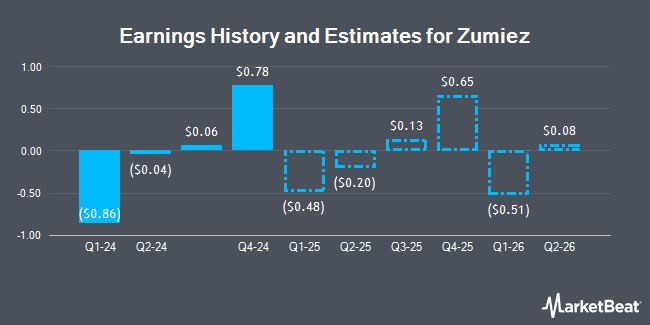

Zumiez Inc. (NASDAQ:ZUMZ - Free Report) - William Blair lifted their Q2 2026 earnings per share (EPS) estimates for shares of Zumiez in a report released on Friday, December 6th. William Blair analyst D. Carden now anticipates that the apparel and footwear maker will post earnings of $0.13 per share for the quarter, up from their prior forecast of $0.09. The consensus estimate for Zumiez's current full-year earnings is $0.06 per share. William Blair also issued estimates for Zumiez's Q3 2026 earnings at $0.23 EPS and Q4 2026 earnings at $0.89 EPS.

Zumiez (NASDAQ:ZUMZ - Get Free Report) last posted its quarterly earnings data on Thursday, December 5th. The apparel and footwear maker reported $0.06 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.02 by $0.04. Zumiez had a negative return on equity of 2.67% and a negative net margin of 5.60%. The company had revenue of $222.50 million during the quarter, compared to analysts' expectations of $222.06 million. During the same quarter in the previous year, the business earned ($0.12) EPS. Zumiez's revenue was up 2.9% compared to the same quarter last year.

Separately, B. Riley lifted their target price on Zumiez from $20.00 to $25.00 and gave the company a "neutral" rating in a research report on Friday, September 6th.

Get Our Latest Analysis on ZUMZ

Zumiez Stock Performance

NASDAQ ZUMZ traded down $0.64 on Monday, reaching $21.70. 394,106 shares of the stock traded hands, compared to its average volume of 260,272. The company has a fifty day moving average price of $21.84 and a 200-day moving average price of $22.23. The company has a market cap of $415.99 million, a price-to-earnings ratio of -8.69 and a beta of 1.25. Zumiez has a 12 month low of $12.90 and a 12 month high of $31.37.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in ZUMZ. Signaturefd LLC raised its holdings in shares of Zumiez by 83.2% during the second quarter. Signaturefd LLC now owns 1,480 shares of the apparel and footwear maker's stock worth $29,000 after purchasing an additional 672 shares during the last quarter. Quarry LP increased its holdings in shares of Zumiez by 315.1% during the 3rd quarter. Quarry LP now owns 1,764 shares of the apparel and footwear maker's stock valued at $38,000 after purchasing an additional 1,339 shares in the last quarter. CWM LLC lifted its stake in shares of Zumiez by 2,090.1% in the 2nd quarter. CWM LLC now owns 1,993 shares of the apparel and footwear maker's stock valued at $39,000 after purchasing an additional 1,902 shares during the period. ProShare Advisors LLC purchased a new stake in Zumiez during the second quarter worth $42,000. Finally, Ariadne Wealth Management LP acquired a new stake in Zumiez during the second quarter valued at $54,000. 95.45% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Zumiez

In related news, Director Liliana Gil Valletta sold 3,283 shares of the business's stock in a transaction on Friday, September 27th. The stock was sold at an average price of $21.85, for a total transaction of $71,733.55. Following the transaction, the director now directly owns 15,002 shares in the company, valued at $327,793.70. The trade was a 17.95 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 20.30% of the company's stock.

Zumiez Company Profile

(

Get Free Report)

Zumiez Inc operates as a specialty retailer of apparel, footwear, accessories, and hardgoods for young men and women. The company provides hardgoods, including skateboards, snowboards, bindings, components, and other equipment. It operates stores in the United States, Canada, Europe, and Australia under the names of Zumiez, Blue Tomato, and Fast Times.

Recommended Stories

Before you consider Zumiez, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zumiez wasn't on the list.

While Zumiez currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.