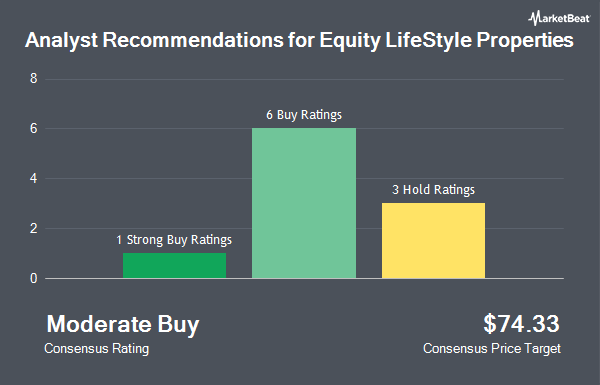

Shares of Equity LifeStyle Properties, Inc. (NYSE:ELS - Get Free Report) have earned a consensus rating of "Moderate Buy" from the ten research firms that are currently covering the firm, MarketBeat Ratings reports. Three research analysts have rated the stock with a hold recommendation, six have assigned a buy recommendation and one has assigned a strong buy recommendation to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $73.78.

Several equities analysts recently weighed in on ELS shares. Royal Bank of Canada reduced their target price on Equity LifeStyle Properties from $69.00 to $68.00 and set a "sector perform" rating on the stock in a research report on Wednesday, January 29th. Deutsche Bank Aktiengesellschaft upgraded Equity LifeStyle Properties from a "hold" rating to a "buy" rating and upped their price target for the stock from $66.00 to $73.00 in a research note on Tuesday, January 21st. Robert W. Baird increased their target price on Equity LifeStyle Properties from $72.00 to $73.00 and gave the company an "outperform" rating in a research note on Tuesday, January 28th. Truist Financial upgraded Equity LifeStyle Properties from a "hold" rating to a "buy" rating in a research note on Friday, January 17th. Finally, Evercore ISI lowered their price objective on Equity LifeStyle Properties from $74.00 to $73.00 and set an "in-line" rating for the company in a research note on Tuesday, January 28th.

Read Our Latest Stock Analysis on ELS

Equity LifeStyle Properties Stock Up 0.6 %

Equity LifeStyle Properties stock opened at $68.96 on Tuesday. The company has a debt-to-equity ratio of 0.15, a quick ratio of 0.03 and a current ratio of 0.02. The firm has a market capitalization of $13.18 billion, a price-to-earnings ratio of 35.36, a price-to-earnings-growth ratio of 3.02 and a beta of 0.79. Equity LifeStyle Properties has a fifty-two week low of $59.82 and a fifty-two week high of $76.60. The stock's fifty day moving average is $66.37 and its two-hundred day moving average is $69.12.

Equity LifeStyle Properties (NYSE:ELS - Get Free Report) last issued its quarterly earnings data on Monday, January 27th. The real estate investment trust reported $0.76 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.76. Equity LifeStyle Properties had a return on equity of 23.12% and a net margin of 24.05%. Analysts predict that Equity LifeStyle Properties will post 3.07 EPS for the current fiscal year.

Equity LifeStyle Properties Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, April 11th. Investors of record on Friday, March 28th will be issued a $0.515 dividend. This is an increase from Equity LifeStyle Properties's previous quarterly dividend of $0.48. The ex-dividend date of this dividend is Friday, March 28th. This represents a $2.06 annualized dividend and a dividend yield of 2.99%. Equity LifeStyle Properties's dividend payout ratio (DPR) is 105.64%.

Institutional Trading of Equity LifeStyle Properties

Several hedge funds have recently added to or reduced their stakes in ELS. Moran Wealth Management LLC increased its position in shares of Equity LifeStyle Properties by 0.8% during the 3rd quarter. Moran Wealth Management LLC now owns 17,721 shares of the real estate investment trust's stock valued at $1,264,000 after purchasing an additional 143 shares during the period. MassMutual Private Wealth & Trust FSB grew its holdings in shares of Equity LifeStyle Properties by 43.5% in the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 564 shares of the real estate investment trust's stock worth $38,000 after acquiring an additional 171 shares during the last quarter. Bessemer Group Inc. grew its holdings in shares of Equity LifeStyle Properties by 121.4% in the 4th quarter. Bessemer Group Inc. now owns 383 shares of the real estate investment trust's stock worth $25,000 after acquiring an additional 210 shares during the last quarter. Carmel Capital Partners LLC boosted its position in shares of Equity LifeStyle Properties by 3.6% in the fourth quarter. Carmel Capital Partners LLC now owns 6,533 shares of the real estate investment trust's stock worth $435,000 after buying an additional 230 shares during the period. Finally, Corient Private Wealth LLC boosted its position in shares of Equity LifeStyle Properties by 1.0% in the fourth quarter. Corient Private Wealth LLC now owns 22,861 shares of the real estate investment trust's stock worth $1,523,000 after buying an additional 230 shares during the period. Institutional investors own 97.21% of the company's stock.

Equity LifeStyle Properties Company Profile

(

Get Free ReportEquity LifeStyle Properties, Inc is a real estate investment trust, which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home, and recreational vehicle communities. It operates through the following segments: Property Operations and Home Sales and Rentals Operations.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Equity LifeStyle Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity LifeStyle Properties wasn't on the list.

While Equity LifeStyle Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.