Equity Investment Corp grew its stake in shares of TotalEnergies SE (NYSE:TTE - Free Report) by 2.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,862,312 shares of the company's stock after purchasing an additional 41,564 shares during the quarter. TotalEnergies accounts for 2.8% of Equity Investment Corp's investment portfolio, making the stock its 13th biggest position. Equity Investment Corp owned 0.08% of TotalEnergies worth $120,343,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

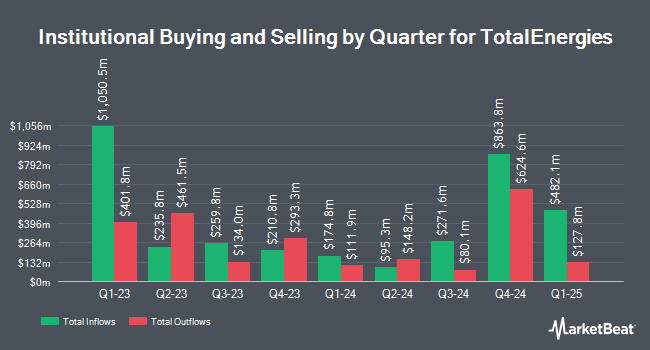

Several other institutional investors and hedge funds also recently modified their holdings of the stock. Thrivent Financial for Lutherans acquired a new stake in TotalEnergies during the 3rd quarter valued at $212,000. Atlanta Consulting Group Advisors LLC acquired a new position in shares of TotalEnergies in the third quarter worth about $880,000. Natixis Advisors LLC boosted its holdings in TotalEnergies by 4.9% in the third quarter. Natixis Advisors LLC now owns 2,266,950 shares of the company's stock valued at $146,490,000 after purchasing an additional 106,347 shares during the last quarter. Empowered Funds LLC boosted its holdings in TotalEnergies by 2.8% in the third quarter. Empowered Funds LLC now owns 40,321 shares of the company's stock valued at $2,606,000 after purchasing an additional 1,107 shares during the last quarter. Finally, Intellectus Partners LLC grew its stake in TotalEnergies by 6.3% during the 3rd quarter. Intellectus Partners LLC now owns 25,370 shares of the company's stock valued at $1,662,000 after purchasing an additional 1,500 shares in the last quarter. Hedge funds and other institutional investors own 13.22% of the company's stock.

TotalEnergies Stock Performance

NYSE TTE traded up $0.52 during trading hours on Monday, reaching $61.37. The company's stock had a trading volume of 1,896,090 shares, compared to its average volume of 1,490,513. TotalEnergies SE has a 52 week low of $58.46 and a 52 week high of $74.97. The stock has a market cap of $144.92 billion, a PE ratio of 8.70, a PEG ratio of 1.96 and a beta of 0.64. The company has a current ratio of 1.10, a quick ratio of 0.88 and a debt-to-equity ratio of 0.39. The business has a 50-day simple moving average of $65.35 and a 200 day simple moving average of $67.76.

Wall Street Analysts Forecast Growth

TTE has been the subject of several research analyst reports. Barclays upgraded TotalEnergies to a "strong-buy" rating in a research note on Wednesday, October 2nd. The Goldman Sachs Group raised shares of TotalEnergies to a "hold" rating in a research report on Thursday, October 3rd. UBS Group raised shares of TotalEnergies to a "strong-buy" rating in a research report on Wednesday, October 9th. Scotiabank cut their price objective on TotalEnergies from $80.00 to $75.00 and set a "sector perform" rating on the stock in a research note on Thursday, October 10th. Finally, TD Cowen downgraded TotalEnergies from a "strong-buy" rating to a "hold" rating in a report on Monday, September 30th. Five investment analysts have rated the stock with a hold rating, one has issued a buy rating and two have given a strong buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $78.75.

Check Out Our Latest Analysis on TotalEnergies

About TotalEnergies

(

Free Report)

TotalEnergies SE, a multi-energy company, produces and markets oil and biofuels, natural gas, green gases, renewables, and electricity in France, rest of Europe, North America, Africa, and internationally. It operates through five segments: Exploration & Production, Integrated LNG, Integrated Power, Refining & Chemicals, and Marketing & Services.

Further Reading

Before you consider TotalEnergies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TotalEnergies wasn't on the list.

While TotalEnergies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.