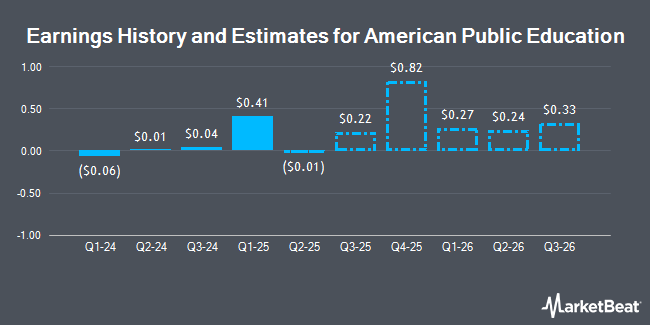

American Public Education, Inc. (NASDAQ:APEI - Free Report) - Research analysts at Zacks Research lowered their FY2024 earnings per share estimates for American Public Education in a note issued to investors on Tuesday, November 26th. Zacks Research analyst A. Gupta now forecasts that the company will post earnings per share of $0.47 for the year, down from their prior estimate of $0.50. The consensus estimate for American Public Education's current full-year earnings is $0.48 per share. Zacks Research also issued estimates for American Public Education's Q4 2024 earnings at $0.55 EPS, Q1 2025 earnings at $0.27 EPS, Q2 2025 earnings at $0.15 EPS, Q3 2025 earnings at $0.22 EPS, Q4 2025 earnings at $0.60 EPS, FY2025 earnings at $1.24 EPS, Q1 2026 earnings at $0.29 EPS, Q2 2026 earnings at $0.23 EPS, Q3 2026 earnings at $0.31 EPS and FY2026 earnings at $1.49 EPS.

Several other research analysts have also weighed in on APEI. Barrington Research boosted their price target on American Public Education from $18.00 to $24.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. StockNews.com downgraded shares of American Public Education from a "buy" rating to a "hold" rating in a research note on Thursday, November 14th. Truist Financial boosted their price target on American Public Education from $15.00 to $20.00 and gave the stock a "hold" rating in a research report on Thursday, November 14th. Finally, B. Riley raised their price objective on American Public Education from $22.00 to $25.00 and gave the company a "buy" rating in a research report on Thursday, November 7th.

Read Our Latest Stock Analysis on APEI

American Public Education Stock Up 0.1 %

NASDAQ:APEI traded up $0.03 on Wednesday, hitting $20.55. 73,024 shares of the company's stock were exchanged, compared to its average volume of 195,345. The company has a market cap of $363.94 million, a P/E ratio of 36.79, a price-to-earnings-growth ratio of 2.83 and a beta of 1.24. The firm has a 50-day moving average price of $15.79 and a 200-day moving average price of $16.47. The company has a debt-to-equity ratio of 0.37, a current ratio of 2.65 and a quick ratio of 2.65. American Public Education has a 52 week low of $6.71 and a 52 week high of $21.04.

Institutional Investors Weigh In On American Public Education

A number of institutional investors have recently modified their holdings of APEI. Assenagon Asset Management S.A. grew its position in American Public Education by 329.5% during the second quarter. Assenagon Asset Management S.A. now owns 425,064 shares of the company's stock worth $7,473,000 after buying an additional 326,091 shares in the last quarter. Jacobs Levy Equity Management Inc. bought a new position in shares of American Public Education in the first quarter worth $2,159,000. Renaissance Technologies LLC lifted its position in American Public Education by 14.5% during the second quarter. Renaissance Technologies LLC now owns 1,004,011 shares of the company's stock worth $17,651,000 after purchasing an additional 127,000 shares during the period. Segall Bryant & Hamill LLC acquired a new stake in American Public Education during the third quarter worth about $1,691,000. Finally, American Century Companies Inc. increased its holdings in American Public Education by 43.6% in the 2nd quarter. American Century Companies Inc. now owns 351,644 shares of the company's stock valued at $6,182,000 after buying an additional 106,689 shares during the period. Institutional investors own 79.62% of the company's stock.

Insider Buying and Selling

In other news, Director Michael David Braner acquired 17,872 shares of the firm's stock in a transaction on Friday, August 30th. The shares were purchased at an average cost of $16.77 per share, with a total value of $299,713.44. Following the acquisition, the director now directly owns 1,922,610 shares in the company, valued at $32,242,169.70. This represents a 0.94 % increase in their position. The purchase was disclosed in a document filed with the SEC, which is accessible through this link. 11.38% of the stock is currently owned by insiders.

About American Public Education

(

Get Free Report)

American Public Education, Inc, together with its subsidiaries, provides online and campus-based postsecondary education and career learning in the United States. It operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing. The company offers 184 degree programs and 134 certificate programs in various fields of study, including nursing, national security, military studies, intelligence, homeland security, business, health science, information technology, justice studies, education, and liberal arts; and career learning opportunities in leadership, finance, human resources, and other fields of study critical to the federal government workforce.

Read More

Before you consider American Public Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Public Education wasn't on the list.

While American Public Education currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.