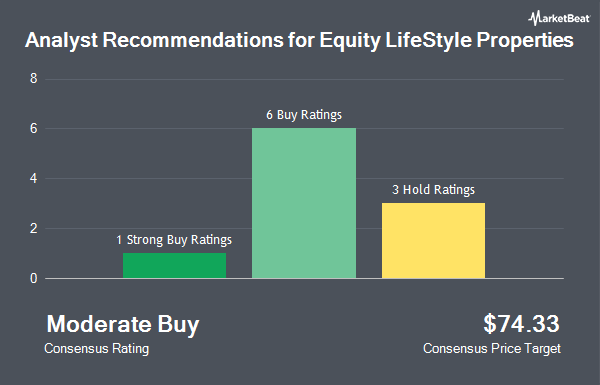

Shares of Equity LifeStyle Properties, Inc. (NYSE:ELS - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the eleven analysts that are presently covering the company, MarketBeat.com reports. Five research analysts have rated the stock with a hold recommendation, five have assigned a buy recommendation and one has issued a strong buy recommendation on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $73.30.

A number of brokerages have issued reports on ELS. Evercore ISI increased their price target on Equity LifeStyle Properties from $76.00 to $77.00 and gave the stock an "in-line" rating in a research report on Monday, October 21st. UBS Group upgraded Equity LifeStyle Properties to a "strong-buy" rating in a research report on Thursday, October 10th. Compass Point boosted their price target on shares of Equity LifeStyle Properties from $70.00 to $72.00 and gave the stock a "neutral" rating in a report on Wednesday, October 23rd. Jefferies Financial Group raised shares of Equity LifeStyle Properties from a "hold" rating to a "buy" rating and increased their price objective for the company from $72.00 to $80.00 in a report on Thursday, January 2nd. Finally, Wells Fargo & Company raised shares of Equity LifeStyle Properties from an "equal weight" rating to an "overweight" rating and boosted their target price for the stock from $70.50 to $82.00 in a research note on Thursday, September 19th.

Check Out Our Latest Stock Report on Equity LifeStyle Properties

Institutional Trading of Equity LifeStyle Properties

Several institutional investors have recently made changes to their positions in the company. Townsquare Capital LLC increased its stake in Equity LifeStyle Properties by 23.7% during the third quarter. Townsquare Capital LLC now owns 12,835 shares of the real estate investment trust's stock worth $916,000 after acquiring an additional 2,458 shares during the last quarter. Victory Capital Management Inc. grew its holdings in shares of Equity LifeStyle Properties by 0.9% during the 3rd quarter. Victory Capital Management Inc. now owns 4,649,670 shares of the real estate investment trust's stock worth $331,707,000 after purchasing an additional 39,864 shares during the period. Citigroup Inc. increased its position in shares of Equity LifeStyle Properties by 16.7% during the 3rd quarter. Citigroup Inc. now owns 213,209 shares of the real estate investment trust's stock worth $15,210,000 after purchasing an additional 30,489 shares during the last quarter. Sanctuary Advisors LLC boosted its stake in Equity LifeStyle Properties by 95.3% during the third quarter. Sanctuary Advisors LLC now owns 32,578 shares of the real estate investment trust's stock worth $2,311,000 after buying an additional 15,899 shares during the period. Finally, BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its stake in Equity LifeStyle Properties by 60.7% during the second quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 33,950 shares of the real estate investment trust's stock worth $2,211,000 after buying an additional 12,826 shares during the period. Hedge funds and other institutional investors own 97.21% of the company's stock.

Equity LifeStyle Properties Price Performance

Shares of NYSE ELS opened at $64.43 on Monday. The company has a debt-to-equity ratio of 0.35, a current ratio of 0.03 and a quick ratio of 0.03. The firm's 50 day simple moving average is $68.98 and its 200-day simple moving average is $69.39. Equity LifeStyle Properties has a 12 month low of $59.82 and a 12 month high of $76.60. The stock has a market capitalization of $12.31 billion, a price-to-earnings ratio of 33.21, a PEG ratio of 3.61 and a beta of 0.79.

Equity LifeStyle Properties (NYSE:ELS - Get Free Report) last released its quarterly earnings data on Monday, October 21st. The real estate investment trust reported $0.44 earnings per share for the quarter, missing analysts' consensus estimates of $0.72 by ($0.28). Equity LifeStyle Properties had a net margin of 23.97% and a return on equity of 24.10%. The firm had revenue of $387.30 million during the quarter, compared to analysts' expectations of $315.78 million. During the same period in the previous year, the firm posted $0.71 EPS. The firm's quarterly revenue was down .4% on a year-over-year basis. Analysts expect that Equity LifeStyle Properties will post 2.92 EPS for the current year.

Equity LifeStyle Properties Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, January 10th. Shareholders of record on Friday, December 27th were issued a $0.477 dividend. The ex-dividend date of this dividend was Friday, December 27th. This represents a $1.91 annualized dividend and a yield of 2.96%. Equity LifeStyle Properties's payout ratio is 98.45%.

Equity LifeStyle Properties Company Profile

(

Get Free ReportWe are a self-administered, self-managed real estate investment trust (REIT) with headquarters in Chicago. As of January 29, 2024, we own or have an interest in 451 properties in 35 states and British Columbia consisting of 172,465 sites.

Featured Articles

Before you consider Equity LifeStyle Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity LifeStyle Properties wasn't on the list.

While Equity LifeStyle Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.