch Health Companies in a research note issued to investors on Monday, January 20th. Zacks Research analyst R. Department now expects that the company will post earnings of $4.23 per share for the year, down from their previous forecast of $4.28. The consensus estimate for Bausch Health Companies' current full-year earnings is $3.73 per share. Zacks Research also issued estimates for Bausch Health Companies' Q4 2026 earnings at $1.27 EPS and FY2026 earnings at $4.90 EPS.

Bausch Health Companies (NYSE:BHC - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $1.12 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.02 by $0.10. The firm had revenue of $2.51 billion for the quarter, compared to analysts' expectations of $2.42 billion. Bausch Health Companies had a negative net margin of 1.88% and a negative return on equity of 755.86%. Bausch Health Companies's revenue was up 12.2% on a year-over-year basis. During the same quarter last year, the company posted $1.03 earnings per share.

Several other equities analysts have also commented on BHC. Royal Bank of Canada upped their price target on shares of Bausch Health Companies from $10.00 to $11.00 and gave the stock a "sector perform" rating in a research report on Friday, November 1st. StockNews.com upgraded shares of Bausch Health Companies from a "hold" rating to a "buy" rating in a research report on Friday, October 25th. Finally, Evercore ISI raised Bausch Health Companies to a "hold" rating in a report on Tuesday, October 15th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $7.75.

Read Our Latest Research Report on BHC

Bausch Health Companies Trading Up 1.2 %

BHC traded up $0.10 during trading on Thursday, reaching $7.82. 1,568,070 shares of the company were exchanged, compared to its average volume of 3,642,190. The stock has a market cap of $2.83 billion, a P/E ratio of -16.28 and a beta of 0.69. Bausch Health Companies has a 52 week low of $3.96 and a 52 week high of $11.46. The firm has a 50 day moving average of $7.86 and a 200 day moving average of $7.45.

Institutional Trading of Bausch Health Companies

Institutional investors have recently made changes to their positions in the stock. DGS Capital Management LLC acquired a new position in shares of Bausch Health Companies during the fourth quarter valued at approximately $143,000. Merit Financial Group LLC acquired a new position in shares of Bausch Health Companies during the 4th quarter valued at $228,000. Sanders Morris Harris LLC raised its stake in shares of Bausch Health Companies by 16.0% in the 4th quarter. Sanders Morris Harris LLC now owns 28,975 shares of the company's stock worth $234,000 after buying an additional 4,000 shares in the last quarter. Northwest & Ethical Investments L.P. raised its stake in shares of Bausch Health Companies by 13.0% in the 3rd quarter. Northwest & Ethical Investments L.P. now owns 32,384 shares of the company's stock worth $264,000 after buying an additional 3,734 shares in the last quarter. Finally, Creative Planning boosted its stake in Bausch Health Companies by 16.9% during the third quarter. Creative Planning now owns 55,351 shares of the company's stock valued at $452,000 after buying an additional 7,995 shares in the last quarter. 78.65% of the stock is owned by institutional investors and hedge funds.

Bausch Health Companies Company Profile

(

Get Free Report)

Bausch Health Companies Inc operates as a diversified specialty pharmaceutical and medical device company in the United States and internationally. It develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, international pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health.

Read More

Before you consider Bausch Health Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch Health Companies wasn't on the list.

While Bausch Health Companies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.