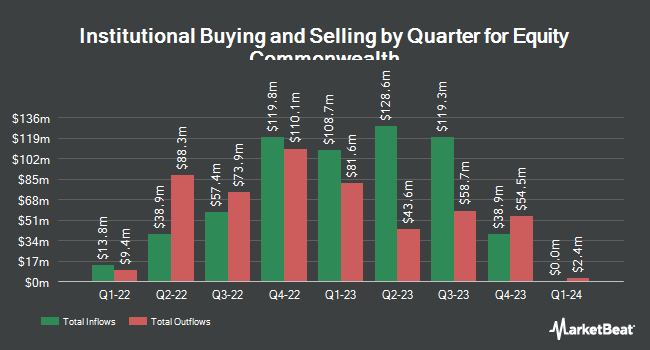

Western Standard LLC reduced its holdings in shares of Equity Commonwealth (NYSE:EQC - Free Report) by 3.8% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 709,582 shares of the real estate investment trust's stock after selling 28,129 shares during the quarter. Equity Commonwealth makes up approximately 13.2% of Western Standard LLC's holdings, making the stock its biggest position. Western Standard LLC owned approximately 0.66% of Equity Commonwealth worth $14,121,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Van ECK Associates Corp increased its position in shares of Equity Commonwealth by 25.6% during the 3rd quarter. Van ECK Associates Corp now owns 3,103 shares of the real estate investment trust's stock worth $61,000 after purchasing an additional 632 shares during the last quarter. CWM LLC increased its holdings in Equity Commonwealth by 29.3% during the third quarter. CWM LLC now owns 3,097 shares of the real estate investment trust's stock worth $62,000 after buying an additional 701 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. raised its position in Equity Commonwealth by 35.2% during the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,165 shares of the real estate investment trust's stock worth $83,000 after acquiring an additional 1,084 shares in the last quarter. Blue Trust Inc. lifted its stake in Equity Commonwealth by 459.8% in the third quarter. Blue Trust Inc. now owns 4,551 shares of the real estate investment trust's stock valued at $88,000 after acquiring an additional 3,738 shares during the last quarter. Finally, Quarry LP lifted its stake in Equity Commonwealth by 629.6% in the second quarter. Quarry LP now owns 5,932 shares of the real estate investment trust's stock valued at $115,000 after acquiring an additional 5,119 shares during the last quarter. 96.00% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, StockNews.com cut shares of Equity Commonwealth from a "hold" rating to a "sell" rating in a report on Friday, October 25th.

Read Our Latest Report on Equity Commonwealth

Equity Commonwealth Trading Up 0.4 %

NYSE:EQC traded up $0.09 on Friday, hitting $20.42. The company's stock had a trading volume of 3,834,113 shares, compared to its average volume of 1,211,760. Equity Commonwealth has a one year low of $17.93 and a one year high of $21.00. The firm has a market capitalization of $2.19 billion, a P/E ratio of 52.33 and a beta of 0.27. The stock has a fifty day moving average of $19.95 and a two-hundred day moving average of $19.80.

Equity Commonwealth Profile

(

Free Report)

Equity Commonwealth NYSE: EQC is a Chicago based, internally managed and self-advised real estate investment trust (REIT) with commercial office properties in the United States. EQC's portfolio is comprised of four properties totaling 1.5 million square feet.

See Also

Before you consider Equity Commonwealth, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Commonwealth wasn't on the list.

While Equity Commonwealth currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.