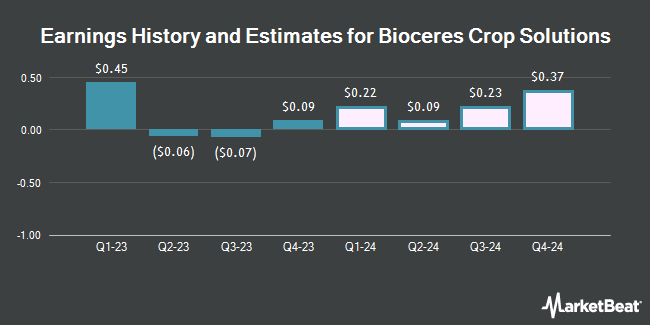

Bioceres Crop Solutions Corp. (NASDAQ:BIOX - Free Report) - Equities research analysts at Brookline Capital Management dropped their Q2 2025 earnings per share estimates for Bioceres Crop Solutions in a research report issued on Tuesday, November 12th. Brookline Capital Management analyst K. Dolliver now anticipates that the company will earn $0.14 per share for the quarter, down from their prior forecast of $0.28. The consensus estimate for Bioceres Crop Solutions' current full-year earnings is $0.33 per share. Brookline Capital Management also issued estimates for Bioceres Crop Solutions' Q3 2025 earnings at $0.02 EPS and FY2025 earnings at $0.16 EPS.

A number of other equities analysts have also commented on the stock. Canaccord Genuity Group raised shares of Bioceres Crop Solutions to a "strong-buy" rating in a research report on Friday, July 19th. Canaccord Genuity Group reduced their price target on Bioceres Crop Solutions from $10.00 to $9.50 and set a "buy" rating for the company in a research report on Wednesday. Oppenheimer cut their target price on Bioceres Crop Solutions from $16.00 to $13.00 and set an "outperform" rating on the stock in a research note on Monday, October 21st. Roth Mkm lowered their price target on shares of Bioceres Crop Solutions from $15.00 to $13.00 and set a "buy" rating on the stock in a report on Wednesday, September 11th. Finally, Lake Street Capital reduced their price objective on shares of Bioceres Crop Solutions from $25.00 to $13.00 and set a "buy" rating for the company in a research note on Wednesday, September 11th. Four research analysts have rated the stock with a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat, Bioceres Crop Solutions currently has an average rating of "Buy" and an average target price of $12.13.

Read Our Latest Analysis on BIOX

Bioceres Crop Solutions Trading Down 2.6 %

Shares of NASDAQ BIOX traded down $0.17 during midday trading on Friday, hitting $6.25. The company's stock had a trading volume of 181,818 shares, compared to its average volume of 89,892. The business's 50 day moving average is $7.58 and its two-hundred day moving average is $9.80. The firm has a market cap of $392.81 million, a P/E ratio of 321.16 and a beta of 0.49. The company has a current ratio of 1.27, a quick ratio of 0.86 and a debt-to-equity ratio of 0.37. Bioceres Crop Solutions has a 12-month low of $5.71 and a 12-month high of $14.05.

Bioceres Crop Solutions (NASDAQ:BIOX - Get Free Report) last issued its earnings results on Monday, November 11th. The company reported ($0.09) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.02 by ($0.11). The firm had revenue of $92.60 million during the quarter, compared to the consensus estimate of $117.15 million. Bioceres Crop Solutions had a return on equity of 0.68% and a net margin of 0.53%. During the same period last year, the firm posted ($0.07) earnings per share.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of BIOX. Sumitomo Mitsui Trust Holdings Inc. acquired a new stake in Bioceres Crop Solutions in the 2nd quarter valued at approximately $472,000. Fourth Sail Capital LP increased its holdings in Bioceres Crop Solutions by 20.5% during the 2nd quarter. Fourth Sail Capital LP now owns 1,961,825 shares of the company's stock worth $21,992,000 after purchasing an additional 334,195 shares during the period. Oppenheimer & Co. Inc. purchased a new position in shares of Bioceres Crop Solutions in the 1st quarter valued at about $139,000. Ping Capital Management Inc. acquired a new position in shares of Bioceres Crop Solutions during the second quarter worth about $448,000. Finally, Lazard Asset Management LLC purchased a new stake in shares of Bioceres Crop Solutions during the first quarter worth approximately $212,000. Institutional investors and hedge funds own 17.68% of the company's stock.

About Bioceres Crop Solutions

(

Get Free Report)

Bioceres Crop Solutions Corp., together with its subsidiaries, provides crop productivity solutions. It operates through Seed and Integrated Products, Crop Protection, and Crop Nutrition segments. The Seed and Integrated Products segment provides seed traits, germplasms, and seed treatment packs for healthier, and higher yielding crops.

See Also

Before you consider Bioceres Crop Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bioceres Crop Solutions wasn't on the list.

While Bioceres Crop Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.