Barclays PLC boosted its stake in Equity Commonwealth (NYSE:EQC - Free Report) by 250.5% in the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 415,187 shares of the real estate investment trust's stock after purchasing an additional 296,742 shares during the quarter. Barclays PLC owned about 0.39% of Equity Commonwealth worth $8,263,000 as of its most recent filing with the SEC.

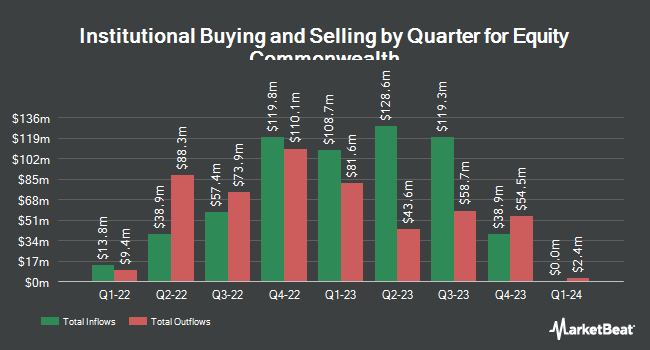

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Creative Planning grew its stake in shares of Equity Commonwealth by 2.9% during the 3rd quarter. Creative Planning now owns 19,400 shares of the real estate investment trust's stock valued at $386,000 after buying an additional 551 shares during the period. Arizona State Retirement System grew its position in Equity Commonwealth by 2.1% during the second quarter. Arizona State Retirement System now owns 29,952 shares of the real estate investment trust's stock valued at $581,000 after acquiring an additional 625 shares during the period. Van ECK Associates Corp grew its position in Equity Commonwealth by 25.6% during the third quarter. Van ECK Associates Corp now owns 3,103 shares of the real estate investment trust's stock valued at $61,000 after acquiring an additional 632 shares during the period. CWM LLC raised its holdings in shares of Equity Commonwealth by 29.3% in the 3rd quarter. CWM LLC now owns 3,097 shares of the real estate investment trust's stock worth $62,000 after purchasing an additional 701 shares during the period. Finally, Sequoia Financial Advisors LLC raised its holdings in shares of Equity Commonwealth by 2.8% in the 3rd quarter. Sequoia Financial Advisors LLC now owns 35,738 shares of the real estate investment trust's stock worth $711,000 after purchasing an additional 959 shares during the period. Institutional investors and hedge funds own 96.00% of the company's stock.

Equity Commonwealth Stock Performance

Shares of NYSE:EQC traded up $0.04 during midday trading on Wednesday, hitting $1.72. 5,825,794 shares of the company's stock traded hands, compared to its average volume of 1,499,784. The firm's fifty day moving average price is $17.42 and its two-hundred day moving average price is $18.95. Equity Commonwealth has a twelve month low of $1.40 and a twelve month high of $21.00. The company has a market cap of $184.61 million, a PE ratio of 4.41 and a beta of 0.27.

Wall Street Analysts Forecast Growth

Separately, StockNews.com downgraded shares of Equity Commonwealth from a "hold" rating to a "sell" rating in a research report on Friday, October 25th.

Check Out Our Latest Research Report on EQC

About Equity Commonwealth

(

Free Report)

Equity Commonwealth NYSE: EQC is a Chicago based, internally managed and self-advised real estate investment trust (REIT) with commercial office properties in the United States. EQC's portfolio is comprised of four properties totaling 1.5 million square feet.

See Also

Before you consider Equity Commonwealth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Commonwealth wasn't on the list.

While Equity Commonwealth currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.