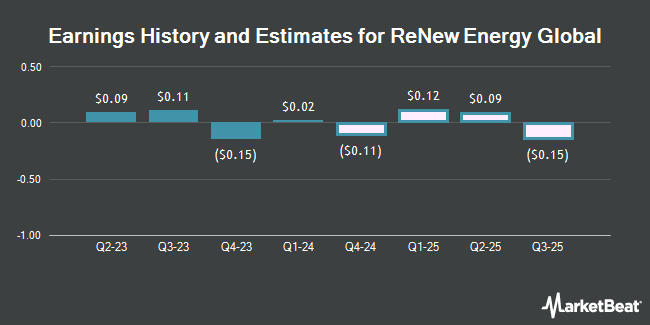

ReNew Energy Global Plc (NASDAQ:RNW - Free Report) - Equities research analysts at Roth Capital boosted their Q3 2025 EPS estimates for ReNew Energy Global in a research note issued on Sunday, November 24th. Roth Capital analyst J. Clare now expects that the company will post earnings per share of ($0.05) for the quarter, up from their prior estimate of ($0.06). The consensus estimate for ReNew Energy Global's current full-year earnings is $0.12 per share. Roth Capital also issued estimates for ReNew Energy Global's Q4 2025 earnings at $0.02 EPS, FY2025 earnings at $0.12 EPS, Q1 2026 earnings at $0.20 EPS, Q2 2026 earnings at $0.22 EPS, Q3 2026 earnings at ($0.03) EPS, Q4 2026 earnings at $0.06 EPS and FY2026 earnings at $0.45 EPS.

RNW has been the topic of a number of other reports. Roth Mkm dropped their price objective on shares of ReNew Energy Global from $9.00 to $8.00 and set a "buy" rating on the stock in a research note on Monday, August 19th. Morgan Stanley lowered shares of ReNew Energy Global from an "overweight" rating to an "equal weight" rating in a research report on Thursday, September 26th.

Get Our Latest Analysis on RNW

ReNew Energy Global Stock Up 0.7 %

Shares of ReNew Energy Global stock traded up $0.04 during trading hours on Wednesday, reaching $6.09. The company's stock had a trading volume of 760,924 shares, compared to its average volume of 871,036. ReNew Energy Global has a one year low of $5.15 and a one year high of $7.79. The company has a market capitalization of $2.21 billion, a P/E ratio of 101.52 and a beta of 0.95. The stock's fifty day simple moving average is $5.88 and its two-hundred day simple moving average is $5.95. The company has a debt-to-equity ratio of 4.51, a quick ratio of 0.64 and a current ratio of 0.65.

Institutional Trading of ReNew Energy Global

A number of large investors have recently added to or reduced their stakes in RNW. Van ECK Associates Corp increased its holdings in ReNew Energy Global by 58.1% during the third quarter. Van ECK Associates Corp now owns 12,278 shares of the company's stock worth $72,000 after buying an additional 4,513 shares during the last quarter. Robeco Institutional Asset Management B.V. increased its holdings in ReNew Energy Global by 23.1% during the third quarter. Robeco Institutional Asset Management B.V. now owns 12,672 shares of the company's stock worth $80,000 after buying an additional 2,379 shares during the last quarter. Mercer Global Advisors Inc. ADV increased its holdings in ReNew Energy Global by 12.7% during the second quarter. Mercer Global Advisors Inc. ADV now owns 15,187 shares of the company's stock worth $95,000 after buying an additional 1,709 shares during the last quarter. Quantbot Technologies LP increased its holdings in ReNew Energy Global by 454.7% during the third quarter. Quantbot Technologies LP now owns 15,788 shares of the company's stock worth $99,000 after buying an additional 12,942 shares during the last quarter. Finally, Barclays PLC increased its holdings in ReNew Energy Global by 382.5% during the third quarter. Barclays PLC now owns 26,381 shares of the company's stock worth $166,000 after buying an additional 20,913 shares during the last quarter. Hedge funds and other institutional investors own 43.56% of the company's stock.

ReNew Energy Global Company Profile

(

Get Free Report)

ReNew Energy Global Plc generates power through non-conventional and renewable energy sources in India. The company operates through two segments: Wind Power and Solar Power. It develops, builds, owns, and operates utility scale wind and solar energy, hydro energy, and utility-scale firm power projects, as well as distributed solar energy projects that generate energy for commercial and industrial customers.

See Also

Before you consider ReNew Energy Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ReNew Energy Global wasn't on the list.

While ReNew Energy Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.