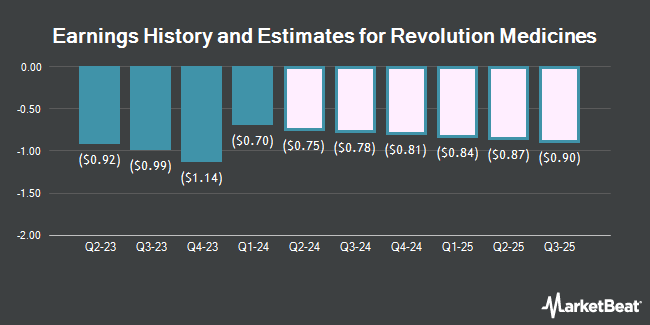

Revolution Medicines, Inc. (NASDAQ:RVMD - Free Report) - Wedbush cut their FY2024 EPS estimates for Revolution Medicines in a research note issued to investors on Thursday, November 7th. Wedbush analyst R. Driscoll now forecasts that the company will post earnings per share of ($3.43) for the year, down from their prior forecast of ($3.41). Wedbush currently has a "Outperform" rating and a $59.00 price objective on the stock. The consensus estimate for Revolution Medicines' current full-year earnings is ($3.42) per share. Wedbush also issued estimates for Revolution Medicines' Q4 2024 earnings at ($0.98) EPS, Q1 2025 earnings at ($0.98) EPS, Q2 2025 earnings at ($1.01) EPS, Q3 2025 earnings at ($1.04) EPS, Q4 2025 earnings at ($1.07) EPS, FY2025 earnings at ($4.10) EPS, FY2026 earnings at ($4.33) EPS, FY2027 earnings at ($4.20) EPS and FY2028 earnings at ($2.43) EPS.

Revolution Medicines (NASDAQ:RVMD - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported ($0.94) EPS for the quarter, missing the consensus estimate of ($0.89) by ($0.05). During the same quarter in the prior year, the firm earned ($0.99) EPS.

Several other equities research analysts have also recently weighed in on the company. HC Wainwright boosted their target price on Revolution Medicines from $62.00 to $64.00 and gave the stock a "buy" rating in a research note on Thursday. Piper Sandler lifted their price target on shares of Revolution Medicines from $57.00 to $70.00 and gave the stock an "overweight" rating in a research note on Thursday. JPMorgan Chase & Co. lifted their target price on Revolution Medicines from $54.00 to $63.00 and gave the stock an "overweight" rating in a research report on Thursday. Bank of America upped their target price on Revolution Medicines from $48.00 to $55.00 and gave the company a "buy" rating in a research report on Tuesday, July 16th. Finally, Oppenheimer lifted their price target on Revolution Medicines from $55.00 to $60.00 and gave the stock an "outperform" rating in a research report on Monday, October 28th. Eleven analysts have rated the stock with a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Revolution Medicines has an average rating of "Buy" and an average target price of $61.00.

Get Our Latest Research Report on Revolution Medicines

Revolution Medicines Stock Up 0.6 %

Revolution Medicines stock traded up $0.34 during trading on Monday, reaching $60.78. The stock had a trading volume of 914,984 shares, compared to its average volume of 1,335,808. Revolution Medicines has a 52-week low of $19.05 and a 52-week high of $62.35. The business has a 50 day moving average price of $47.56 and a 200 day moving average price of $43.27. The stock has a market cap of $10.22 billion, a PE ratio of -16.84 and a beta of 1.40.

Insider Activity

In other news, insider Mark A. Goldsmith sold 10,000 shares of Revolution Medicines stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $44.93, for a total transaction of $449,300.00. Following the sale, the insider now owns 300,170 shares of the company's stock, valued at approximately $13,486,638.10. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. In other Revolution Medicines news, Director Barbara Weber sold 5,200 shares of the company's stock in a transaction dated Tuesday, October 8th. The shares were sold at an average price of $48.02, for a total transaction of $249,704.00. Following the completion of the sale, the director now directly owns 13,065 shares of the company's stock, valued at approximately $627,381.30. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Mark A. Goldsmith sold 10,000 shares of the firm's stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $44.93, for a total value of $449,300.00. Following the completion of the sale, the insider now directly owns 300,170 shares of the company's stock, valued at approximately $13,486,638.10. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 127,866 shares of company stock valued at $6,355,624. 8.00% of the stock is currently owned by company insiders.

Institutional Trading of Revolution Medicines

A number of institutional investors have recently bought and sold shares of RVMD. GAMMA Investing LLC grew its position in Revolution Medicines by 55.8% in the third quarter. GAMMA Investing LLC now owns 620 shares of the company's stock worth $28,000 after acquiring an additional 222 shares in the last quarter. Headlands Technologies LLC lifted its stake in shares of Revolution Medicines by 140.9% in the 1st quarter. Headlands Technologies LLC now owns 1,513 shares of the company's stock valued at $49,000 after purchasing an additional 885 shares during the last quarter. Values First Advisors Inc. bought a new stake in Revolution Medicines in the third quarter worth $93,000. Allspring Global Investments Holdings LLC acquired a new position in Revolution Medicines during the first quarter worth $104,000. Finally, KBC Group NV raised its holdings in Revolution Medicines by 12.9% during the third quarter. KBC Group NV now owns 3,221 shares of the company's stock valued at $146,000 after buying an additional 368 shares in the last quarter. Institutional investors and hedge funds own 94.34% of the company's stock.

Revolution Medicines Company Profile

(

Get Free Report)

Revolution Medicines, Inc, a clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers. The company's research and development pipeline comprises RAS(ON) inhibitors designed to be used as monotherapy in combination with other RAS(ON) inhibitors and/or in combination with RAS companion inhibitors or other therapeutic agents, and RAS companion inhibitors for combination treatment strategies.

Featured Articles

Before you consider Revolution Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolution Medicines wasn't on the list.

While Revolution Medicines currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.