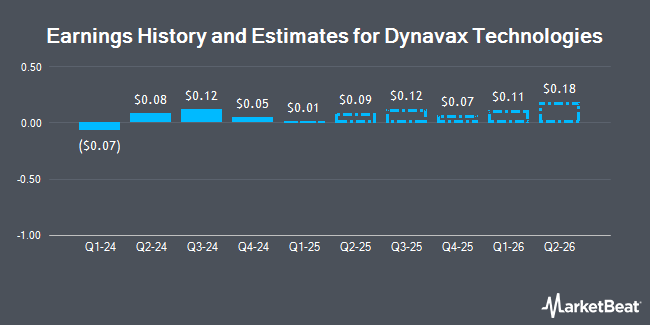

Dynavax Technologies Co. (NASDAQ:DVAX - Free Report) - Investment analysts at William Blair lifted their FY2024 earnings estimates for shares of Dynavax Technologies in a research note issued on Thursday, November 7th. William Blair analyst M. Phipps now forecasts that the biopharmaceutical company will earn $0.15 per share for the year, up from their previous estimate of $0.12. The consensus estimate for Dynavax Technologies' current full-year earnings is $0.18 per share. William Blair also issued estimates for Dynavax Technologies' Q2 2025 earnings at $0.10 EPS, Q3 2025 earnings at $0.11 EPS and FY2025 earnings at $0.27 EPS.

A number of other equities research analysts have also recently weighed in on DVAX. HC Wainwright restated a "buy" rating and set a $29.00 price objective on shares of Dynavax Technologies in a research note on Friday. The Goldman Sachs Group cut their price target on shares of Dynavax Technologies from $20.00 to $15.00 and set a "neutral" rating on the stock in a report on Thursday, August 8th.

Get Our Latest Stock Report on DVAX

Dynavax Technologies Stock Up 5.0 %

NASDAQ:DVAX traded up $0.65 during trading hours on Monday, reaching $13.66. The company's stock had a trading volume of 7,176,190 shares, compared to its average volume of 2,138,794. The stock has a 50 day moving average price of $11.16 and a two-hundred day moving average price of $11.24. The company has a debt-to-equity ratio of 0.35, a quick ratio of 13.18 and a current ratio of 14.18. The company has a market capitalization of $1.79 billion, a P/E ratio of 105.01 and a beta of 1.34. Dynavax Technologies has a 12 month low of $9.74 and a 12 month high of $15.01.

Institutional Investors Weigh In On Dynavax Technologies

A number of large investors have recently bought and sold shares of DVAX. Mizuho Markets Americas LLC lifted its stake in Dynavax Technologies by 16.9% during the 1st quarter. Mizuho Markets Americas LLC now owns 852,057 shares of the biopharmaceutical company's stock valued at $10,574,000 after acquiring an additional 123,300 shares during the period. Assenagon Asset Management S.A. acquired a new position in Dynavax Technologies during the third quarter valued at $8,291,000. Millennium Management LLC purchased a new stake in Dynavax Technologies in the second quarter valued at $17,615,000. Vanguard Group Inc. boosted its holdings in Dynavax Technologies by 1.4% in the first quarter. Vanguard Group Inc. now owns 9,402,246 shares of the biopharmaceutical company's stock valued at $116,682,000 after purchasing an additional 126,458 shares during the last quarter. Finally, Bank of Montreal Can grew its position in Dynavax Technologies by 15.2% during the 2nd quarter. Bank of Montreal Can now owns 994,632 shares of the biopharmaceutical company's stock worth $11,309,000 after purchasing an additional 130,893 shares during the period. Hedge funds and other institutional investors own 96.96% of the company's stock.

About Dynavax Technologies

(

Get Free Report)

Dynavax Technologies Corporation, a commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States. It markets HEPLISAV-B, a hepatitis B vaccine for prevention of infection caused by all known subtypes of hepatitis B virus in age 18 years and older in the United States and Europe.

See Also

Before you consider Dynavax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynavax Technologies wasn't on the list.

While Dynavax Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.