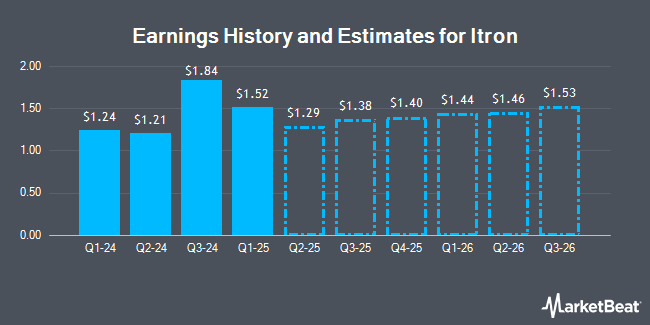

Itron, Inc. (NASDAQ:ITRI - Free Report) - Stock analysts at Zacks Research raised their Q4 2024 EPS estimates for shares of Itron in a research report issued on Tuesday, November 19th. Zacks Research analyst R. Department now expects that the scientific and technical instruments company will post earnings per share of $1.02 for the quarter, up from their previous estimate of $0.92. The consensus estimate for Itron's current full-year earnings is $5.33 per share. Zacks Research also issued estimates for Itron's Q3 2025 earnings at $1.19 EPS, Q2 2026 earnings at $1.32 EPS, Q3 2026 earnings at $1.38 EPS and FY2026 earnings at $5.29 EPS.

Itron (NASDAQ:ITRI - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The scientific and technical instruments company reported $1.84 EPS for the quarter, beating analysts' consensus estimates of $1.13 by $0.71. Itron had a return on equity of 19.03% and a net margin of 9.37%. The company had revenue of $615.46 million during the quarter, compared to the consensus estimate of $596.41 million. During the same period last year, the business posted $0.98 earnings per share. Itron's revenue was up 9.8% on a year-over-year basis.

ITRI has been the subject of a number of other research reports. Oppenheimer raised their price objective on shares of Itron from $120.00 to $124.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. Robert W. Baird raised their price target on shares of Itron from $123.00 to $132.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. Roth Mkm lifted their price target on shares of Itron from $125.00 to $130.00 and gave the stock a "buy" rating in a report on Friday, November 1st. Piper Sandler increased their price objective on Itron from $110.00 to $119.00 and gave the company a "neutral" rating in a report on Friday, November 1st. Finally, TD Cowen upped their price target on Itron from $125.00 to $136.00 and gave the company a "buy" rating in a research report on Friday, November 1st. Four analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $123.92.

Get Our Latest Stock Report on ITRI

Itron Trading Down 0.8 %

NASDAQ ITRI opened at $114.11 on Thursday. The business's fifty day moving average is $108.87 and its 200-day moving average is $104.86. The company has a debt-to-equity ratio of 0.91, a current ratio of 3.36 and a quick ratio of 2.83. The stock has a market capitalization of $5.15 billion, a price-to-earnings ratio of 23.38, a PEG ratio of 0.86 and a beta of 1.46. Itron has a one year low of $64.96 and a one year high of $124.90.

Hedge Funds Weigh In On Itron

A number of institutional investors have recently made changes to their positions in ITRI. Vanguard Group Inc. grew its position in Itron by 0.8% in the first quarter. Vanguard Group Inc. now owns 5,701,337 shares of the scientific and technical instruments company's stock worth $527,488,000 after acquiring an additional 45,909 shares in the last quarter. Geode Capital Management LLC lifted its stake in Itron by 0.5% during the third quarter. Geode Capital Management LLC now owns 1,074,940 shares of the scientific and technical instruments company's stock worth $114,835,000 after purchasing an additional 5,630 shares during the last quarter. Handelsbanken Fonder AB boosted its holdings in shares of Itron by 62.7% in the 3rd quarter. Handelsbanken Fonder AB now owns 899,789 shares of the scientific and technical instruments company's stock worth $96,106,000 after purchasing an additional 346,615 shares in the last quarter. Select Equity Group L.P. increased its position in shares of Itron by 86.2% during the 2nd quarter. Select Equity Group L.P. now owns 603,877 shares of the scientific and technical instruments company's stock valued at $59,760,000 after purchasing an additional 279,629 shares during the last quarter. Finally, Janus Henderson Group PLC raised its holdings in shares of Itron by 2.2% during the 1st quarter. Janus Henderson Group PLC now owns 542,943 shares of the scientific and technical instruments company's stock valued at $50,233,000 after buying an additional 11,918 shares in the last quarter. Institutional investors own 96.19% of the company's stock.

Insider Buying and Selling

In other news, CEO Thomas Deitrich sold 37,500 shares of the business's stock in a transaction dated Tuesday, October 1st. The stock was sold at an average price of $104.83, for a total transaction of $3,931,125.00. Following the completion of the transaction, the chief executive officer now owns 205,276 shares of the company's stock, valued at approximately $21,519,083.08. The trade was a 15.45 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO Joan S. Hooper sold 509 shares of the company's stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $102.15, for a total transaction of $51,994.35. Following the completion of the transaction, the chief financial officer now owns 72,338 shares in the company, valued at approximately $7,389,326.70. This trade represents a 0.70 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 39,066 shares of company stock worth $4,092,737. Corporate insiders own 1.45% of the company's stock.

About Itron

(

Get Free Report)

Itron, Inc, a technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide. It operates in three segments: Device Solutions, Networked Solutions, and Outcomes. The Device Solutions segment offers hardware products that are used for measurement, control, or sensing, such as standard gas, electricity, water, and communicating meters, as well as heat and allocation products.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Itron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itron wasn't on the list.

While Itron currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.