Equity Investment Corp decreased its holdings in General Dynamics Co. (NYSE:GD - Free Report) by 0.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 260,011 shares of the aerospace company's stock after selling 2,051 shares during the period. General Dynamics comprises about 1.8% of Equity Investment Corp's investment portfolio, making the stock its 29th biggest holding. Equity Investment Corp owned 0.09% of General Dynamics worth $78,575,000 at the end of the most recent quarter.

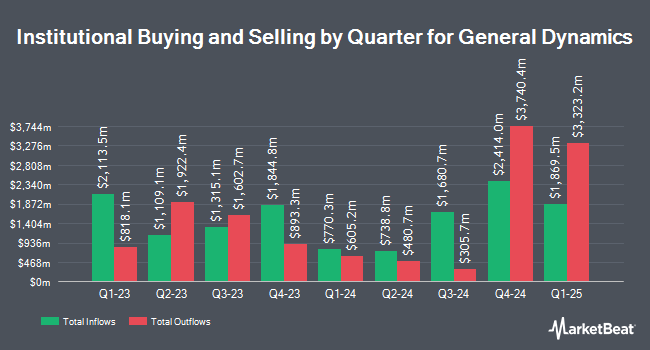

Other hedge funds have also recently modified their holdings of the company. Swiss National Bank raised its position in General Dynamics by 0.4% in the 3rd quarter. Swiss National Bank now owns 692,146 shares of the aerospace company's stock worth $209,167,000 after buying an additional 2,600 shares during the last quarter. Claro Advisors LLC boosted its holdings in General Dynamics by 5.7% in the third quarter. Claro Advisors LLC now owns 4,799 shares of the aerospace company's stock worth $1,450,000 after purchasing an additional 260 shares during the last quarter. Mechanics Financial Corp raised its stake in General Dynamics by 0.6% during the 3rd quarter. Mechanics Financial Corp now owns 8,553 shares of the aerospace company's stock valued at $2,585,000 after buying an additional 50 shares during the last quarter. Mutual of America Capital Management LLC lifted its holdings in shares of General Dynamics by 10.7% during the 3rd quarter. Mutual of America Capital Management LLC now owns 31,711 shares of the aerospace company's stock valued at $9,583,000 after buying an additional 3,073 shares during the period. Finally, WESPAC Advisors SoCal LLC boosted its stake in shares of General Dynamics by 3.4% in the 3rd quarter. WESPAC Advisors SoCal LLC now owns 19,120 shares of the aerospace company's stock worth $5,778,000 after buying an additional 627 shares during the last quarter. Hedge funds and other institutional investors own 86.14% of the company's stock.

General Dynamics Price Performance

General Dynamics stock traded down $1.99 during mid-day trading on Monday, reaching $286.00. 1,286,492 shares of the company's stock traded hands, compared to its average volume of 1,101,693. General Dynamics Co. has a 12-month low of $243.87 and a 12-month high of $316.90. The company has a market cap of $78.64 billion, a price-to-earnings ratio of 21.78, a PEG ratio of 1.74 and a beta of 0.61. The stock has a 50 day moving average of $302.14 and a two-hundred day moving average of $296.33. The company has a quick ratio of 0.80, a current ratio of 1.32 and a debt-to-equity ratio of 0.32.

General Dynamics (NYSE:GD - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The aerospace company reported $3.35 EPS for the quarter, missing analysts' consensus estimates of $3.48 by ($0.13). General Dynamics had a net margin of 7.90% and a return on equity of 16.59%. The business had revenue of $11.67 billion during the quarter, compared to the consensus estimate of $11.65 billion. During the same period in the previous year, the business posted $3.04 EPS. The firm's revenue was up 10.4% on a year-over-year basis. Equities analysts forecast that General Dynamics Co. will post 13.98 earnings per share for the current year.

Insider Transactions at General Dynamics

In related news, Director Peter A. Wall sold 1,320 shares of the company's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of $308.05, for a total transaction of $406,626.00. Following the transaction, the director now directly owns 3,592 shares in the company, valued at approximately $1,106,515.60. This represents a 26.87 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 1.52% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on GD shares. Barclays increased their target price on General Dynamics from $325.00 to $330.00 and gave the company an "overweight" rating in a report on Tuesday, October 29th. Deutsche Bank Aktiengesellschaft decreased their price target on shares of General Dynamics from $309.00 to $306.00 and set a "hold" rating on the stock in a research report on Friday, November 1st. Morgan Stanley upgraded General Dynamics from an "equal weight" rating to an "overweight" rating and upped their price objective for the stock from $293.00 to $345.00 in a research note on Friday, August 9th. Citigroup boosted their price target on General Dynamics from $331.00 to $354.00 and gave the company a "buy" rating in a report on Thursday, October 10th. Finally, Susquehanna lifted their price objective on General Dynamics from $333.00 to $352.00 and gave the company a "positive" rating in a research report on Thursday, October 17th. Seven analysts have rated the stock with a hold rating, eleven have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, General Dynamics currently has a consensus rating of "Moderate Buy" and a consensus target price of $323.69.

View Our Latest Stock Analysis on General Dynamics

General Dynamics Profile

(

Free Report)

General Dynamics Corporation operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets; and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services.

Featured Articles

Before you consider General Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Dynamics wasn't on the list.

While General Dynamics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.