Equity Investment Corp lifted its position in shares of PPG Industries, Inc. (NYSE:PPG - Free Report) by 7.0% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 649,301 shares of the specialty chemicals company's stock after buying an additional 42,380 shares during the period. PPG Industries makes up about 2.0% of Equity Investment Corp's holdings, making the stock its 24th biggest holding. Equity Investment Corp owned 0.28% of PPG Industries worth $86,006,000 at the end of the most recent reporting period.

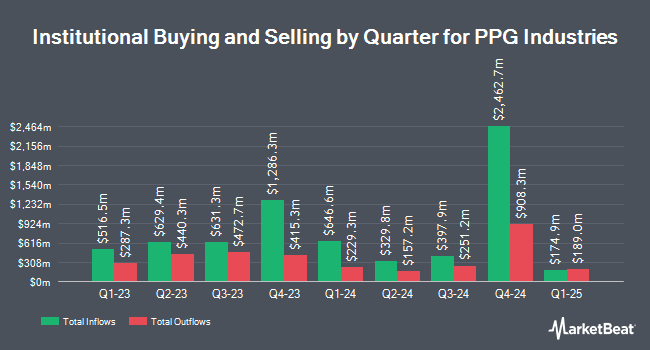

Several other large investors have also made changes to their positions in PPG. Dimensional Fund Advisors LP raised its holdings in shares of PPG Industries by 20.1% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,197,012 shares of the specialty chemicals company's stock worth $276,576,000 after purchasing an additional 368,410 shares during the period. Boston Partners lifted its position in PPG Industries by 4.9% during the first quarter. Boston Partners now owns 1,713,126 shares of the specialty chemicals company's stock valued at $248,172,000 after buying an additional 80,710 shares in the last quarter. ProShare Advisors LLC grew its stake in PPG Industries by 12.2% during the second quarter. ProShare Advisors LLC now owns 1,404,015 shares of the specialty chemicals company's stock worth $176,751,000 after buying an additional 152,719 shares during the period. DekaBank Deutsche Girozentrale increased its position in shares of PPG Industries by 9.6% in the first quarter. DekaBank Deutsche Girozentrale now owns 1,142,195 shares of the specialty chemicals company's stock worth $162,862,000 after acquiring an additional 100,391 shares in the last quarter. Finally, AQR Capital Management LLC raised its stake in shares of PPG Industries by 18.8% in the 2nd quarter. AQR Capital Management LLC now owns 774,871 shares of the specialty chemicals company's stock valued at $96,820,000 after acquiring an additional 122,410 shares during the period. 81.86% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, VP Anne M. Foulkes sold 1,985 shares of PPG Industries stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $125.80, for a total value of $249,713.00. Following the sale, the vice president now directly owns 13,454 shares in the company, valued at $1,692,513.20. This trade represents a 12.86 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.55% of the stock is owned by company insiders.

PPG Industries Stock Performance

Shares of NYSE:PPG traded up $0.89 on Monday, reaching $123.42. 1,745,918 shares of the company's stock were exchanged, compared to its average volume of 1,588,166. The business's 50-day moving average is $127.32 and its two-hundred day moving average is $127.72. The company has a quick ratio of 1.13, a current ratio of 1.58 and a debt-to-equity ratio of 0.77. PPG Industries, Inc. has a fifty-two week low of $118.07 and a fifty-two week high of $151.16. The firm has a market capitalization of $28.63 billion, a price-to-earnings ratio of 19.56, a PEG ratio of 1.87 and a beta of 1.26.

PPG Industries (NYSE:PPG - Get Free Report) last released its quarterly earnings data on Wednesday, October 16th. The specialty chemicals company reported $2.13 earnings per share for the quarter, missing the consensus estimate of $2.15 by ($0.02). PPG Industries had a return on equity of 23.63% and a net margin of 8.24%. The business had revenue of $4.58 billion for the quarter, compared to analyst estimates of $4.66 billion. During the same quarter last year, the company earned $2.07 EPS. PPG Industries's revenue was down 1.5% compared to the same quarter last year. As a group, equities research analysts forecast that PPG Industries, Inc. will post 8.18 EPS for the current year.

PPG Industries Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Tuesday, November 12th will be given a dividend of $0.68 per share. The ex-dividend date of this dividend is Tuesday, November 12th. This represents a $2.72 dividend on an annualized basis and a yield of 2.20%. PPG Industries's dividend payout ratio is currently 43.11%.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on the stock. Barclays decreased their price target on shares of PPG Industries from $148.00 to $144.00 and set an "equal weight" rating for the company in a research report on Monday, July 22nd. Royal Bank of Canada reduced their price target on PPG Industries from $138.00 to $136.00 and set a "sector perform" rating on the stock in a research report on Tuesday, October 22nd. KeyCorp lowered their price objective on shares of PPG Industries from $162.00 to $153.00 and set an "overweight" rating for the company in a research report on Monday, July 22nd. Mizuho decreased their target price on shares of PPG Industries from $160.00 to $150.00 and set an "outperform" rating for the company in a research note on Thursday, October 17th. Finally, JPMorgan Chase & Co. dropped their price target on shares of PPG Industries from $155.00 to $145.00 and set an "overweight" rating on the stock in a research note on Friday, October 18th. Six equities research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $149.93.

Read Our Latest Report on PPG

About PPG Industries

(

Free Report)

PPG Industries, Inc manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through two segments, Performance Coatings and Industrial Coatings. The Performance Coatings segment offers coatings, solvents, adhesives, sealants, sundries, and software for automotive and commercial transport/fleet repair and refurbishing, light industrial coatings, and specialty coatings for signs; wood stains; paints, thermoplastics, pavement marking products, and other advanced technologies for pavement marking for government, commercial infrastructure, painting, and maintenance contractors; and coatings, sealants, transparencies, transparent armor, adhesives, engineered materials, and packaging and chemical management services for commercial, military, regional jet, and general aviation aircraft.

Featured Articles

Before you consider PPG Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPG Industries wasn't on the list.

While PPG Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report